401k Brokerage Account

Brokerage accounts offer much greater flexibility.

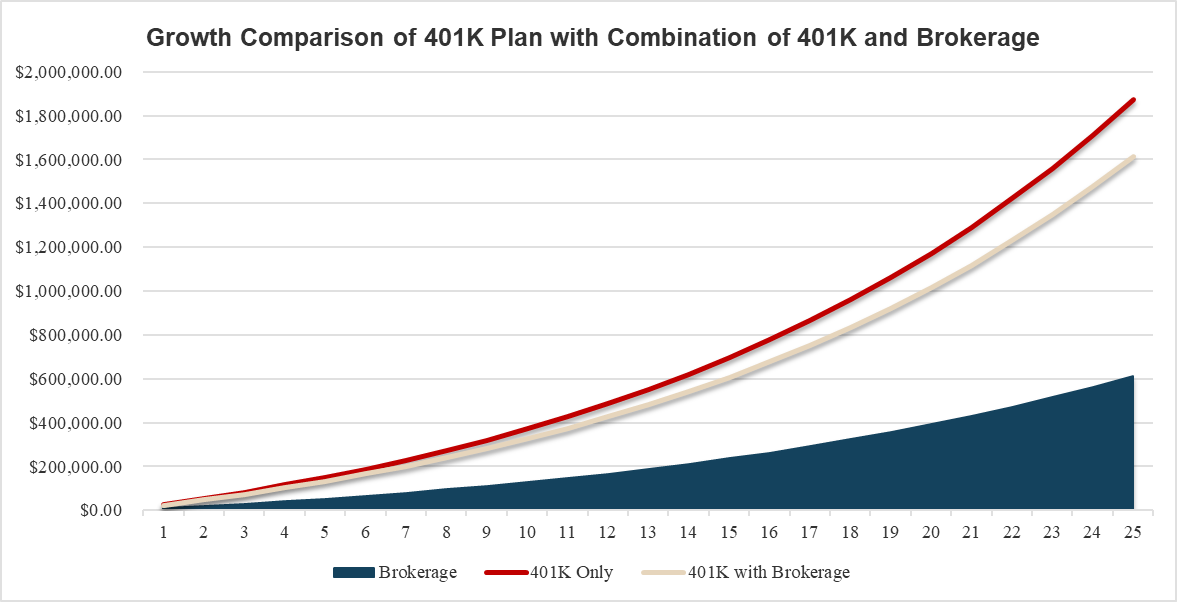

401k brokerage account. What is a brokerage account. A brokerage account is a type of taxable investment account that you open with a brokerage firm. Saving at a young age allows returns to compound over time offering you a significant benefit over any non retirement brokerage account. 0 00 commission applies to online u s.

