20 Vs 30 Year Mortgage

Although 30 year mortgages is among the most common since it offers lower monthly payments there are benefits to having a shorter term.

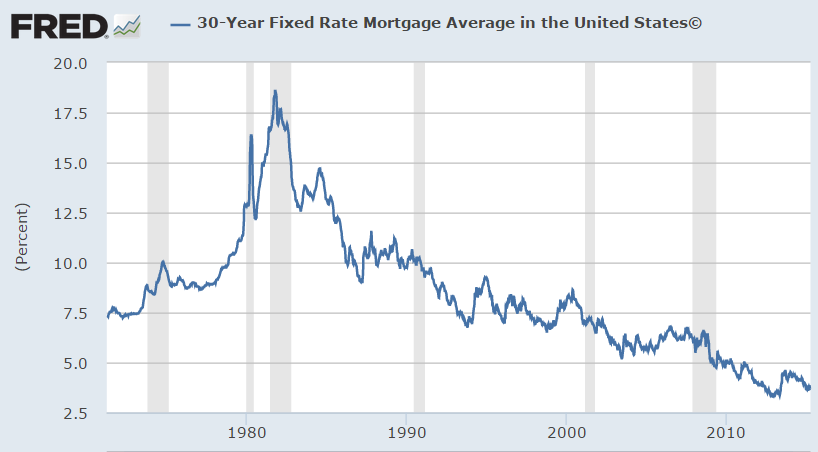

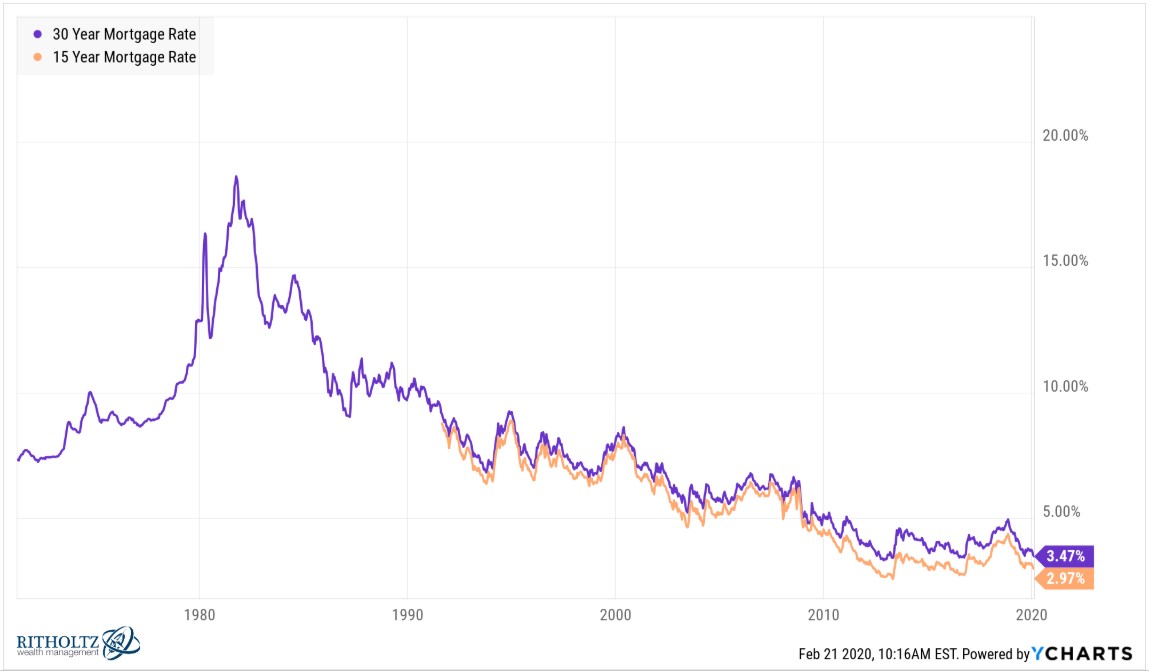

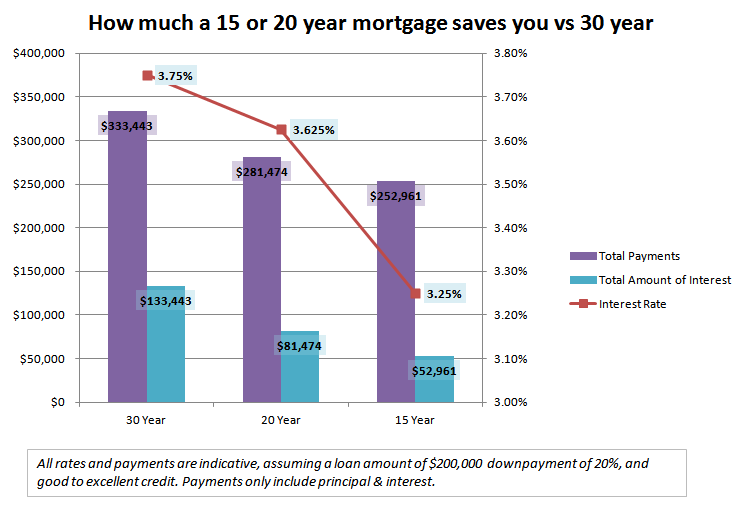

20 vs 30 year mortgage. Mortgage lenders offer various terms including 20 30 and 15 year mortgages. Each mortgage payment is the same every month so there isn t any. While much depends on the individual mortgage terms in general 20 year mortgages have a shorter term than the traditional 30 year mortgage which means a faster payoff and a lower rate. The most common type of mortgage is the 30 year fixed.

20 vs 30 year mortgage. The amortization follows more closely to a 15 year than a 30 year. It amortizes over 30 years and the mortgage rate never changes during that time. Use this calculator for a comparison of a 20 vs.

