Account Receivable Financing Is Based On

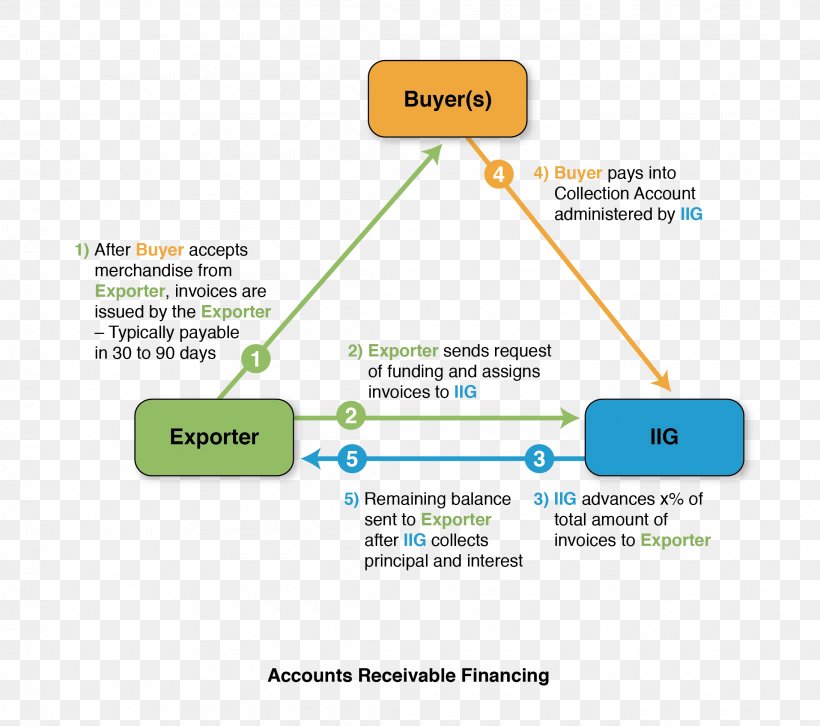

Accounts receivable financing allows companies to receive early payment on their outstanding invoices.

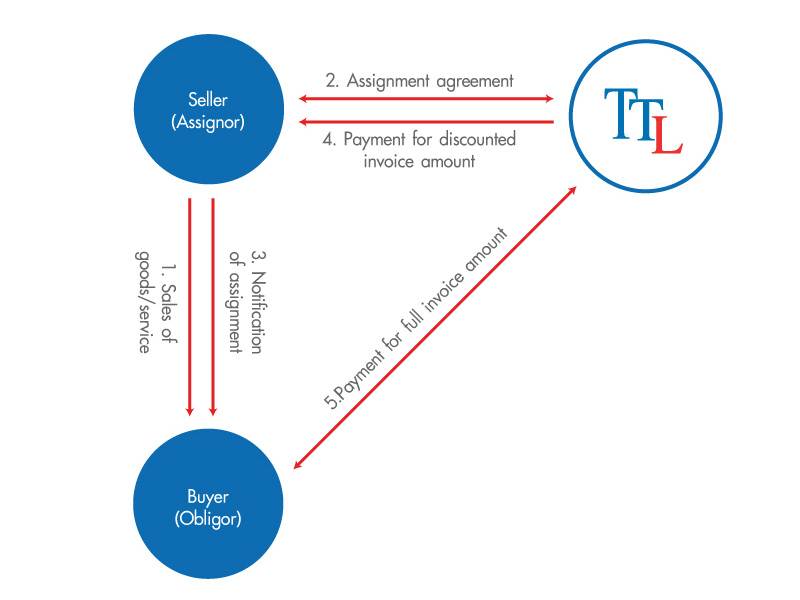

Account receivable financing is based on. However they do offer a different accounts receivable funding model and aren t limited to staffing companies with less than stellar credit or financials. A company just gets an advance based on accounts receivable balances. Receivables a r based financing involves the use of the borrower s accounts receivable credit sales to secure short term loans. Unlike factoring you still retain ownership of the invoices with accounts receivable.

That is why so many businesses are using receivables based financing to solve many of their cash flow shortage problems. Accounts receivable financing is a type of financing arrangement in which a company receives financing capital in relation to. Like accounts receivable factoring invoice financing allows you to access financing based on the value of your receivables. The best part about financing accounts receivable is that it is based on the creditworthiness of your clients and not your business.

A company using accounts receivable financing commits some or all of its outstanding invoices to a funder for early payment in return for a fee. Accounts receivable financing or specialty asset based lending asset based lenders abls such as tricom are oftentimes lumped together with factors in the minds of staffing company owners. But with the latter product you aren t selling your receivables to the business lender. It s a form of asset based lending but instead of using a combination of inventory equipment receivables and other assets to secure the loan only the organization s accounts receivable are pledged.

We offer receivable financing lines also know as factoring or invoice discounting of 1 000 to 5 million per month. A key for any business to run smoothly and successfully. Goodman capital finance in dallas texas offers invoice factoring asset based lending and accounts receivable financing to many industries. You ve sold products or supplied services and now you re ready to invoice your customer.

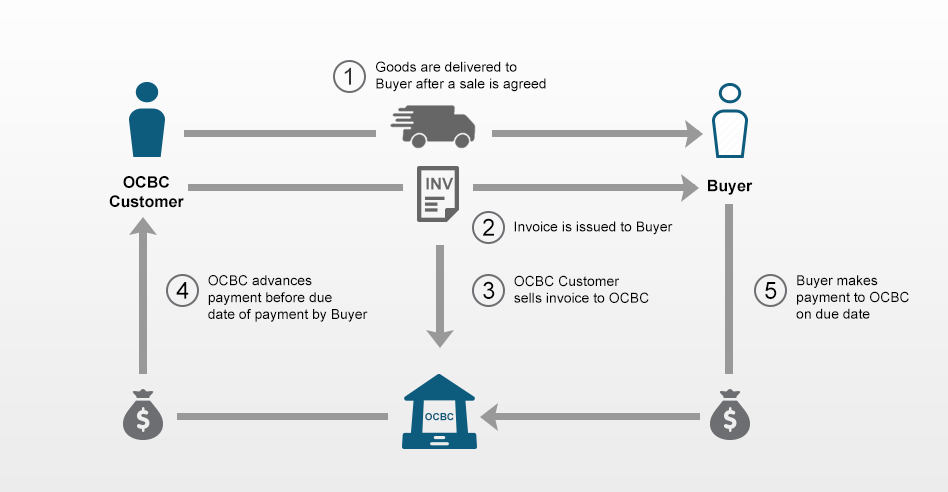

Accounts receivable purchase arp is an arrangement whereby ocbc purchases invoices from our customers to unlock working capital for them. Is accounts receivable factoring the same as invoice financing. Accounts receivable financing is essentially a type of asset based loan abl in which a business owner or entrepreneur obtains short term financing by using his or her invoices as collateral.