Accounts Receivable Financing Companies

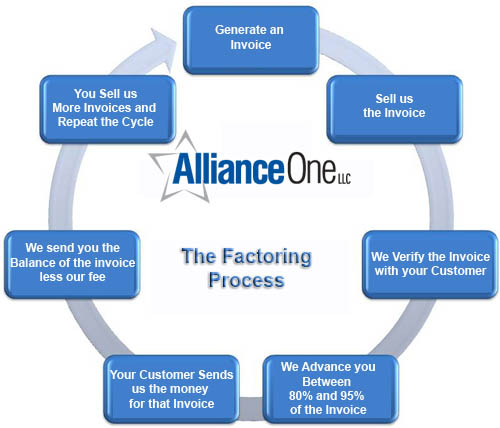

Once your customer pays their debt the invoice financing company will forward you the remaining balance minus their fee.

Accounts receivable financing companies. The only disadvantage of accounts receivable financing is that a there is a financing cost paid to the lender or factoring company that is providing the accounts receivable financing. A r financing is based on the value of outstanding receivables. Accounts receivables are created when a company lets a buyer purchase their. A company using accounts receivable financing commits some or all of its outstanding invoices to a funder for early payment in return for a fee.

Accounts receivable financing is defined as a loan a business owner takes out against unpaid invoices. The factoring company assumes the risks on the receivable and in return issue your business. Accounts receivable factoring is also known as invoice factoring or accounts receivable financing. Accounts receivable financing has the major advantage of providing the money for the goods and services you sold 30 or more days before a typical a r cycle.

Commonly known as factoring accounts receivable ar financing is one of the oldest types of commercial financing. Accounts receivable is an asset account on the balance sheet that represents money due to a company in the short term. In simple terms it is a process that entails the selling of receivables or outstanding invoices at a markdown to a specialized factoring or finance company normally called the factor. We re notable our innovative process and individual attention has been recognized by entrepreneur magazine the washington post crain s chicago business small business trends online and american express open forum.

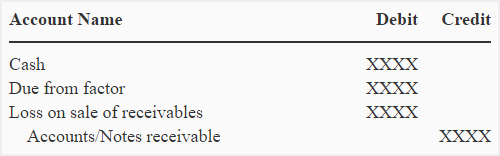

Accounts receivable financing a r accounts receivable financing a r financing sometimes known as a ledgered line of credit or invoice financing is a great solution for businesses that need more funding that is not available from traditional lenders. Understanding accounts receivable financing. Accounts receivable financing allows companies to receive early payment on their outstanding invoices. In these types of agreements a receivables financing company will advance you a percentage of your invoice s face value.

Companies allow their clients to pay at a reasonable extended period of time provided that the terms are agreed upon. Accounts receivable financing is an agreement that involves capital principal in relation to a company s accounts receivables. To a financing company that specializes in buying receivables called a factor at a discount. From start ups to fully established companies with multi millions in annual sales these companies have trusted us for their accounts receivable financing needs.