Account Receivables Finance

There are two types of account receivables finance.

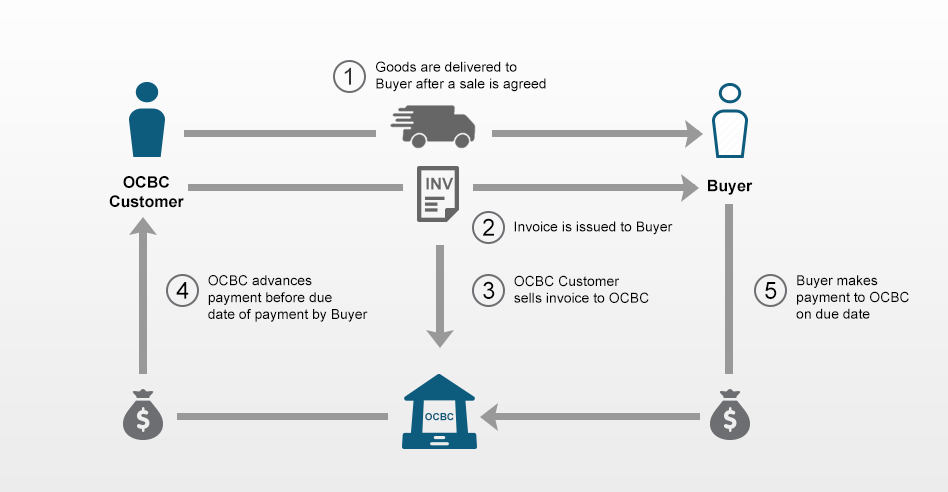

Account receivables finance. Understanding how accounts receivable factoring works. Receivables finance goes by many names and often comes bundled with a lot of confusing jargon. It can be known as invoice financing debtor finance cash flow finance or as here accounts receivables finance once you start exploring various types of business finance you come across even more confusing jargon such as invoice discounting and invoice factoring. It is sometimes referred to as an invoice as this is the promise of future finance into a company.

You are raising cash against your debtors. The factoring company assumes the risks on the receivable and in return issue your business. Accounts receivable is more of an expression used in the united states than the uk. With our receivables finance solution you can access up to 90 per cent of the value of your invoices as soon as the next business day 1 freeing up your working capital to fund growth.

Accounts receivable are assets equal to the outstanding balances of. Selective accounts receivables finance allows companies to pick and choose which receivables to advance for early payment. Receivables finance is part of a sound treasury strategy that reduces customer credit risk and provides faster access to cash. Commonly known as factoring accounts receivable ar financing is one of the oldest types of commercial financing.

Money that a customer owes a company for a good or service purchased on credit accounts receivable are current assets for a company and are expected to be paid within a short amount of time often 10 30 or 90 days. Accounts receivables are created when a company lets a buyer purchase their. So technically it is not lending but an asset purchase. Accounts receivable is an asset account on the balance sheet that represents money due to a company in the short term.

In simple terms it is a process that entails the selling of receivables or outstanding invoices at a markdown to a specialized factoring or finance company normally called the factor. Additionally selective receivables finance enables companies to secure advanced payment for the full amount of each receivable. Accounts receivables financing is essentially the process of raising cash against your book s debts so an asset finance product rather than lending. A unit within a company s accounting department that deals with accounts receivable.

Accounts receivables finance require companies to have receivables or book debts. Accounts receivable financing is an agreement that involves capital principal in relation to a company s accounts receivables. Accounts receivables finance unlocks the cash that is owed to the small company by selling the invoice.

/open-book-with-figures-and-paper-with-words--accounts-receivable--613785056-c6a530e62e164acf899fc612ab80b528.jpg)