2015 Section 179 Limits

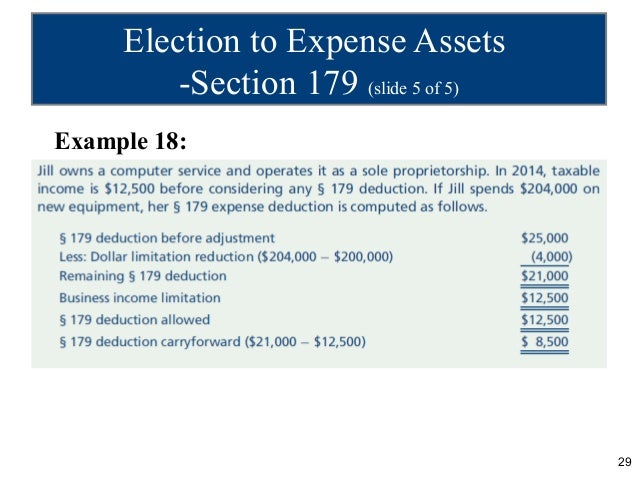

This means as of today section 179 for 2015 has a maximum deduction of 25 000 and a 200 000 cap on equipment purchased.

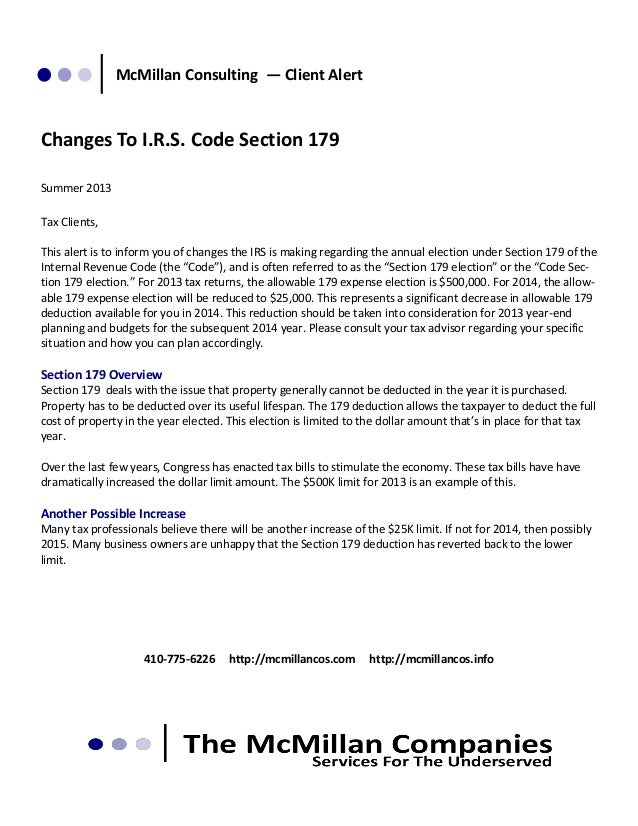

2015 section 179 limits. The limit for the 2015 tax year will be 25 000. The section 179 deduction is subject to an annual dollar limit. Under the tax cuts and jobs act passed in december 2017 congress has changed the annual limit to 1 million starting in tax year 2018. Like i said repeatedly last year it s always nice to have a 25k write off but goodness 500 000 is sooo much better.

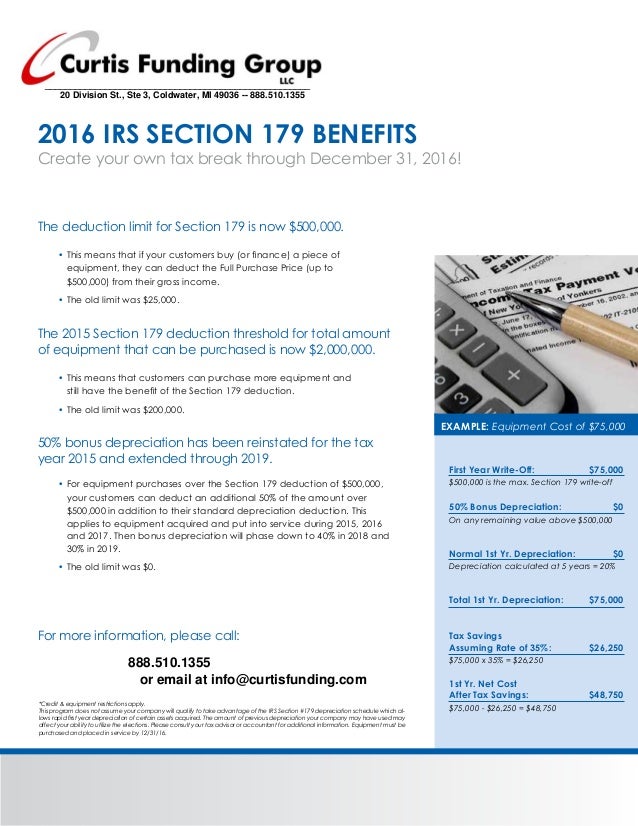

Click on the above link for a section 179 calculator for 2016. The section 179 deduction is now 500 000 for 2015. The maximum you can elect to deduct for most section 179 property you placed in service in tax years beginning in 2019 is 1 020 000 1 055 000 for qualified enterprise zone property. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2 million.

In fact as of jan 1 2015 section 179 fell back to 25 000. Section 179 does come with limits there are caps to the total amount written off 1 040 000 for 2020 and limits to the total amount of the equipment purchased 2 590 000 in 2020. Increased section 179 deduction dollar limits. Click the link above for more information and a 2015 section 179 calculator.

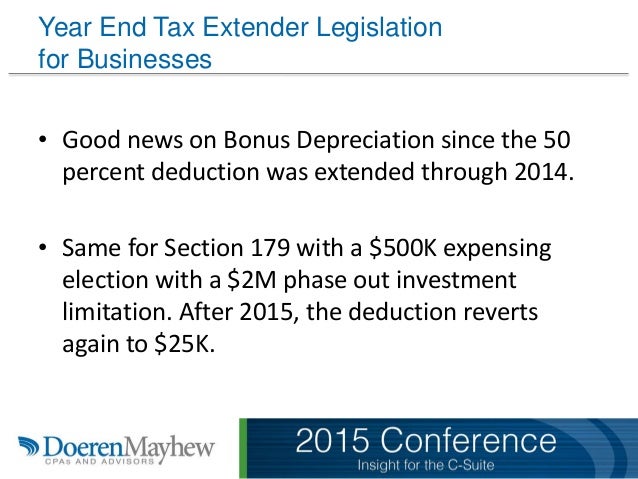

This act passed in late 2015 raised section 179 to 500 000 and also made it permanent. Section 179 in 2014. The biggest of which is section 179 which allows accelerated depreciation for equipment placed in service during the 2015 tax year. See the instructions for part i.

The section 179 limit has varied over the years and was set at 500 000 in 2015 under the protecting americans from tax hikes path act. On december 21 2015 the u s. There were also changes passed in january 2013 for the 2012 and 2013 tax years. For tax years beginning in 2015 the maximum section 179 expense deduction is 500 000 535 000 for enterprise zone property.

Section 179 in 2015 section 179 had a limit of 500 000 in 2015. House and senate approved a bill to return the section 179 deduction to 2014 levels permanently raising the deduction limit to 500 000. Section 179 tax deduction limits for year 2015. The limit for section 179 for the previous tax years was 500 000 with a dollar for dollar phase out beginning at 2 million.

The new higher deduction limit is retroactive to qualifying purchases made since january 1 2015.