Account Receivable Funding

Accounts receivable financing is a type of financing arrangement in which a company receives financing capital in relation to its receivable balances.

Account receivable funding. Accounts receivable financing is a means of short term funding that a business can draw on using its receivables. Ar financing can take various forms but the three major types are. Commonly known as factoring accounts receivable ar financing is one of the oldest types of commercial financing. Accounts receivable financing is a term more accurately used to describe a form of asset based lending against accounts receivable.

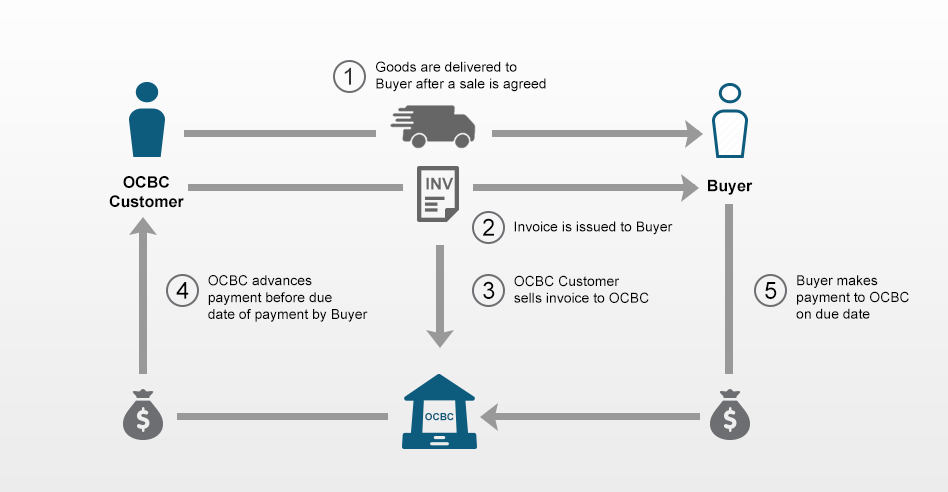

Today across the u s we re providing clients with access to debt free working capital by converting accounts receivables into ready cash. Once you generate an invoice southstar goes to work for you. In the united states factoring is not the same as invoice discounting which is called an. Accounts receivable purchase arp is an arrangement whereby ocbc purchases invoices from our customers to unlock working capital for them.

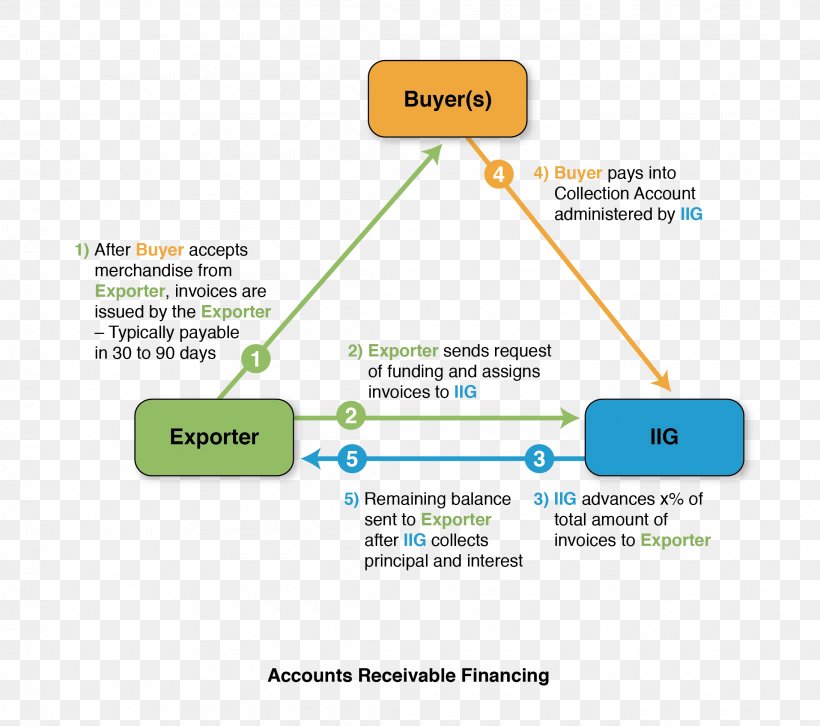

A company using accounts receivable financing commits some or all of its outstanding invoices to a funder for early payment in return for a fee. The factoring company assumes the risks on the receivable and in return issue your business. Accounts receivable factoring is a form of short term financing. A key for any business to run smoothly and successfully.

The commercial finance association is the leading trade association of the asset based lending and factoring industries. Accounts receivable funding offers invoice factoring to various companies that depend on accounts receivable funding to drive their success. We begin by verifying the submitted invoice s and advancing up to 90 of the total value of the invoice s. This helps to improve customers cash flow.

It is very useful if a timing mismatch exists between the cash inflows and outflows of the business. Fund the growth of your business with a wide range of financing solutions. Accounts receivable financing allows companies to receive early payment on their outstanding invoices. Improve business funding with dbs sme accounts receivable purchasing for company s trade.