10 Year Level Term Insurance

A 10 year term life policy is best suited for those with short term life insurance needs.

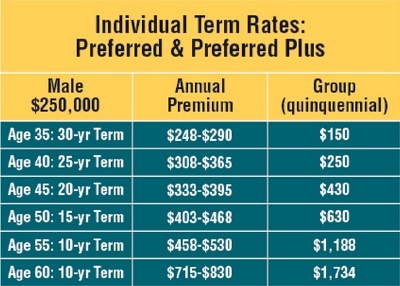

10 year level term insurance. Perhaps you planned ahead when you were young and bought life insurance right after your first child. There s a life insurance term policy and premium level to fit every situation and every budget. Premiums are guaranteed to remain level for the first ten years of coverage. Level term life premium is based on the member s age and the spouse s age amount of insurance requested and health status.

Your actual rate is based upon a number of underwriting criteria including your age and health the amount of insurance and any smoking as well as hobbies or hazardous sports or avocations. Continuing insurance after the 10 year term ends. Keep in mind that with a 10 year plan your rates are only locked in for the first 10 years and then will increase annually should you decide to keep your plan. At the end of the 10 year period you may reapply for 10 year level term rates then in effect for a subsequent 10 year period provided the insured person is under age 65 and otherwise eligible.

Level premium insurance is a type of term life insurance for which the premiums remain the same throughout the duration of the contract. Buy a 10 year term policy to supplement your existing life insurance. Term life insurance guarantees the premiums will remain fixed for a specific number of years 10 15 20 25 or 30 years. Renewable until age 80.

You can renew your life insurance under this plan until age 80. 20 year term life insurance the comparison between 10 year and 20 year term life insurance shows just how flexible life insurance can be. Use a 10 year term life insurance policy to supplement your existing life insurance. Ten year level term insurance is a variation of level term insurance that offers a fixed guaranteed rate or premium for the first 10 policy years.

And a multi state licensed life insurance agent who has helped over a million americans seek out affordable coverage compare quotes or get their family and businesses covered. With the state bar of california group 10 year level term life insurance plan you can help protect your family from the unnecessary financial burdens of your or your spouse s or domestic partner s premature death. The premium paid on this type of policy will be higher at. While the premium rates are expected to remain level for the specific term of the plan you choose 10 or 20 years the insurance company has the right to change rates on a class wide basis.

A 10 year term life insurance contract is often a solid choice for most families both in terms of benefits and cost. You locked in a great low premium payment for a 30 year 250 000 term policy.