15 Yr Refinance

Meanwhile the average 15 year fixed jumbo refinance rate is 2 530 with an apr of 2 570.

15 yr refinance. Compare 15 year refinance rates. 15 year fixed mortgage rates. To change the mortgage product or the loan amount use the search box on the right. Good candidates to refinance into a 15 year mortgage glenn brunker mortgage executive at charlotte north carolina headquartered ally home says worthy prospects for shifting to a 15 year loan.

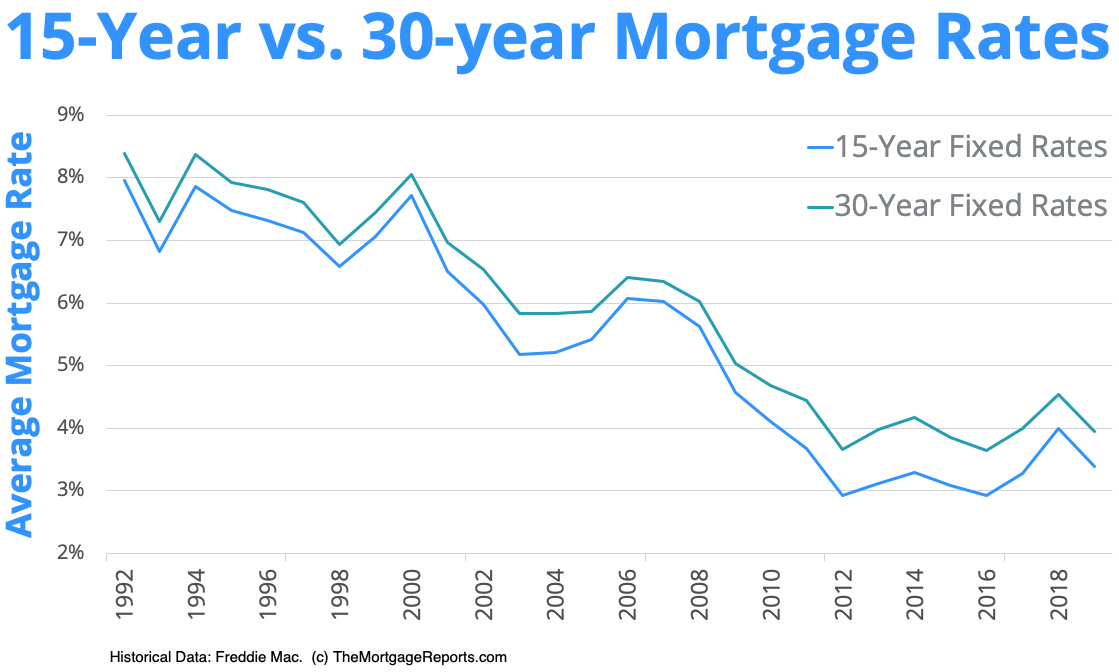

Nationally 15 year fixed mortgage rates are 2 68. Click the lender name to view more information. Run the numbers on 30 and 15 year loans. How to get the cheapest 15 year mortgage rate for your refinance as mortgage rates keep tumbling to new all time lows refinancing remains at the top of many homeowners to do lists.

