1 Reverse Mortgage

How do reverse mortgages work.

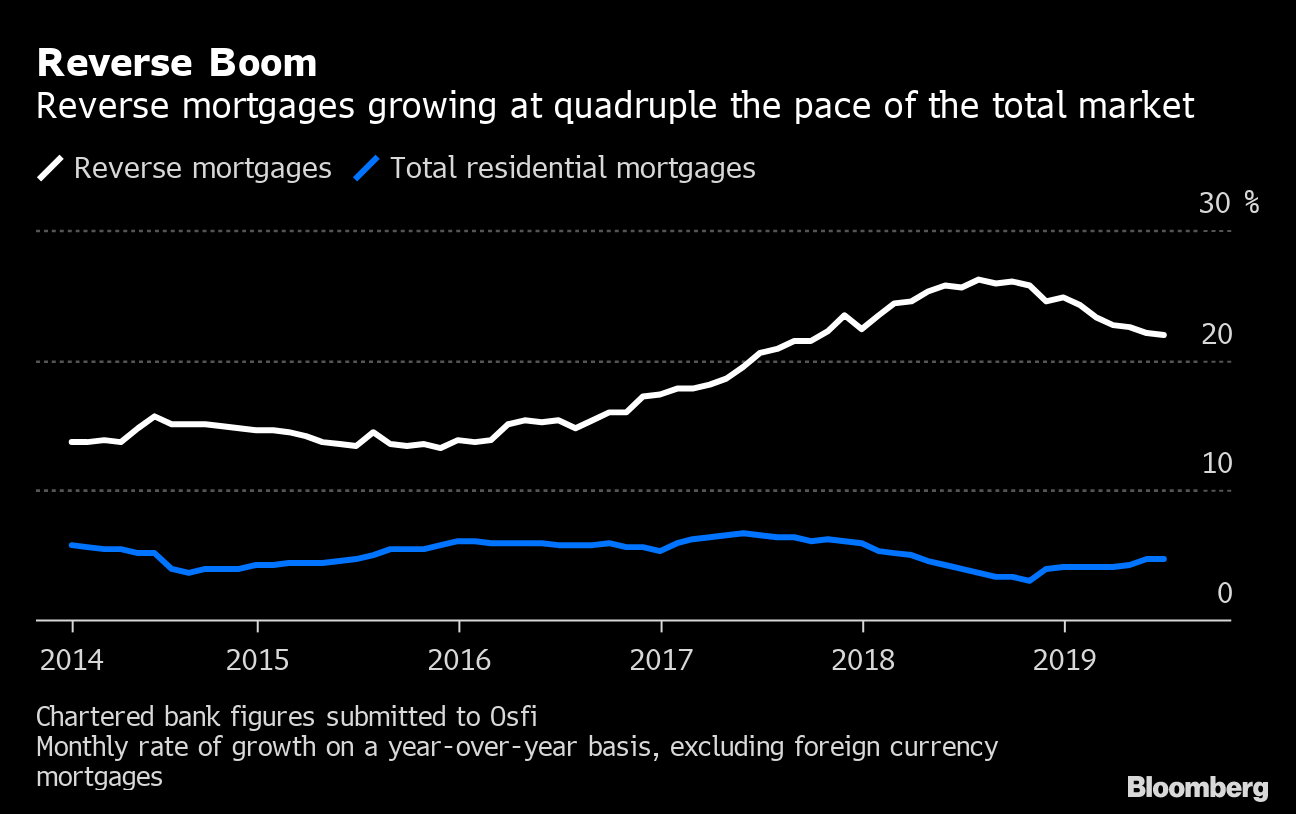

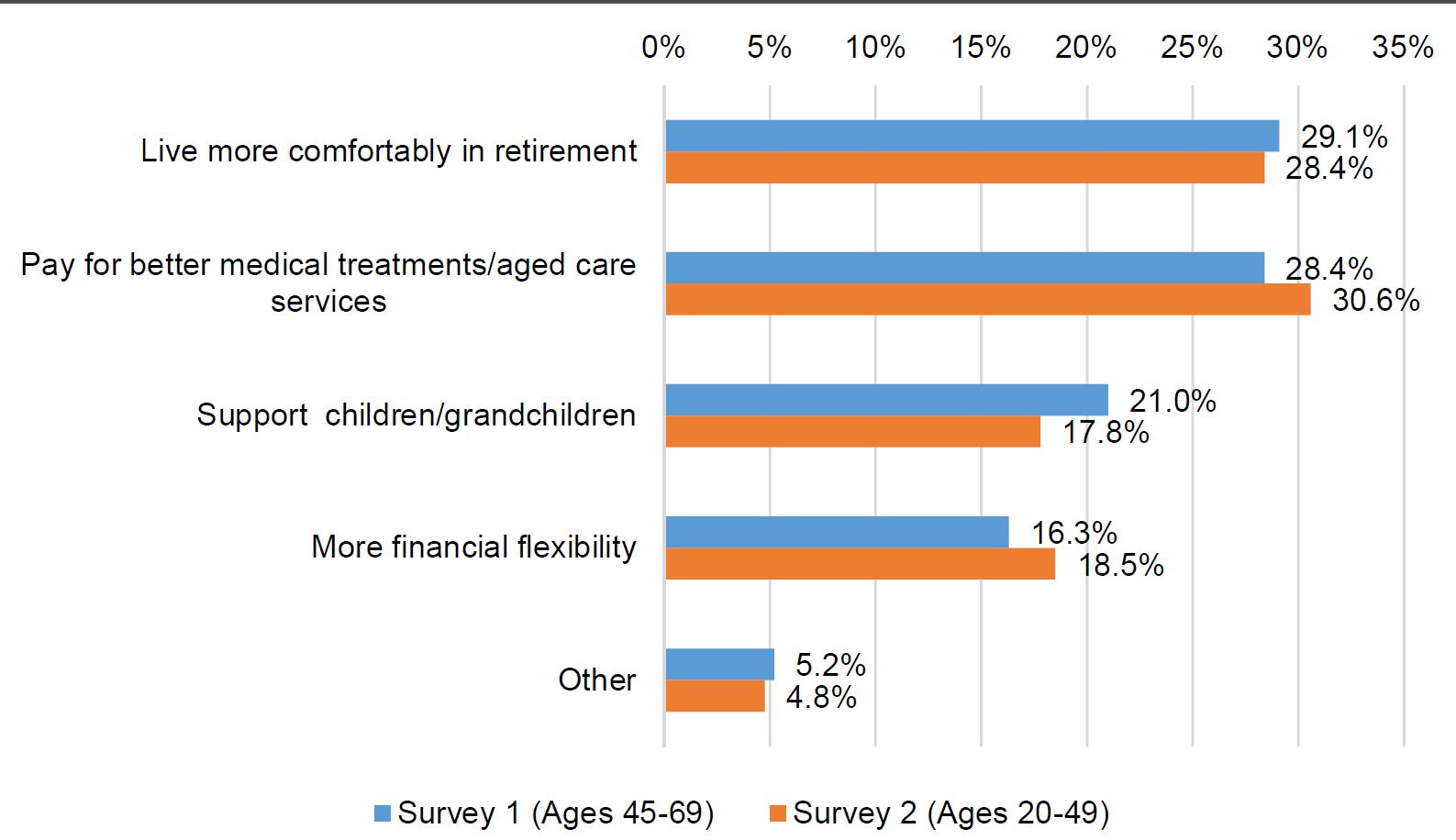

1 reverse mortgage. When you have a regular mortgage you pay the lender every month to buy your home over time. You can use the proceeds from your reverse mortgage loan to pay for medical care or other bills to protect your investment portfolio during market downturns or even to delay social security and increase your monthly benefits later in life. These advertisements and materials are not provided nor approved by the u s. The most money a person can borrow on a reverse mortgage is also dependent on age and current interest rates.

A reverse mortgage financial assessment is a review of the borrower s credit history employment history debts and income during the reverse mortgage application process. Borrowers are still responsible for property taxes and homeowner s insurance. Department of housing and urban development hud or the federal housing administration fha. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property.

I aim to extend my analysis of the iffy reverse mortgage market to help the average person plan for retirement. Reverse mortgage loans are specifically designed to help seniors age 62 and older tap home equity to help cover their retirement needs. A reverse mortgage is a type of mortgage loan that s secured against a residential property that can give retirees added income by giving them access to the unencumbered value of their properties. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments.

However no matter the age or interest rate a person cannot borrow more than 765 600 with a federally insured reverse mortgage. In a reverse mortgage you get a loan in which the lender pays you reverse mortgages take part of the equity in your home and convert it into payments to you a kind of advance payment on your home equity. 2020 one reverse mortgage llc nmls 2052. Reverse mortgages may make sense for some but decidedly not all.

The process for getting a hecm or helo from one reverse is similar to other reverse mortgage lenders. Instead the loan is repaid after the borrower moves out or dies. A reverse mortgage is a type of loan that s reserved for seniors age 62 and older and does not require monthly mortgage payments.

/shutterstock_502630279-5bfc4768c9e77c002636c003.jpg)