664 Credit Score Home Loan

With a 664 credit score that same loan would cost you 4 177 in total interest over 4 years.

664 credit score home loan. With a credit score in the range of 650 to 699 you almost certainly qualify for a mortgage. Repair your 664 score and improve your chances of getting your best auto home and personal loan terms. I have a 664 credit score. Set yourself on a real path toward getting your next home car personal loan credit card and so much more.

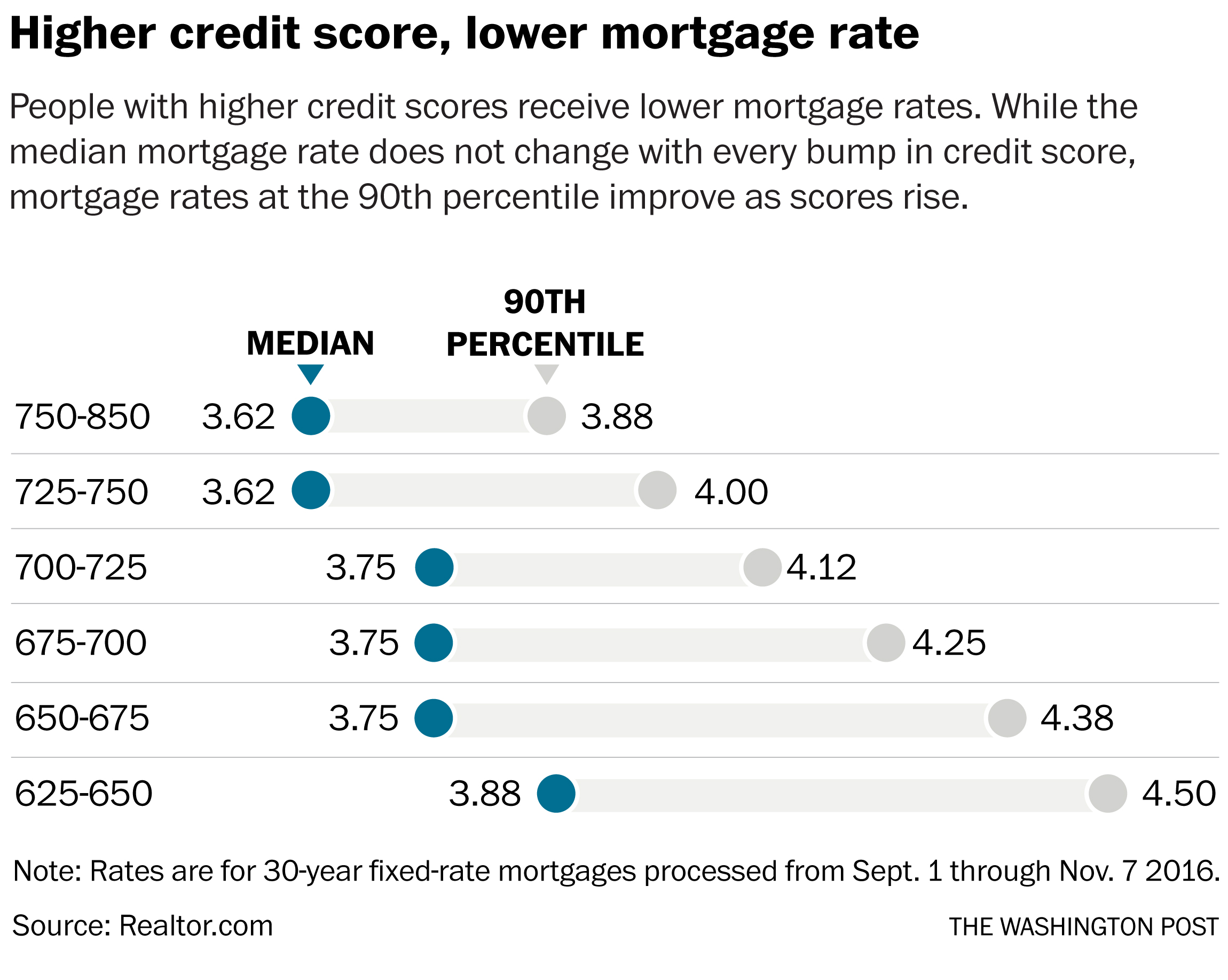

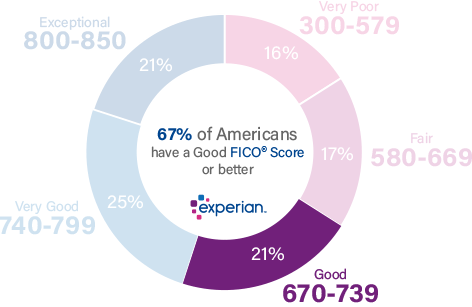

Because many with a 664 credit score may be deemed a potentially risky borrower it is not uncommon for folks with this credit score to be offered credit cards and loans with higher interest rates. 17 of all consumers have fico scores in the fair range 580 669. 8 000 to put down on a home will i qualify for a 230 000 home loan. As you can tell the interest rate monthly payment and total interest paid all increase as credit scores go down.

There are two types of 664 credit score. This makes a difference of 6 25 to a 2 75 rate on a car loan. With a 664 credit score you should also be offered a better interest rate than with a 580 619 fico score. Learn the quickest way to fix your credit score online now.

I make 48 000 annually i owe about 29 000 on a car loan that i just purchased about 6 months ago and owe about 2 000 in credit cards. However your terms will be towards the top of the spectrum with 664 fico score mortgage interest rates ranging from four to five percent. Fha loan with 664 credit score. Refinance my loan get a new loan auto insurance.

A 664 credit score is fair. Personal loans home loans auto loans. Fha loans only require that you have a 580 credit score so with a 664 fico you can definitely meet the credit score requirements. How to turn a 664 credit score into an 850 credit score.

Yep that means by having a credit score of 664 instead of 720 it would cost you an additional 1 953 over the 4 year loan. Statistically speaking 28 of consumers with credit scores in the fair range are likely to become seriously delinquent in the future. That s a lot of money. The threshold to obtain a home loan is usually around 620.

On the one hand there s a 664 credit score on the way up in which case 650 will be just one pit stop on your way to good credit excellent credit and ultimately top walletfitness. A fico score of 664 places you within a population of consumers whose credit may be seen as fair. What can i do to raise my score from 664 to 680.

/GettyImages-1041512942-60ac71d4ef574abbada73644f78ca0cb.jpg)