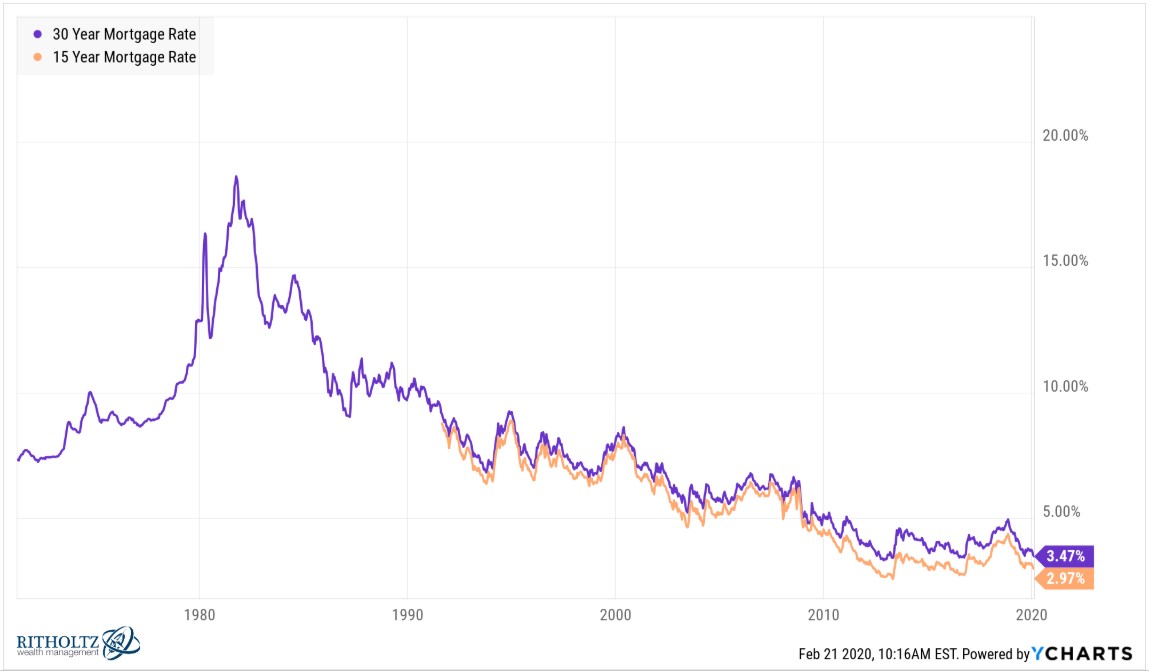

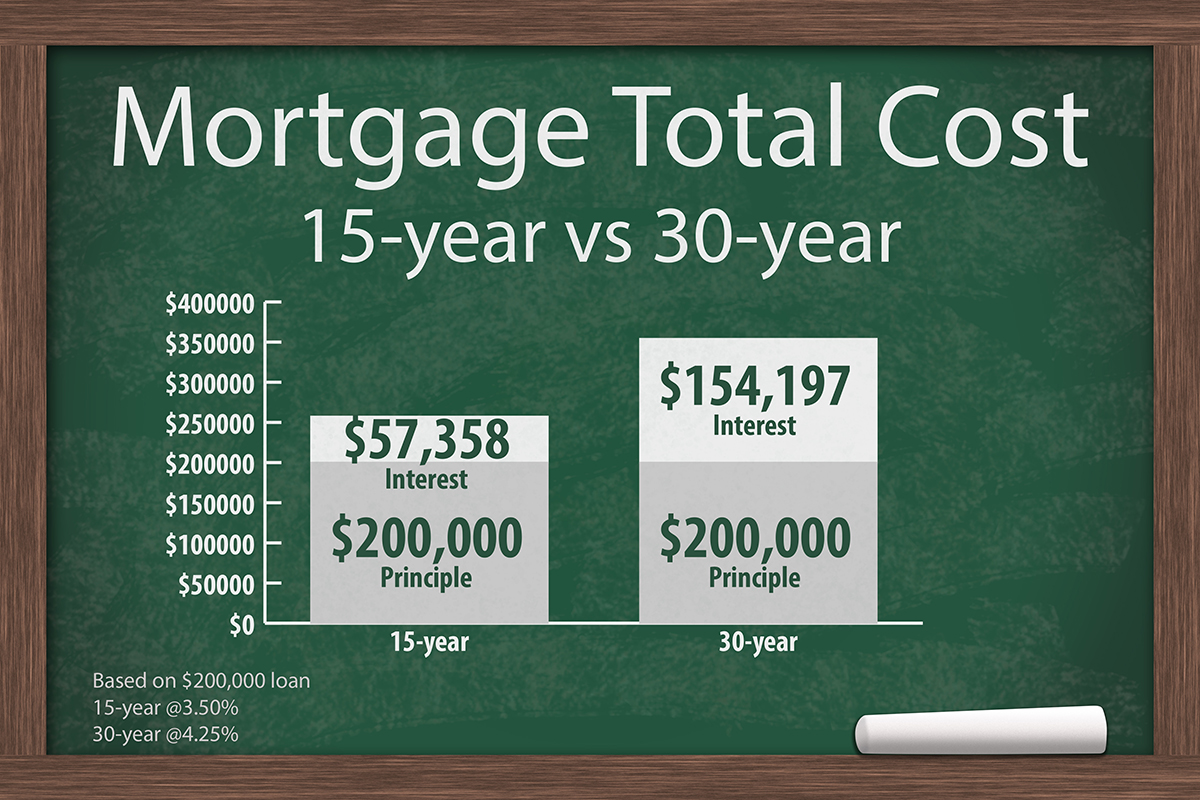

See the arguments on both sides to help you decide if a 30 year or 15 year refinance is the right pick for you. Refinancing rates continually fluctuate but for now they are still within a historically low range. Compare the current average rates between the two loan products then zero in on a couple of. If you re still uncertain whether to refinance o dell suggests asking yourself whether you can comfortably afford the higher 15 year loan payment.

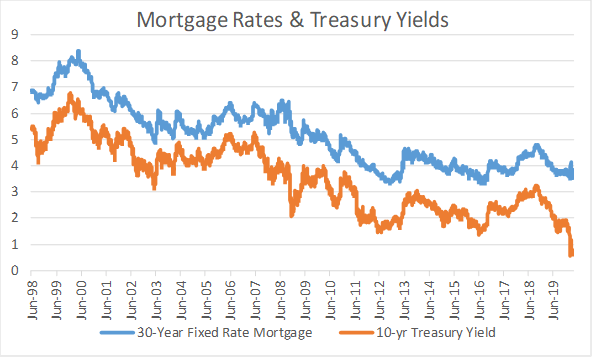

Mortgage rates are updated daily. The following table compares monthly payments interest rates total interest due over the life of a 220 000 loan. A 15 year mortgage popular for refinancing saves money in the long run because you pay less in total interest than on a 30 year loan. Advantages of refinancing to another 30 year mortgage.

Most mortgage lenders offer both 30 and 15 year terms. September 13 2020 compare washington 15 year fixed refinance mortgage refinance rates with a loan amount of 250000.

/find-and-compare-best-mortgage-rates-4148342_FINAL-d90ea8095a49474f90bee793bf4c5918.png)