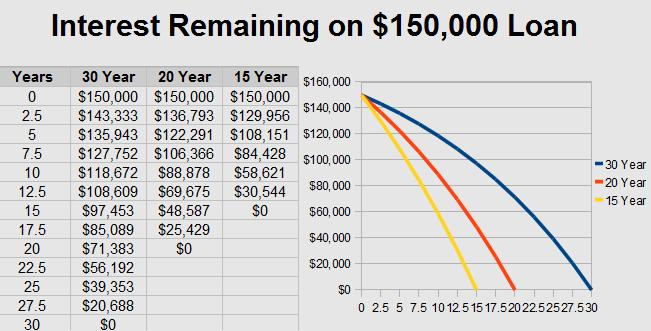

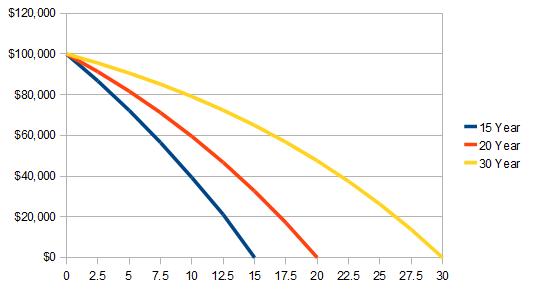

It s time for a new mortgage match up. A 30 year mortgage on a 200 000 loan with 5 interest has a payment of 1 074 not including property taxes and insurance. Determining which mortgage term is right for you can be a challenge. A good representation of how different these loans are is looking at the remaining loan balance 5 years into the loan.

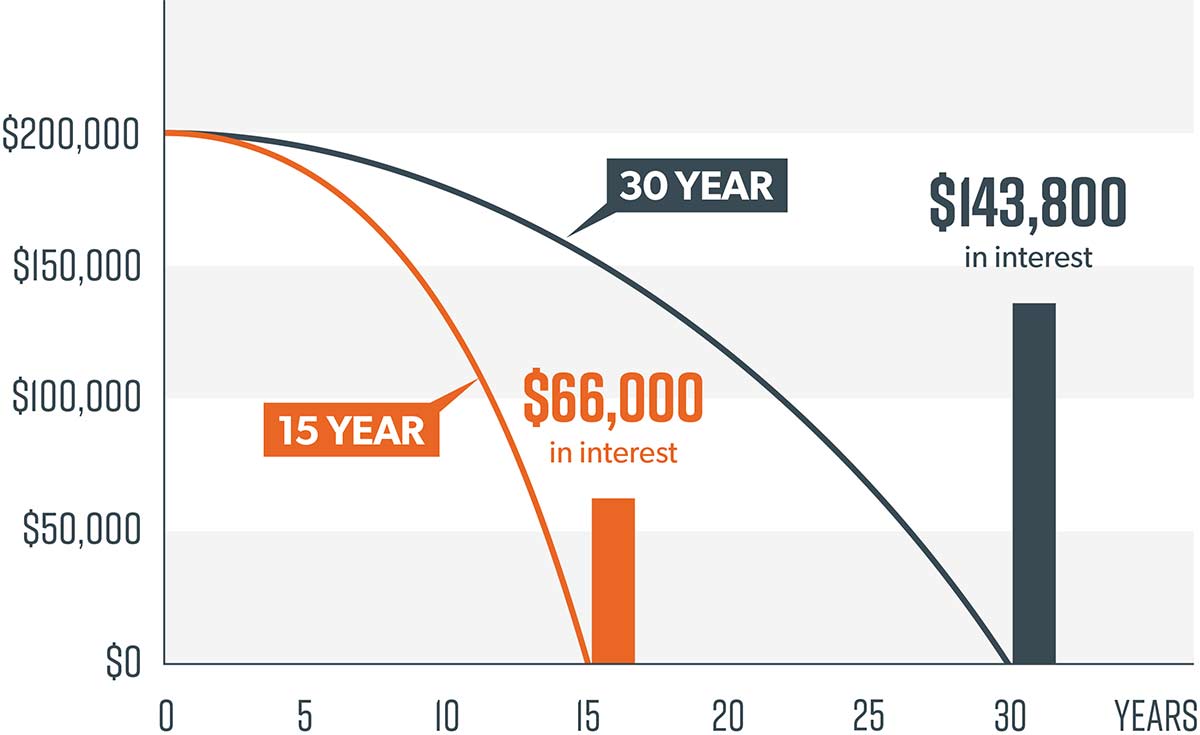

The 20 year mortgage is going to be 1 110 per month. Use this calculator for a comparison of a 20 vs. Let s check out the difference between a 30 year term and 15 year term on a 250 000 home with 20 down. The outstanding principal on a 30 year mortgage at a 3 5 percent interest rate would be 232 280 resulting in 67 720 of equity nearly only half as much as under the 20 year mortgage.

Calculator rates compare 20 30 year fixed rate mortgages. You ll pay less interest on a shorter loan and have a quicker payoff. Determining which mortgage term is right for you can be a challenge. The payment is on a 20 year mortgage is actually closer to a 30 year mortgage even though the total payback time is closer to a 15 year.

That means your mortgage loan amount would be 200 000. The difference between the two could mean a whole lot when it comes to how you want to spend the money leftover if you went. This calculator makes it easy to compare the monthly payments for any 2 fixed rate mortgages frms. A 30 year mortgage will cost you 760 per month but in the end you re going to have to pay down 2 5 times as much interest than you would with a 20 year mortgage.

By default the left column is set to a 20 year amortization while the right column is set to a 30 year amortization but you can change either of these terms to quickly easily compare the monthly payments for any fixed rate.