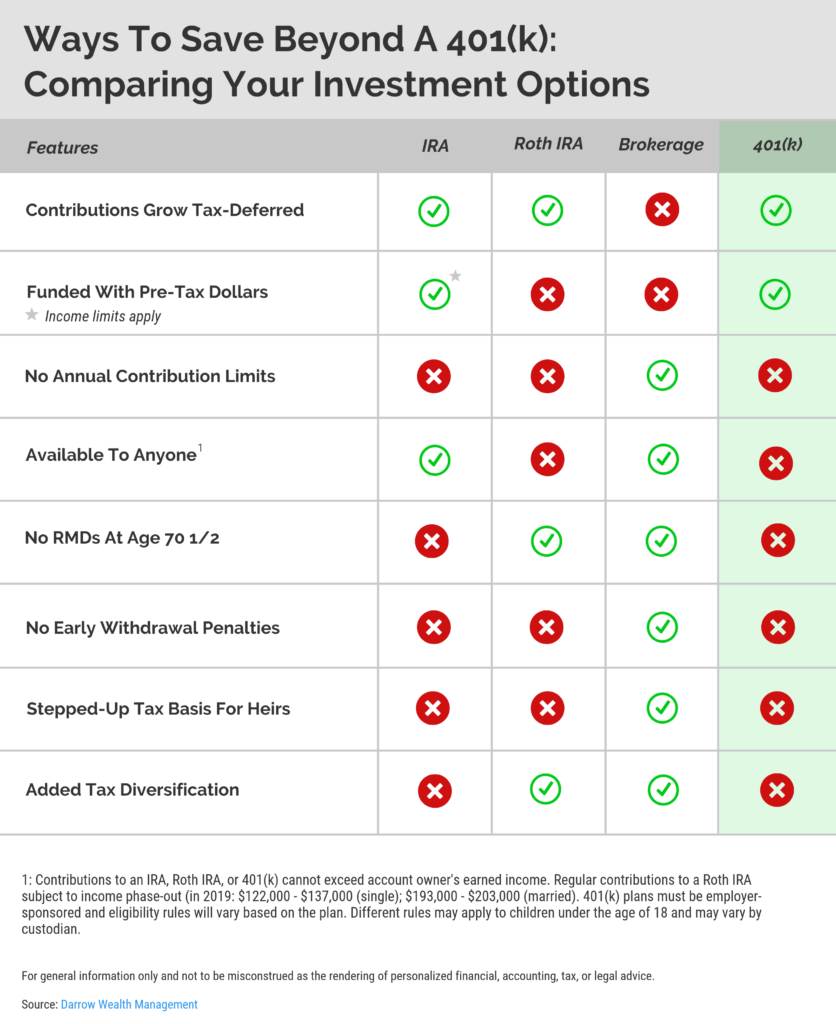

You deposit money into this account by writing a check wiring money or transferring money from your checking or savings account. To roll over any retirement account click to open an account with the broker you decide on select retirement account and ira under type and complete the application. In 2019 a 401 k has a 19 000 annual contribution limit. A personal brokerage account can be your college basketball career brokerage accounts are amazing if you have maxed out your tax advantaged accounts.

The latter is especially true in 401 k accounts. The best answer may be both many investors take advantage of the flexibility of a taxable brokerage account while also actively contributing to a tax advantaged ira for retirement. Once you ve deposited funds you can use the money to buy different types of investment securities. That tax free treatment is extremely unusual and sets apart roth iras both from regular taxable brokerage accounts and from several other types of tax favored retirement accounts.

