20 Year Term Insurance Rates

20 year term life insurance rates.

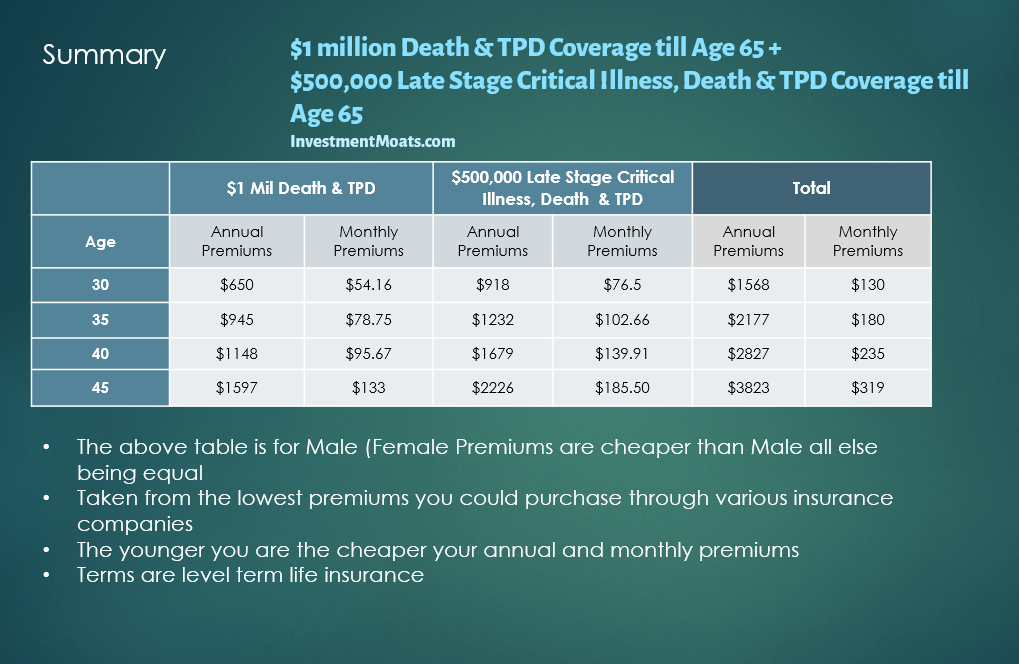

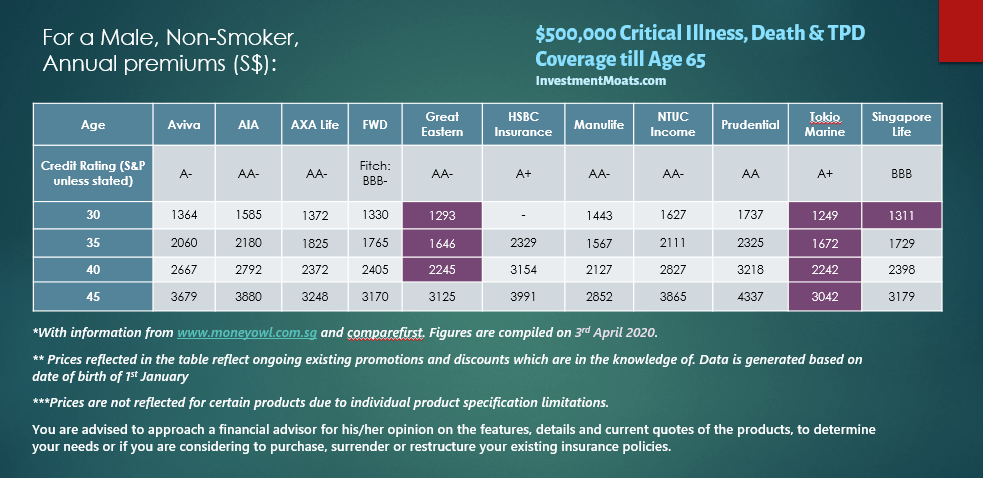

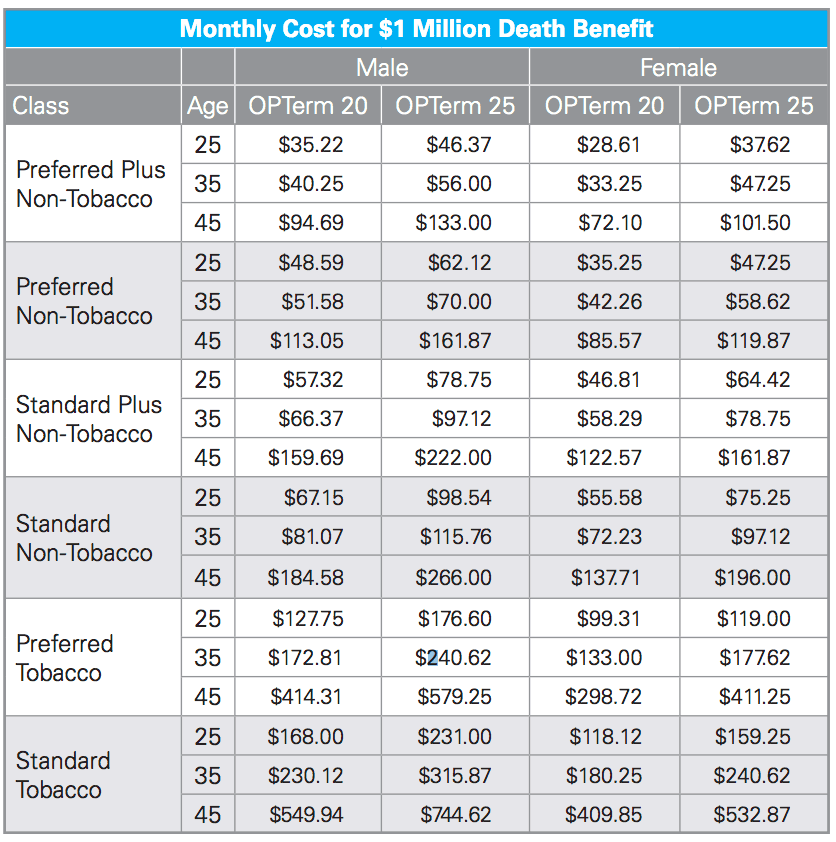

20 year term insurance rates. The premium will be roughly 50 higher on a 30 year term than on the 20 year. Term life is a type of life insurance that provides coverage for a set period of time. There are various term lengths offered. Life insurance rates by age for women call today 888 234 8376.

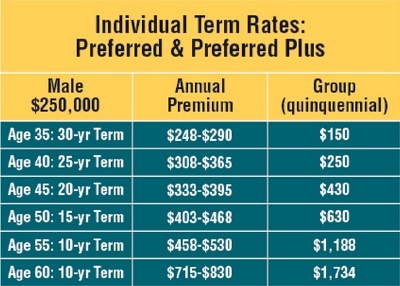

In fact 20 year term life insurance rates are also much more affordable than whole life or even a 30 year term life policy and you re still offered protection for what. 1 year 5 year 10 year 15 year 20 year 25 year and 30 year. You will get a guaranteed level premium for 20 years and once the 20 year term is up your premiums will rise annually if the policy is renewable. The average term life insurance rate on a 500 000 policy for a 35 to 39 year old is 26 20 a month according to policygenius data.

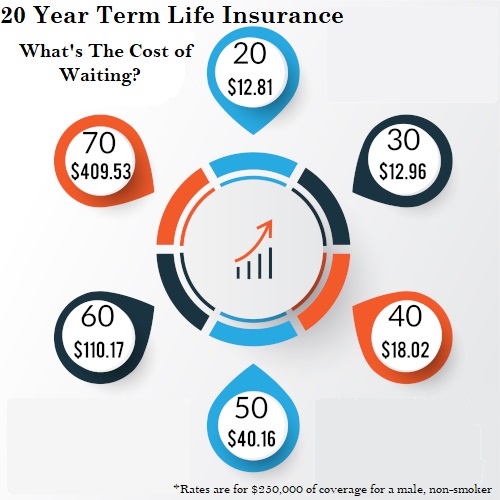

Many people like the 20 year term because it is less expensive than a 30 year term life insurance policy but you still get coverage for an extended period of time. 20 year term life insurance quotes with exam a 20 year term policy usually the middle range of pricing. By waiting 20 years until age 50 rates for a 20 year 500 000 term life policy will more than triple. Life insurance companies will use age as a determinant for life insurance premiums.

The advantages of a 30 year term life insurance policy. While 20 year term life insurance costs a bit more than 10 or 15 year term it provides more comprehensive coverage if you have a young family. Let s start with the lone disadvantage of the 30 year term vs the 20 year. The term represents how long the policy remains in force.

For a 25 year old healthy male non smoker the premium for a 500 000 30 year term policy would be about 450 per year. A 20 year term policy can be one of the most affordable life polices. The term life insurance quotes below are for a 20 year term life insurance policy with a death benefit of 500 000. 20 year term life insurance is available for those 70 and under.

Rates will continue to increase as you age due to a decrease in your total life expectancy. If you don t die during your term you can still convert the policy to guaranteed universal life which is a permanent life insurance policy without proof of insurability that is if you follow my advice.