Accounts Receivable Financing Is Based On What

At 1st commercial credit we are recognized as one of the largest receivable based finance companies for small to medium sized businesses in the industry.

Accounts receivable financing is based on what. Let our accounts receivable financial team help with you with an evaluation of your business. You ve sold products or supplied services and now you re ready to invoice your customer. A company just gets an advance based on accounts receivable balances. Unlike factoring you still retain ownership of the invoices with accounts receivable.

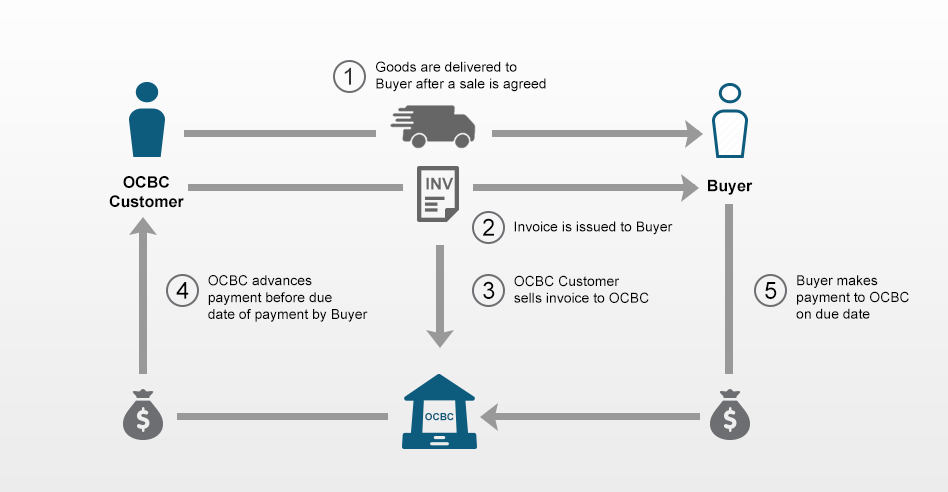

These outstanding invoices can be used as collateral for an immediately available line of credit. Accounts receivable financing allows companies to receive early payment on their outstanding invoices. Accounts receivable financing has the major advantage of providing the money for the goods and services you sold 30 or more days before a typical a r cycle. Like accounts receivable factoring invoice financing allows you to access financing based on the value of your receivables.

Accounts receivable financing is a type of financing arrangement in which a company receives financing capital in relation to. We offer receivable financing lines also know as factoring or invoice discounting of 1 000 to 5 million per month. Receivables a r based financing involves the use of the borrower s accounts receivable credit sales to secure short term loans. These two terms sound alike but are very different.

The only disadvantage of accounts receivable financing is that a there is a financing cost paid to the lender or factoring company that is providing the accounts receivable financing. Accounts receivable financing is essentially a type of asset based loan abl in which a business owner or entrepreneur obtains short term financing by using his or her invoices as collateral. A company using accounts receivable financing commits some or all of its outstanding invoices to a funder for early payment in return for a fee. Accounts receivable financing or ar financing for short is for businesses who need working capital and have outstanding invoices from their clients.

What is accounts receivable finance. But with the latter product you aren t selling your receivables to the business lender. Accounts receivable financing or specialty asset based lending asset based lenders abls such as tricom are oftentimes lumped together with factors in the minds of staffing company owners. However they do offer a different accounts receivable funding model and aren t limited to staffing companies with less than stellar credit or financials.