401k Brokerage Accounts

For example an investor who signs up with a typical discount broker can expect to open a regular taxable brokerage account or retirement account at no cost as long as he or she is able to fund.

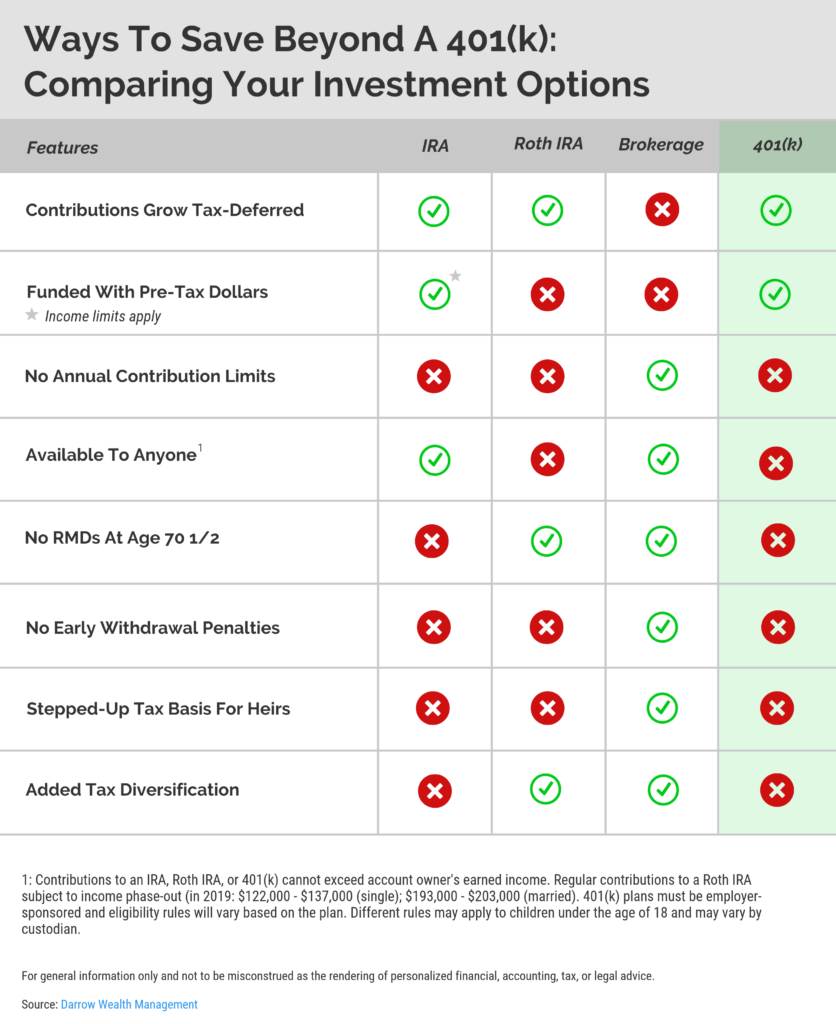

401k brokerage accounts. Understand how to roll over your 401k to an ira. There is no limit to the number of non retirement brokerage accounts you are allowed to have. Saving at a young age allows returns to compound over time offering you a significant benefit over any non retirement brokerage account. You can have multiple brokerage accounts at the same institution segregating assets by investing strategy.

