Accounts Receivable Line Of Credit

Dealstruck s accounts receivable line of credit allows you to borrow against outstanding invoices while retaining their ownership giving you access to your cash with no payments.

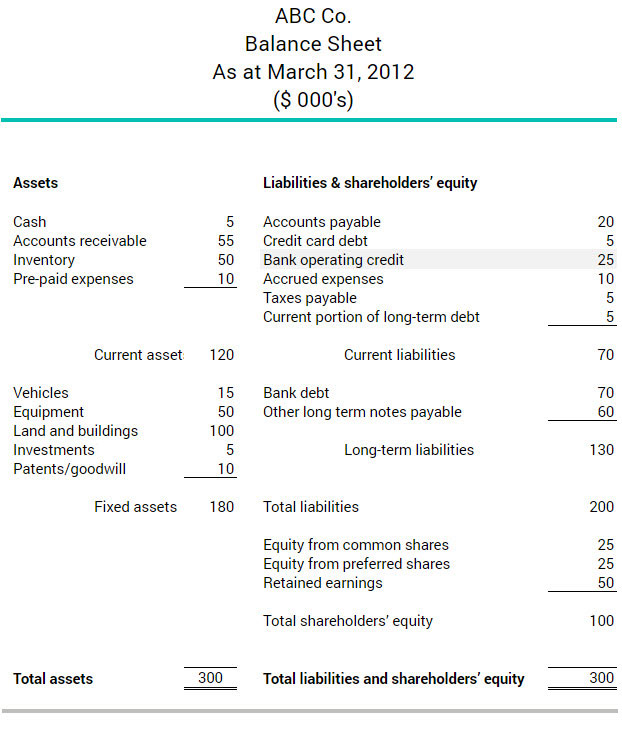

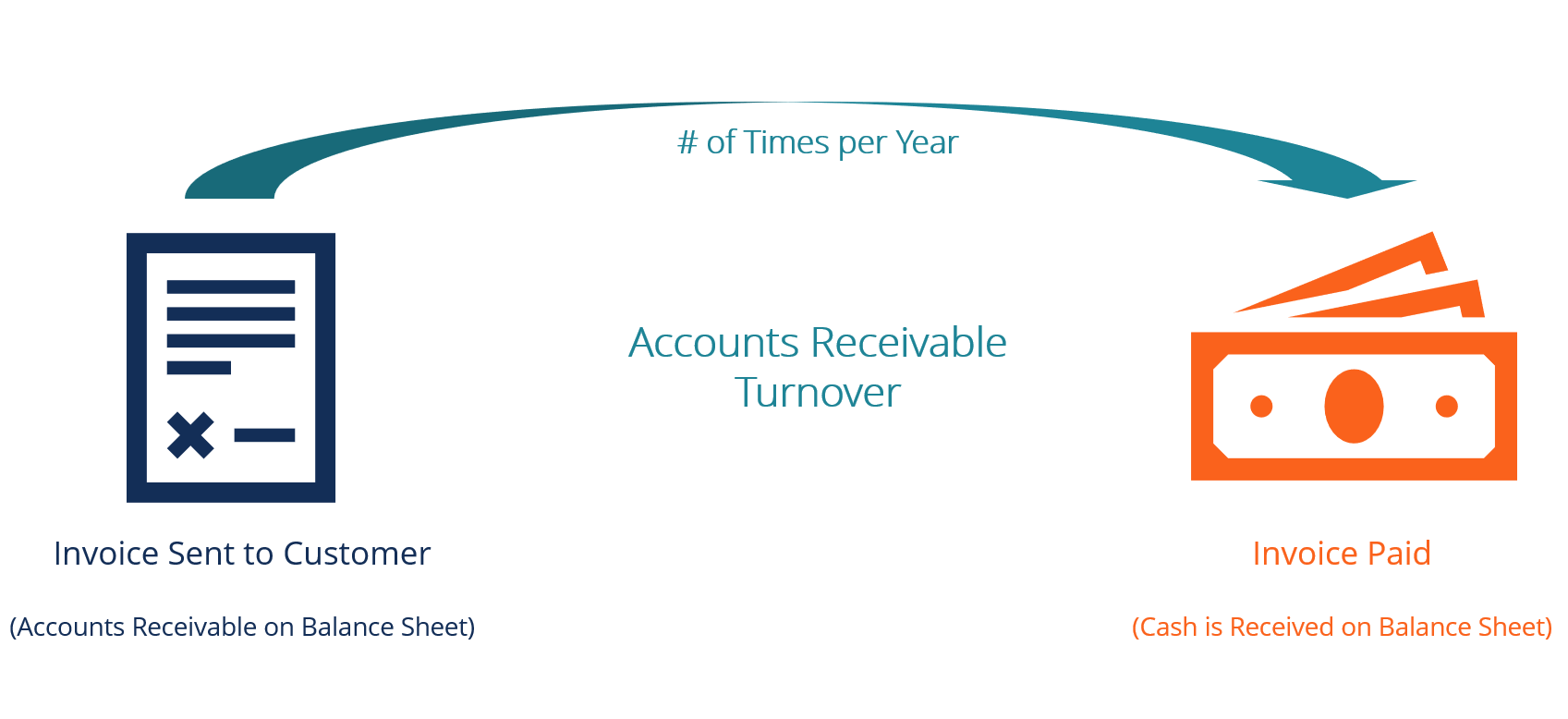

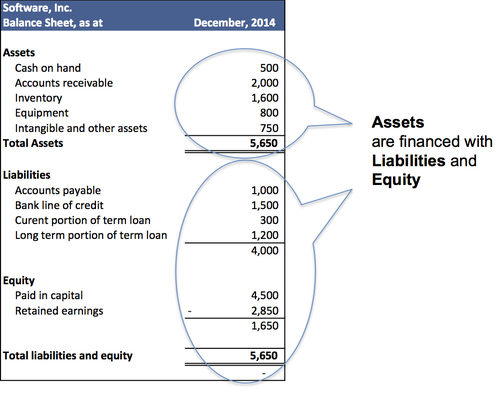

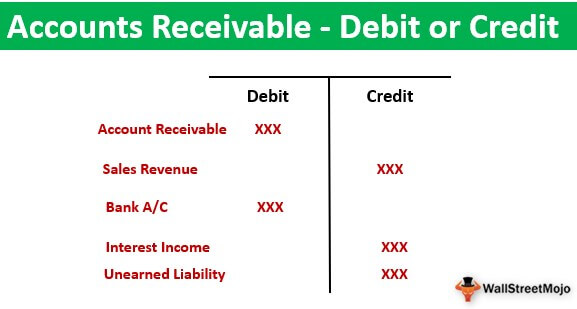

Accounts receivable line of credit. An accounts receivable line of credit and a non recourse invoice factoring line both provide business financing by converting accounts receivable to cash. Business owners sell single or multiple customer invoices in exchange for a revolving credit line. An ar line of credit is secured by accounts receivable as collateral. Your accounts receivable basically invoices that will be paid in 30 to 60 days are considered by lenders as assets that can be used to secure financing.

