401k Rollover To Roth Ira Rules

A 401k rollover to a roth ira.

401k rollover to roth ira rules. Some for profit companies create 401k plans for their employees to assist them in saving for retirement. A new irs rule makes it easier to do an after tax 401 k rollover to a roth ira. New irs rules open the roth door for 401 k investors who contribute after tax money. When you rollover funds from a roth 401 k to a roth ira it s the age of the roth ira that sets the clock for the 5 year rule.

However as of 2008 you can perform a roth ira rollover with a complete or partial rollover distribution you receive from your or your deceased spouse s. Taxes will be withheld from a distribution from a retirement plan see below so you ll have to use other funds to roll over the full amount of the distribution. Find answers to commonly asked questions about iras and work retirement plans rollovers and converting a traditional ira to a roth ira. Roth ira rollover rules from 401k.

A roth 401 k can be rolled over to a new or existing roth ira or roth 401 k. However some employers do permit an in service rollover where you can do the rollover while still employed. Reasons for doing this include the tax free withdrawals that. Rolling over a roth 401 k to a roth ira can make sense in the right circumstances but you need to be aware of the rules.

You can roll over your ira into a qualified retirement plan for example a 401 k plan assuming the retirement plan has language allowing it to accept this type of rollover. 401k to roth ira rollover rules. That s on top of paying taxes on. 60 day rollover if a distribution from an ira or a retirement plan is paid directly to you you can deposit all or a portion of it in an ira or a retirement plan within 60 days.

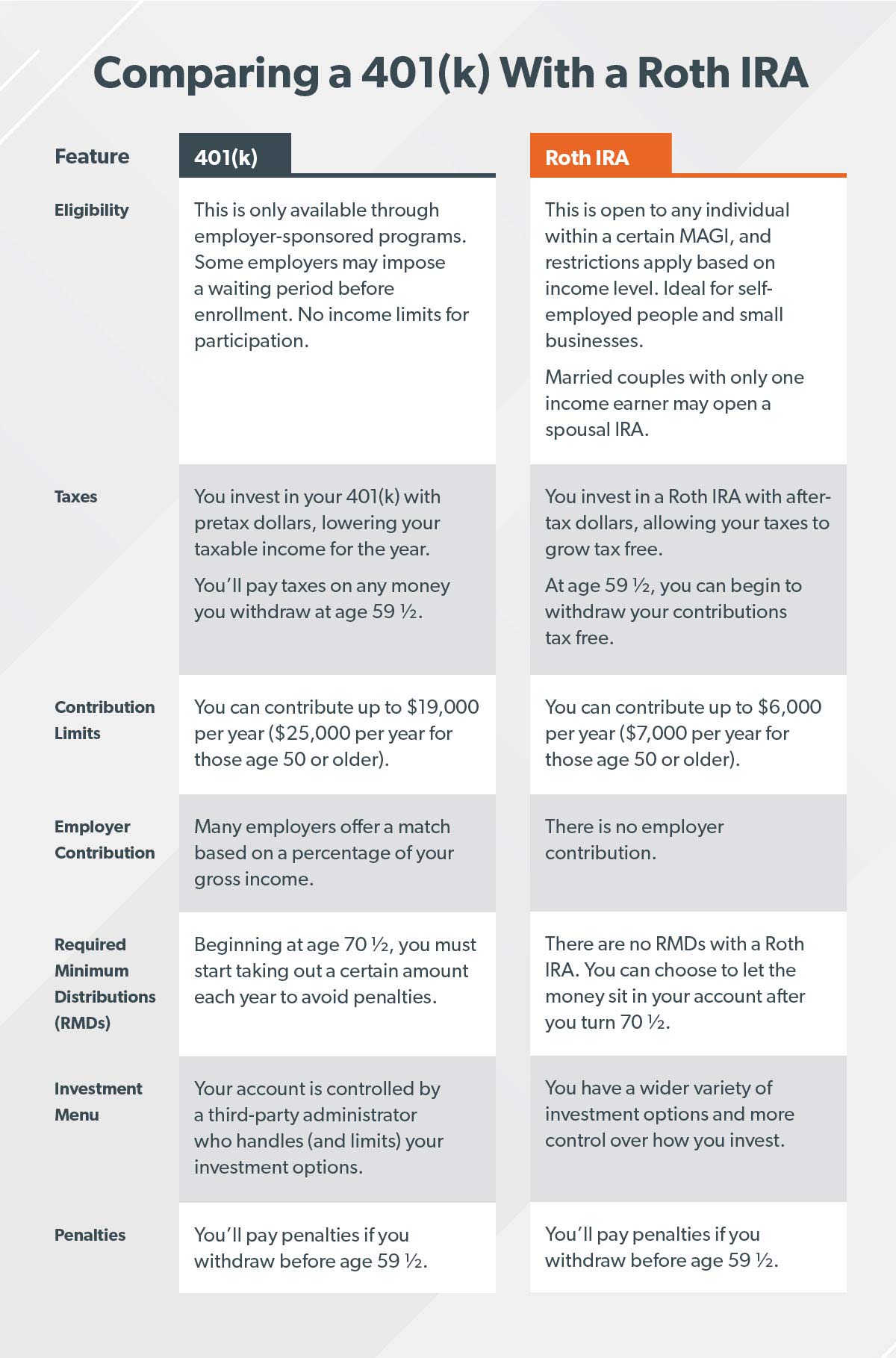

Prior to 2008 you could only rollover convert funds from a traditional sep or simple ira into a roth ira. Rolling over a 401 k into a roth ira may not be an obvious step given that 401 k s are funded with pre tax dollars and roth iras are funded with after tax dollars. However when you leave your job you may want to roll your 401k plan into a roth ira which is an after tax account. As a reminder you must generally be separated from your employer to roll your 401k into a roth ira.

Find out who benefits and the.