Account Recievable Financing

Accounts receivable financing is a term more accurately used to describe a form of asset based lending against accounts receivable.

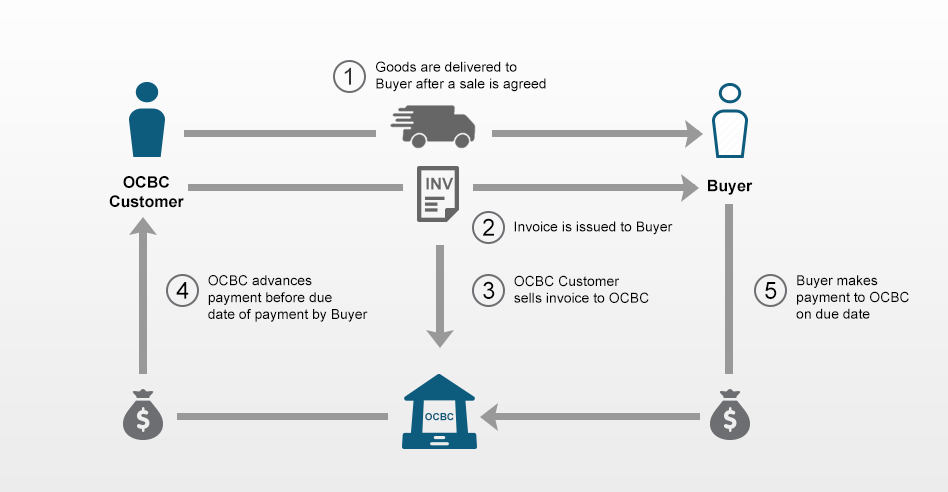

Account recievable financing. Accounts receivable financing allows companies to receive early payment on their outstanding invoices. Accounts receivable financing or ar financing for short is for businesses who need working capital and have outstanding invoices from their clients. What is accounts receivable financing. Accounts receivable purchase arp is an arrangement whereby ocbc purchases invoices from our customers to unlock working capital for them.

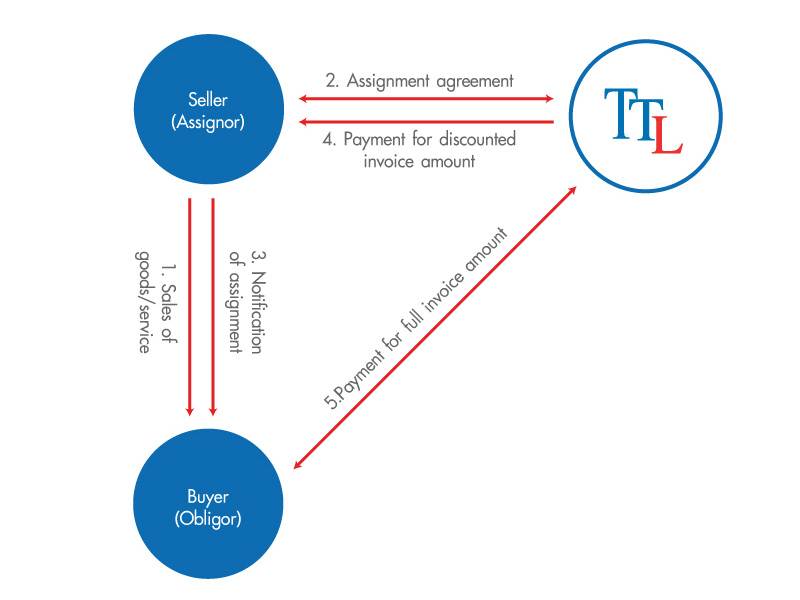

What is accounts receivable ar financing. The commercial finance association is the leading trade association of the asset based lending and factoring industries. A company using accounts receivable financing commits some or all of its outstanding invoices to a funder for early payment in return for a fee. Companies allow their clients to pay at a reasonable extended period of time provided that the terms are agreed upon to a financing company that specializes in buying receivables called a factor at a discount.

In simple terms it is a process that entails the selling of receivables or outstanding invoices at a markdown to a specialized factoring or finance company normally called the factor. Accounts receivable ar financing is a type of financing arrangement in which a company receives financing capital related to a portion of its accounts receivable. Whether you are an established business or just getting started insufficient cash flow can cripple your operations and growth capabilities. Accounts receivables are created when a company lets a buyer purchase their.

These outstanding invoices can be used as collateral for an immediately available line of credit. This helps to improve customers cash flow. Accounts receivable financing including invoice factoring is a popular alternative to bank financing for start ups growing businesses and more mature companies looking for maximum flexibility. Traditional institutions often do not view your company s accounts receivable for what they are an asset.

Accounts receivable factoring is also known as invoice factoring or accounts receivable financing.