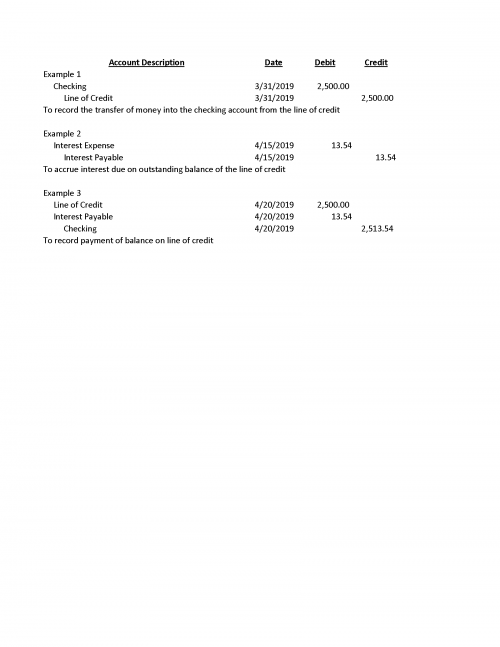

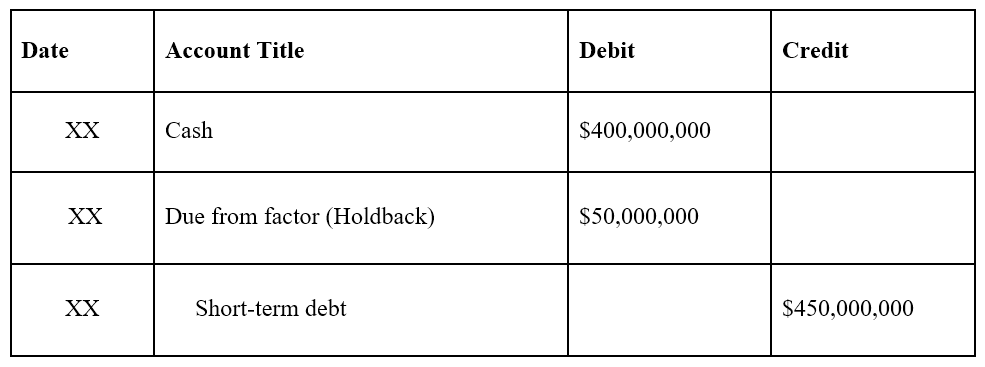

Rates as low as 0 25 per week. Approvals within 24 hours. An ar line of credit is a loan secured by accounts receivable as collateral whereas non recourse invoice factoring is an outright purchase of accounts receivable for cash. It s a type of loan and the borrower must have the financial ability to repay.

Accounts receivable or receivables represent a line of credit extended by a company and normally have terms that require payments due within a relatively short time period. Enroll online fill out a short application form. Access to this funding is given in exchange for your accounts receivables or the expected payment for your invoices. These are a relatively newer product compared to revolving business lines of credit and their counterpart purchase order invoice factoring.

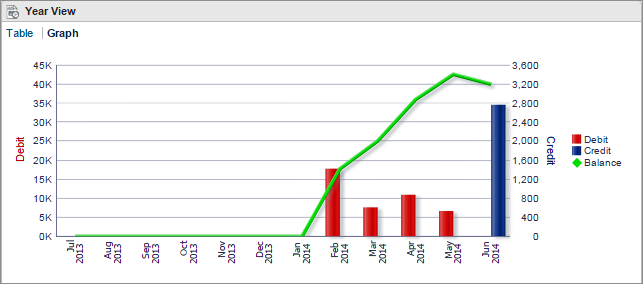

You can pay down the line as your cash flow improves. How accounts receivable financing works. Into a line of credit. An ar credit line works like this.

It typically ranges. How does an accounts receivable line of credit work. An ar line of credit is a loan secured by accounts receivable as collateral. For companies with good or great credit.

Another solution that allows you to finance your accounts receivable is a line of credit. Accounts receivable line of credit don t wait on invoices borrow against them. Accounts receivable line of credit accounts receivable financing. Your company can draw funds when needed up to the limit.

Get started today. Accounts receivable ar is the proceeds or payment which the company will receive from its customers who have purchased its goods services on credit usually the credit period is short ranging from few days to months or in some cases maybe a year. Because an accounts receivable line of credit is a loan the borrower must have the financial ability to repay. A line of credit provides you with funding up to a preset amount.

An accounts receivable line of credit is a form of financing in which a lender gives you access to a pool of money from which you can withdraw at any time. Invoices up to 1 000 000.

:max_bytes(150000):strip_icc()/dotdash_Final_How_should_investors_interpret_accounts_receivable_information_on_a_companys_balance_sheet_Apr_2020-01-93d387c085e04ab4bf99fa38dcdfd48d.jpg)