401k Rollover Withdrawal Rules

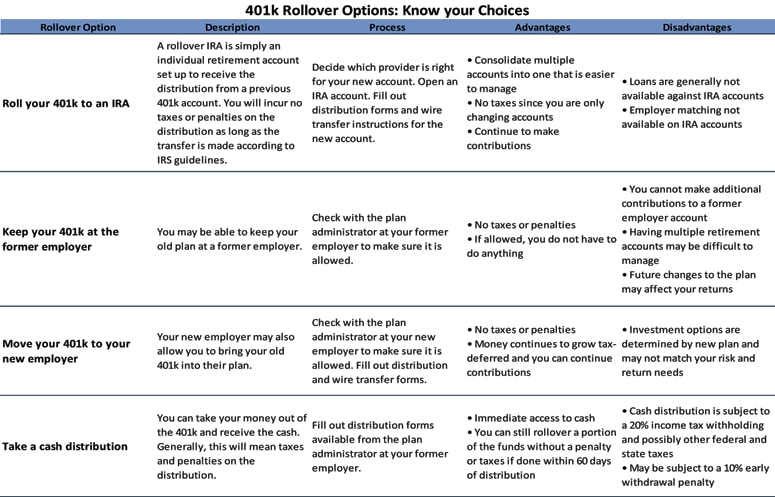

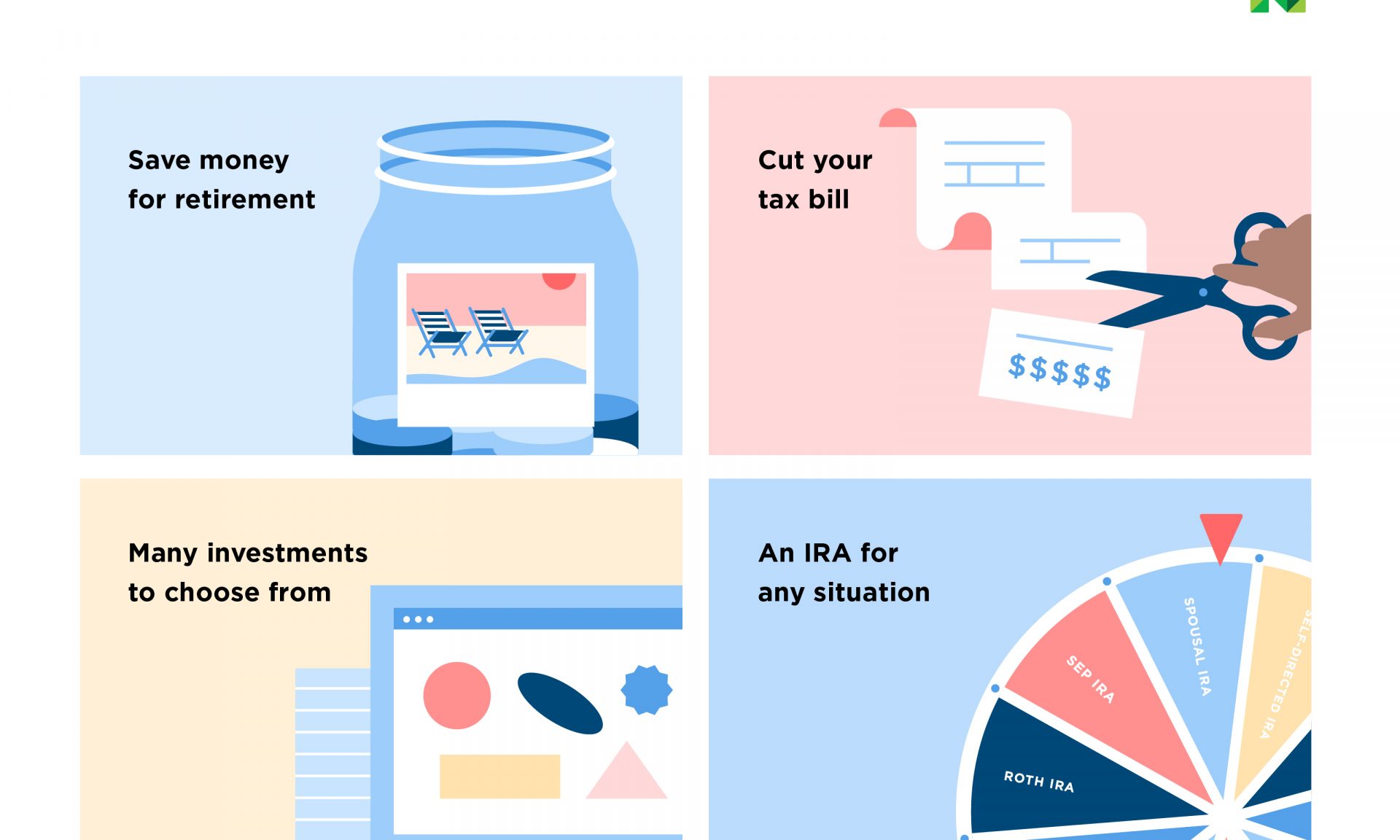

By rolling over you re saving for your future and your money continues to grow tax deferred.

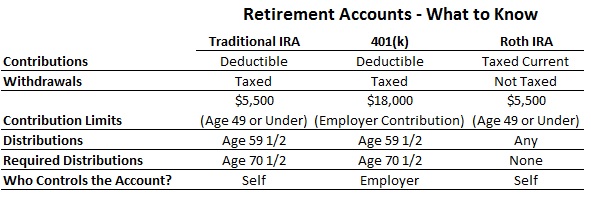

401k rollover withdrawal rules. Those who take distributions based on the above requirements would have three years to pay income taxes on the distribution. When you roll over a retirement plan distribution you generally don t pay tax on it until you withdraw it from the new plan. If instead james follows the rollover then withdraw strategy and rolls his roth 401 k to a roth ira the first 100 000 he withdraws before age 59 will be a return of contributions and only if he exceeds 100 000 in withdrawals will he have ordinary income and a penalty. Part of the cares act allowed individuals to tap iras or 401 k retirement plans if they were impacted by the coronavirus and needed cash.

