Accounts Receivable Financing

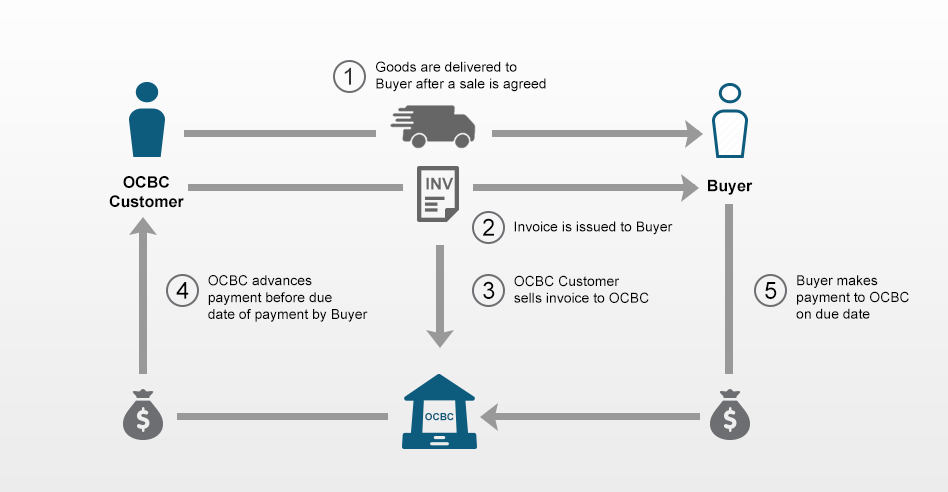

Accounts receivable financing is a type of financing arrangement in which a company receives financing capital in relation to its receivable balances.

Accounts receivable financing. Accounts receivable financing allows companies to receive early payment on their outstanding invoices. It is very useful if a timing mismatch exists between the cash inflows and outflows of the business. Southstar is concerned with the credit quality of your clients account debtors and not your personal or business credit scores. Stay protected from buyer s credit risk.

Accounts receivables are created when a company lets a buyer purchase their. We begin by verifying the submitted invoice s and advancing up to 90 of the total value of the invoice s. The only disadvantage of accounts receivable financing is that a there is a financing cost paid to the lender or factoring company that is providing the accounts receivable financing. When cash flow challenges prevent you from managing and expanding your business accounts receivable financing can provide an unlimited growth line to get the funding you need quickly and easily.

Once you generate an invoice southstar goes to work for you. Accounts receivable is an asset account on the balance sheet that represents money due to a company in the short term. Creative financing that works for you. How does accounts receivable financing work.

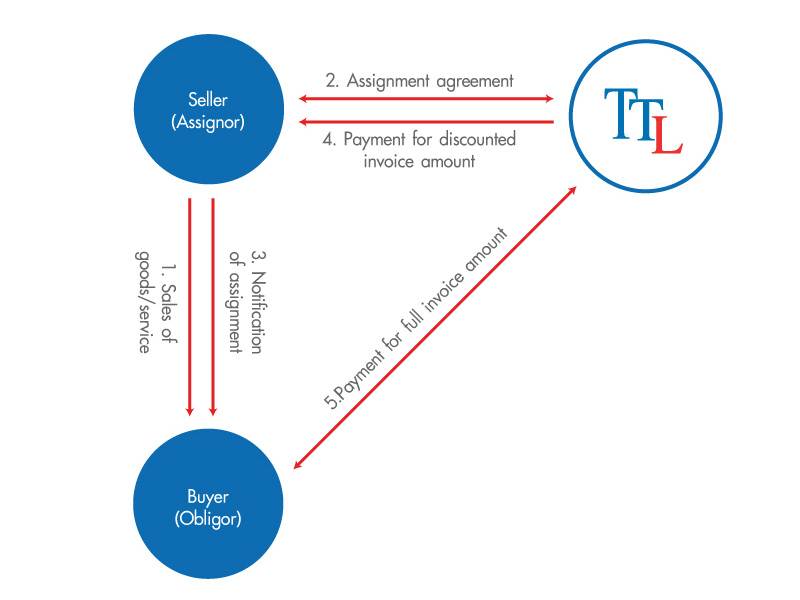

In simple terms it is a process that entails the selling of receivables or outstanding invoices at a markdown to a specialized factoring or finance company normally called the factor. Accounts receivable financing has the major advantage of providing the money for the goods and services you sold 30 or more days before a typical a r cycle. Commonly known as factoring accounts receivable ar financing is one of the oldest types of commercial financing. The factoring company assumes the risks on the receivable and in return issue your business.

It s a common form of financing businesses use to improve cash flow and eliminate the wait for payments from customers. Financing tenor ranges up to 360 days. Our flexible financial tools allow you to fulfill your obligations get your shipments out and make the move to grow your business. Accounts receivable financing is a form of business finance where a company sells their open invoices to a factoring company in exchange for an immediate cash advance.

Ar financing can take various forms but the three major types are.