401k Rollover To Ira Tax

As mentioned above you generally won t have to pay any taxes on your 401 k to ira rollover.

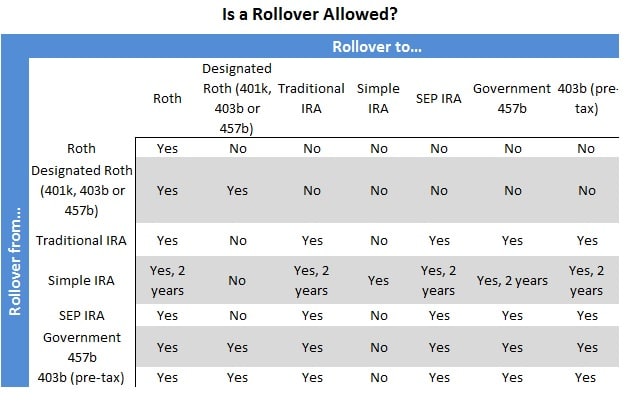

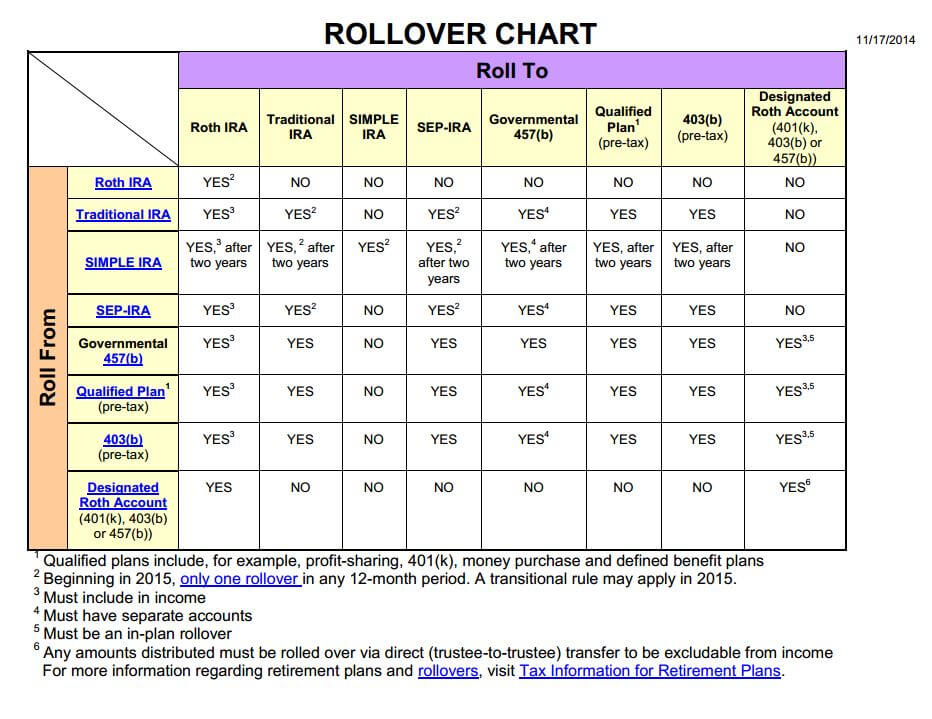

401k rollover to ira tax. Although most people think of an ira rollover as moving funds from a 401 k to an ira there is also a reverse rollover where you move ira money back into a 401 k plan. One other tax consideration. The tax rules for 401 k rollovers can be simple or complex depending on which path you take. The type of retirement plan the distribution was made from and moved to e g.

Whether or not you have a cost basis to recover. 60 day rollover if a distribution from an ira or a retirement plan is paid directly to you you can deposit all or a portion of it in an ira or a retirement plan within 60 days. If you have small ira accounts in many places and your employer plan offers good fund choices with low fees using this reverse rollover option can be a way to consolidate everything in one place. You can only roll an ira into a 401 k if the provider is willing and able to accept the deposit.