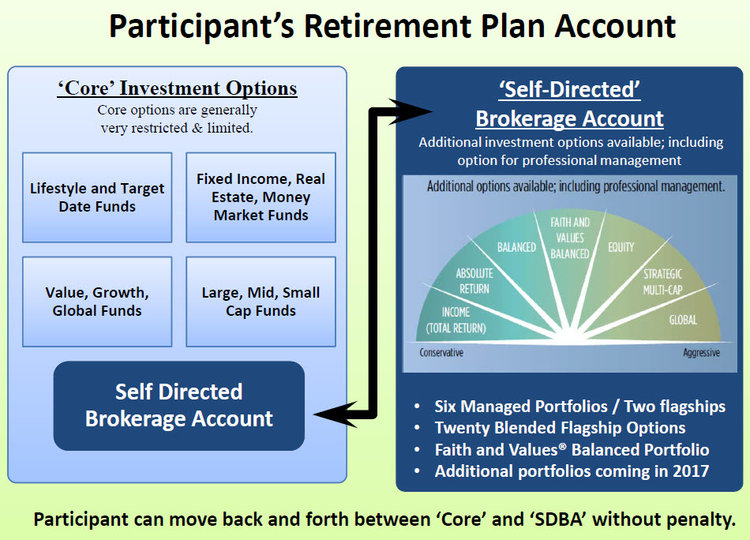

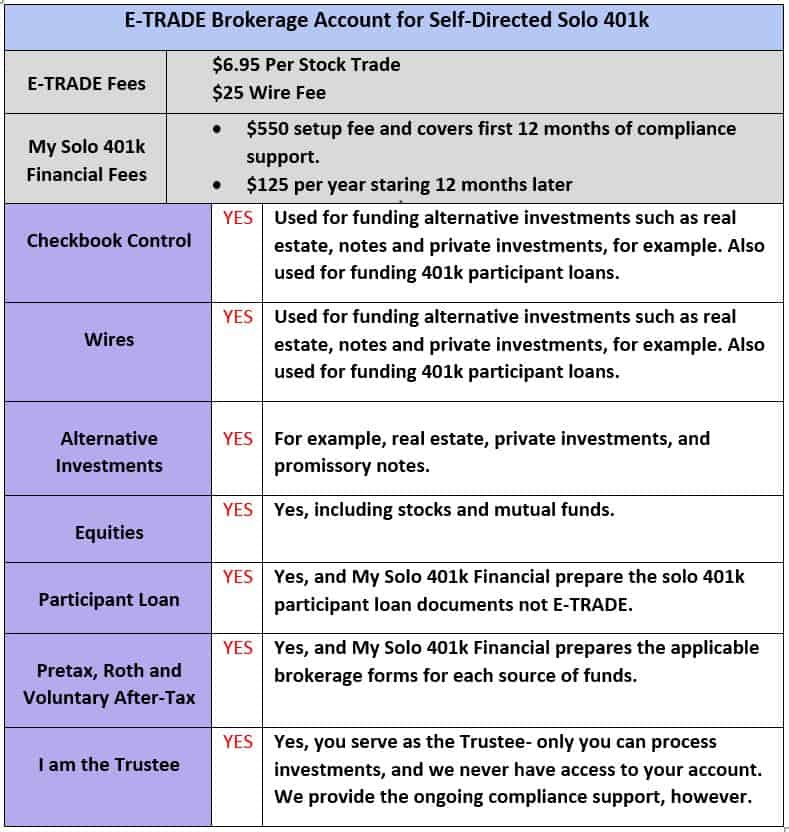

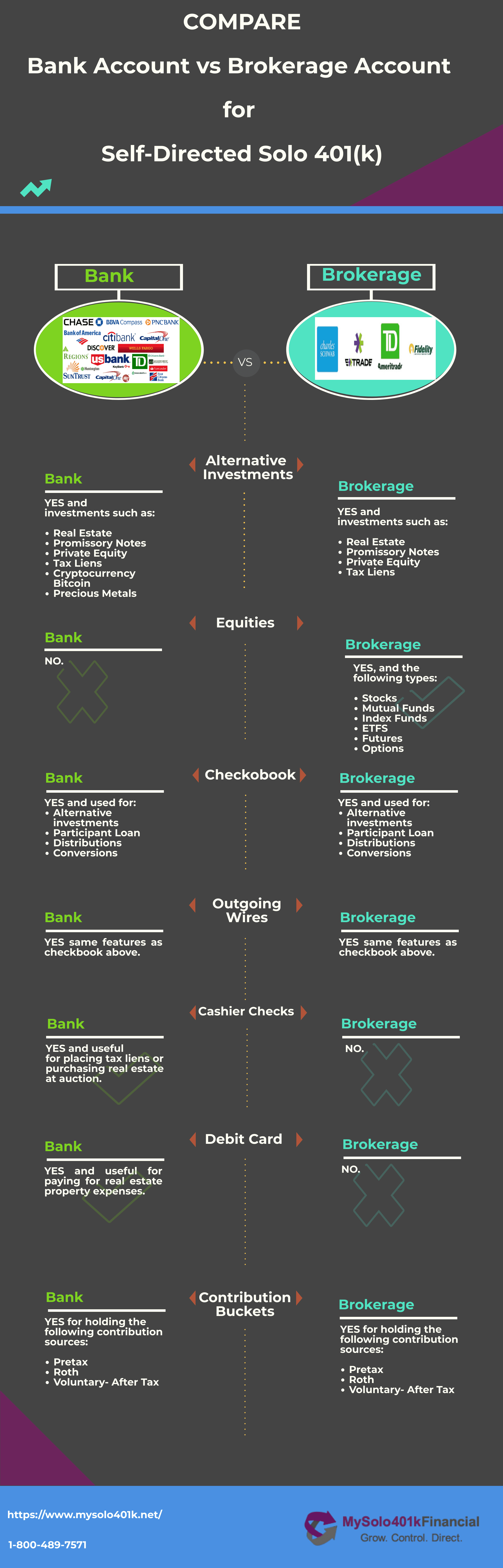

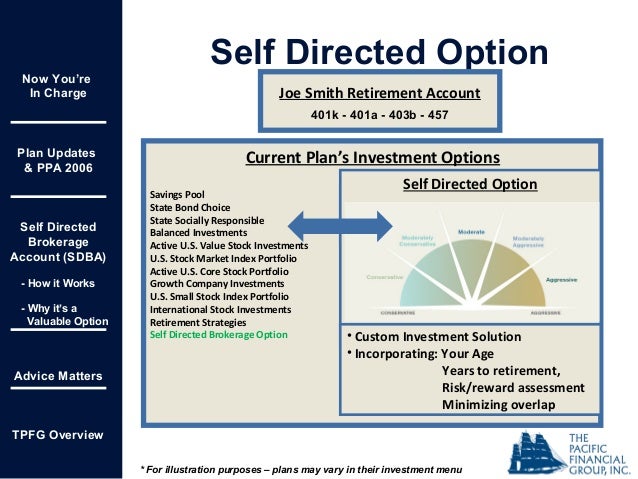

You can have as many or as few brokerage accounts as you want through as many institutions as will permit you to open those accounts. Many 401 k plans now allow participants to trade stocks bonds and other securities by offering self directed brokerage accounts inside the plan. Before we get started note that i often used the terms brokerage account taxable brokerage account and standard brokerage account to describe the same thing a non retirement investment. That tax free treatment is extremely unusual and sets apart roth iras both from regular taxable brokerage accounts and from several other types of tax favored retirement accounts.

A personal brokerage account can be your college basketball career brokerage accounts are amazing if you have maxed out your tax advantaged accounts. To roll over any retirement account click to open an account with the broker you decide on select retirement account and ira under type and complete the application. 401k plans with self directed brokerage accounts that allows participants to choose almost any type of investment is another form of gambling and a plan sponsor may unknowingly expose themselves to liability by offering this feature. A second opportunity i see for using a personal brokerage account is an obvious one you have maxed out your tax advantaged option.

Offering self directed brokerage accounts in a 401k plan is a bad bet.

/401K-cash-2441f4926cef43c29c12c2453016245c.jpg)

/building-complete-financial-portfolio-357968-color-FINAL2-86933638b6844aa296049011de61d7fb.png)