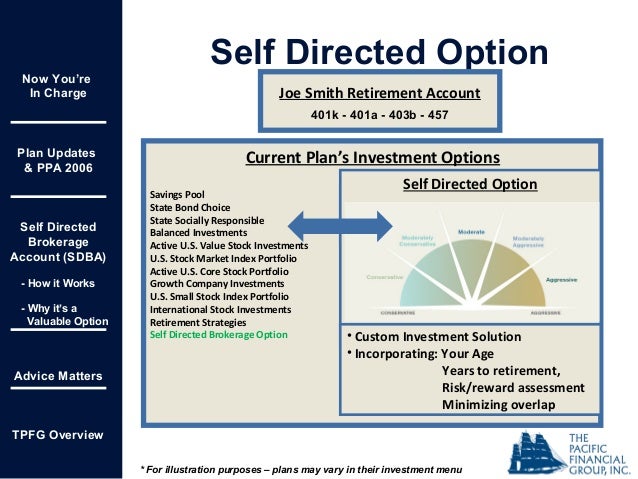

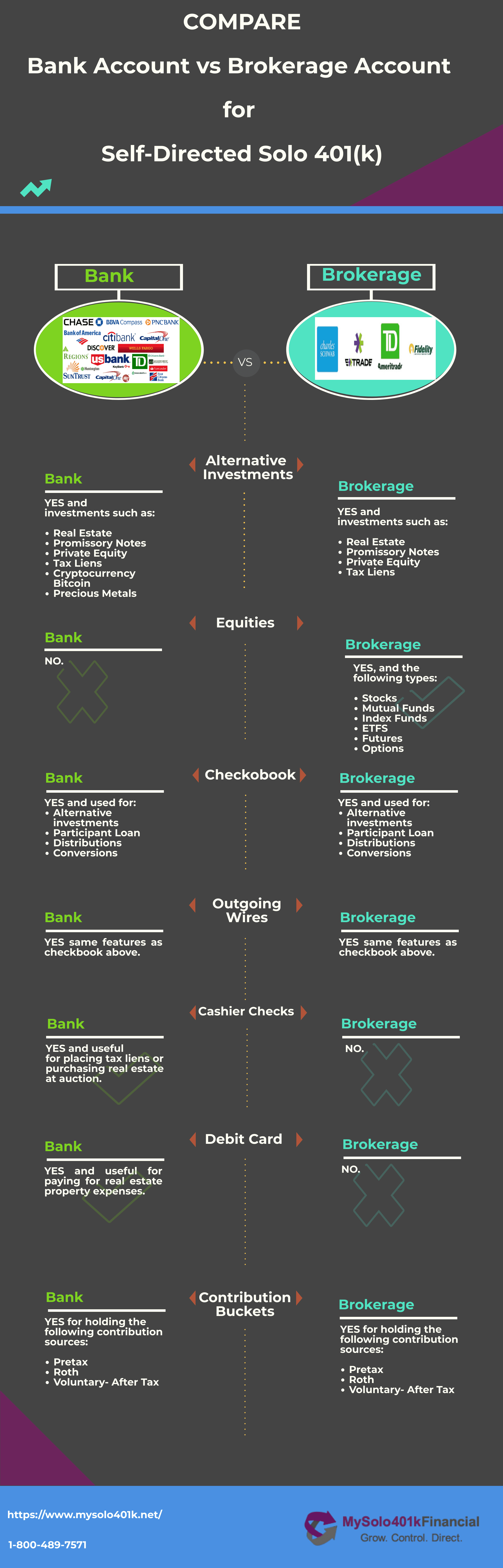

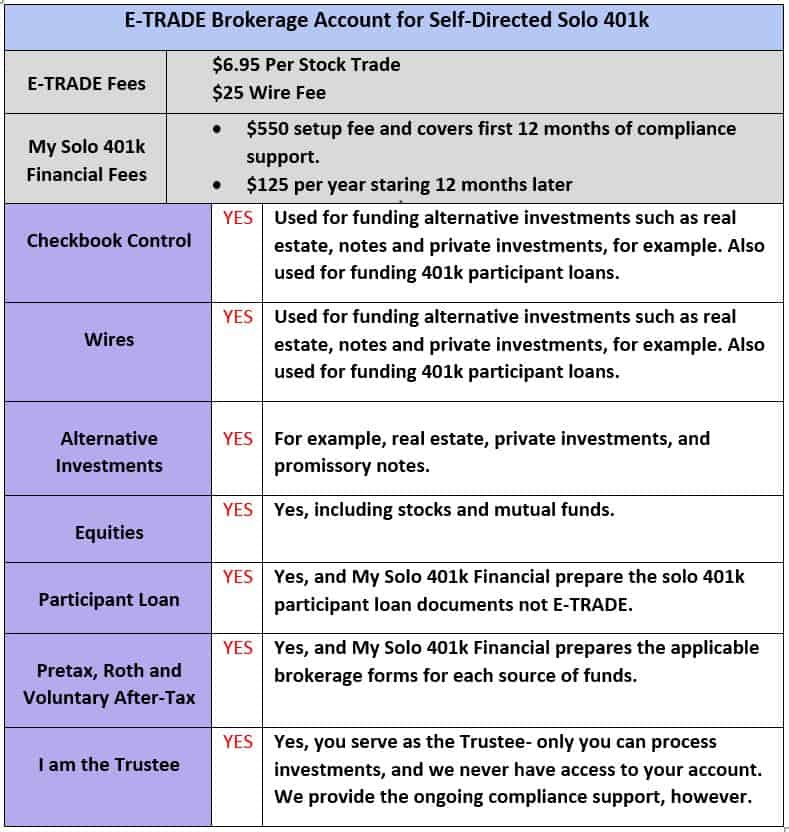

Equity trades exchange traded funds etfs and options 0 65 per contract fee in a fidelity retail account only for fidelity brokerage services llc retail clients. You may deposit as much money as you want in a brokerage account. But if your account includes publicly traded stock in the company you work for you can save money by withdrawing it from your 401 k and putting it in a taxable brokerage account for more. Many 401 k plans now allow participants to trade stocks bonds and other securities by offering self directed brokerage accounts inside the plan.

/building-complete-financial-portfolio-357968-color-FINAL2-86933638b6844aa296049011de61d7fb.png)

/401K-cash-2441f4926cef43c29c12c2453016245c.jpg)