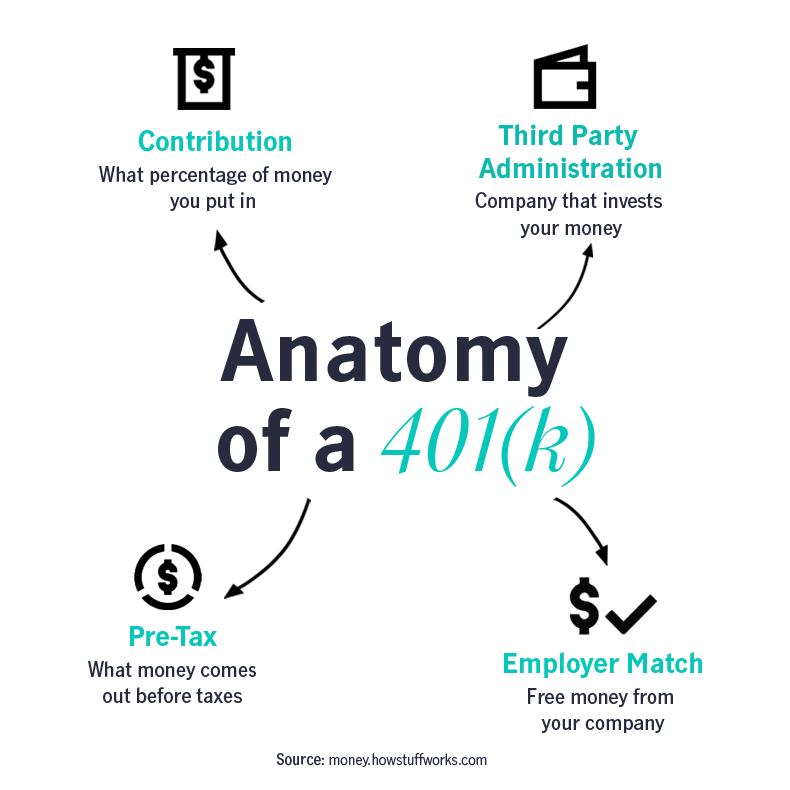

How to do an ira rollover to a 401 k without tax penalties first you must check your eligibility. If you have a 401 k and want to roll it over into an ira you may or may not have to pay taxes on the rollover. Generally 401 k rollover tax implications only come into play when you re rolling. Traditional ira roth ira qualified employee plan other than a designated roth account.

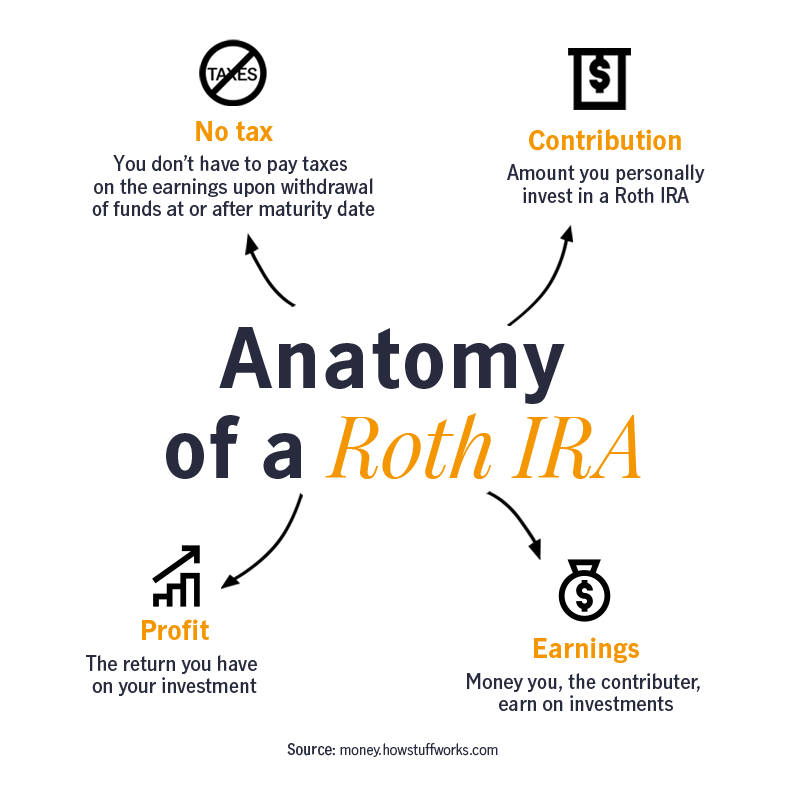

The only time you ll have to deal with taxes is if you have a traditional ira and want to rollover to a roth ira. Taxes will be withheld from a distribution from a retirement plan see below so you ll have to use other funds to roll over the full amount of the distribution. Individuals with 401 k plans have several options when leaving an employer. If you roll over your funds into an ira or a 401 k plan sponsored by your new employer.

Tax consequences of a 401 k to ira rollover. Roll the plan to an ira cash out the 401 k keep the plan as is or consolidate the old 401 k with a 401 k at the. You can choose to do a direct or indirect rollover. You may need to check with your ira trustee or retirement plan administrator to determine the account type.

The rollover of after tax amounts to a roth ira are tax free. He could do that but in this case 80 000 would be considered a taxable roth conversion because 80 of his 401 k balance is pre tax money.

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)