The exemption to 401k withdrawals are considered hardship withdrawals. However if you are not yet age 59 you may not want to do this because once it becomes your own ira any distributions you take will be considered early distributions and subject to a 10 penalty tax as well as regular income taxes. The rules around a 401k withdrawal are set up to help protect your retirement money so it s available to you when you retire. Distributions from your 401 k plan are taxable unless the amounts are rolled over as described below in the section titled rollovers from your 401 k plan if you receive a lump sum distribution from a 401 k plan and you were born before 1936 you may be able to elect optional methods of figuring the tax on the distribution.

The total distributions may not exceed 100 000. There will be no taxes on this transaction. If you don t meet the basic qualifications for a 401k withdrawal you will not be able to withdraw the money without paying taxes and a penalty. If you retire after age 59 the irs allows you to begin taking distributions from your 401 k without owing a 10 early withdrawal penalty.

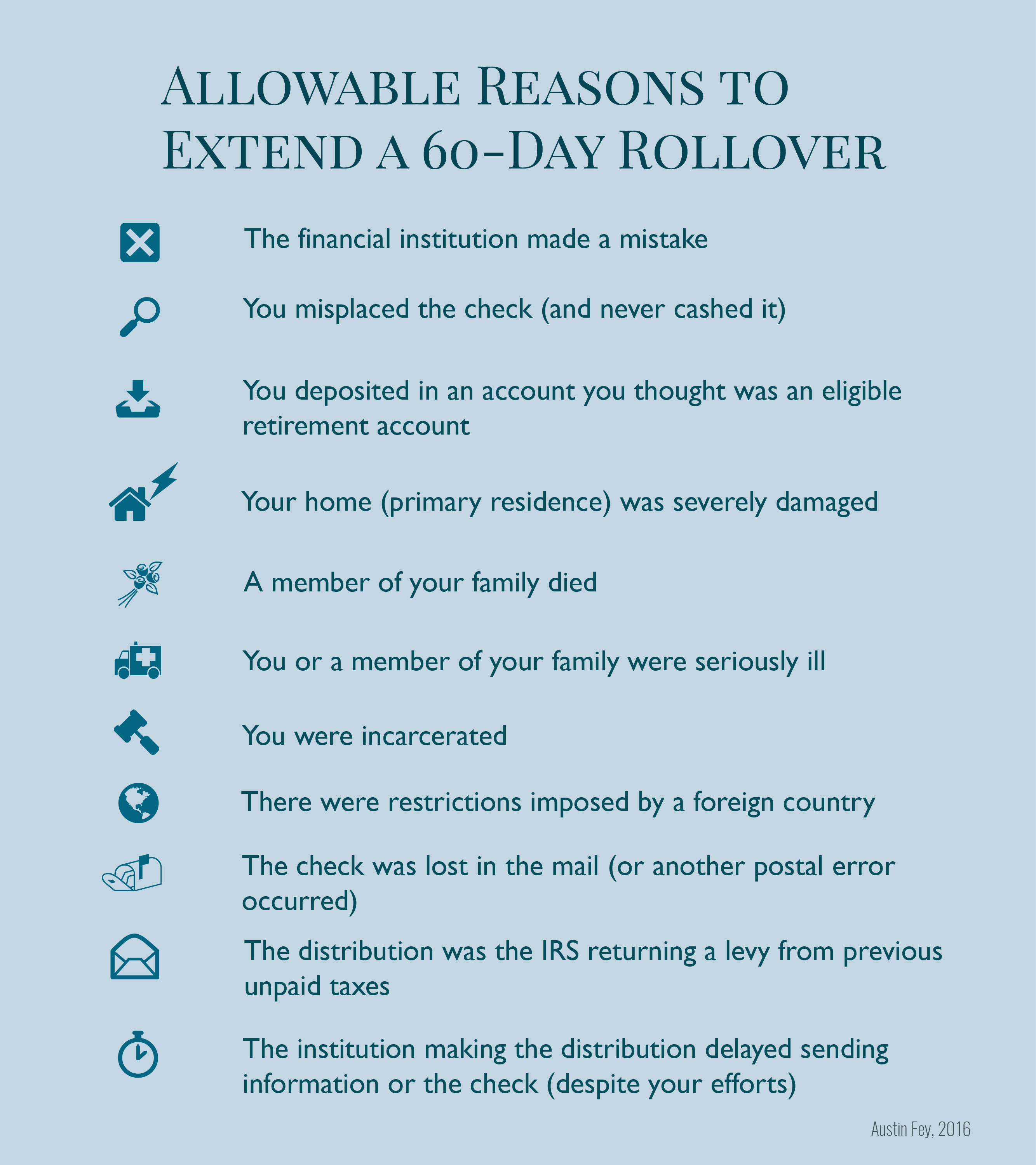

You re not eligible to take a 401k distribution until you reach age 59 so if you don t rollover funds within 60 days you ll have to include the withdrawal in your taxable income and you ll pay a 10 early withdrawal penalty in addition to the 20 withholding.

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)

:max_bytes(150000):strip_icc()/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)

/what-age-can-funds-be-withdrawn-from-401k-abd801d6dbd343309cf738f1fa2c621c.png)

/exceptions-ira-early-withdrawal-penalty-2388980-Final-38a20015611944799acc47f83bba47af.png)

/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)

/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)