30 Day Late Payment Affect Credit Score

Because of the way late payments are reported you get somewhat of a grace period for being late without having it affect your credit.

30 day late payment affect credit score. If you had a 30 day late payment reported in june 2017 and bring the account current in july 2017 the late payment would drop off your reports in june 2024. Older 30 day late payments which were isolated incidents are not going to adversely affect your credit score. Even though a late payment remains on your credit reports for seven years the impact these negative marks have on your credit score steadily diminishes over time. More important a 30 day late payment will affect your credit scores.

As time goes on the late payment will hurt your credit score less and less until it drops off. Late payments appear on your report as either being 30 days late 60 days late 90 days late or 120 plus days late. A 30 day late payment will hurt your credit scores. A 30 day late payment is not as damaging as a 90 day late payment.

However potential creditors can still see that history as long as it s listed on your report. The two largest credit scoring companies fico and vantagescore rank payment history as the most important score factor and thus a late payment will shave points from your score. If you are only a few days or a couple of weeks late on your payment you can dodge having the late payment placed on your credit report as long as you make up the payment before the 30 day mark. As you exceed 60 and 90 days past.

You will see damage to your score from these payments for most of the seven years that they are allowed to report on your credit report scanlon said. A late payment also known as a delinquency will typically fall off your credit reports seven years from the original delinquency date. How 30 60 90 and 120 day late payments affect credit scores. While a late payment might drag down your score by 100 points immediately it won t have nearly as much of an impact five years later or seven years later.

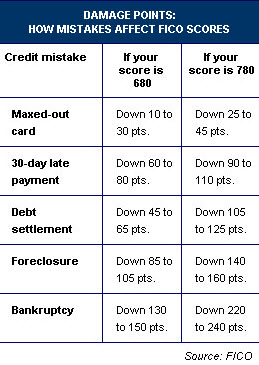

For example if you have a credit score of 780 without any prior late payments just one credit card marked 30 days past due could lower your score by 110 points. Scanlon said payments that become 90 to 120 days late affect your score for a much longer time than a 30 day late payment. Looking at this chart again we can see that late payments that are 30 days past due will drop a 900 point credit score by as much as 90 points and a 60 day late payment can cause a 105 point drop.

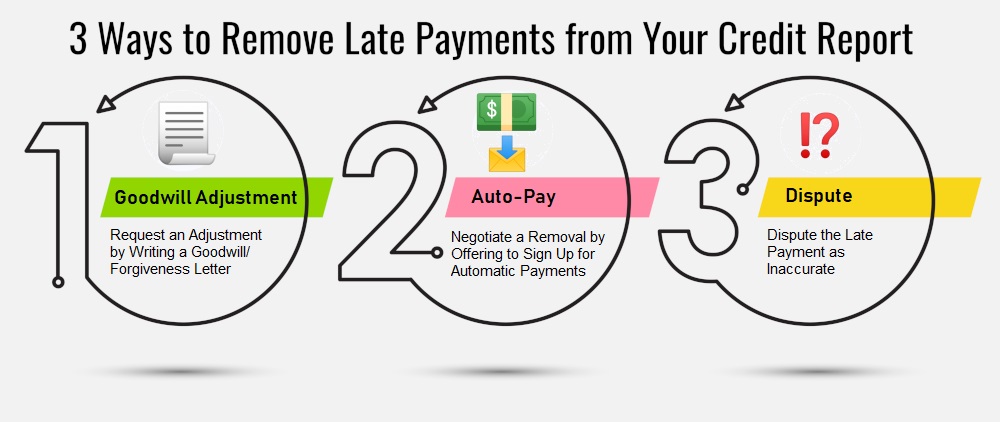

/remove-credit-report-late-payments-4134208_color-6a8317fc55d340da8ecb4dfa8853aab7.gif)

/remove-credit-report-late-payments-4134208_color-6a8317fc55d340da8ecb4dfa8853aab7.gif)

/remove-credit-report-late-payments-4134208_color-6a8317fc55d340da8ecb4dfa8853aab7.gif)