Accounts Receivable Management Definition

A unit within a company s accounting department that deals with accounts receivable.

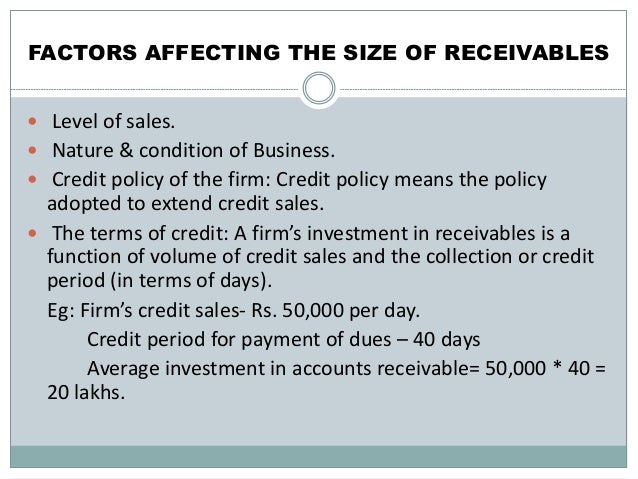

Accounts receivable management definition. Factoring accounts receivable means selling receivables both accounts receivable and notes receivable to a financial institution at a discount factoring is a common practice among small companies. Accounts receivable ar is the proceeds or payment which the company will receive from its customers who have purchased its goods services on credit usually the credit period is short ranging from few days to months or in some cases maybe a year. Accounts receivable is shown in a balance sheet as an asset. Assessing how receivables management affects nwc levels can help in good liquidity management current and quick ratio two other liquidity measures the current and quick ratio is an excellent trend analysis tool that can serve to raise warning or red flags with respect to receivables management.

The institution to whom receivables are sold is known as factor. Management uses the allowance for doubtful accounts to define accounts receivable that will likely not be collected and actively manage the ones that will. Accounts receivable are legally enforceable claims for payment held by a business for goods supplied and or services rendered that customers clients have ordered but not paid for. At the end of each period management must evaluate the list of customers and balances on the accounts receivable aging report to identify which ones are past due and unlikely to be collected.

Money that a customer owes a company for a good or service purchased on credit accounts receivable are current assets for a company and are expected to be paid within a short amount of time often 10 30 or 90 days. The word receivable refers to the payment not being realised this means that the company must have extended a credit line. Someone might think why companies sell their receivables. Accounts receivable are a completely different part of the credit column for many companies and receivables management practices help keep track of them.

Receivables or accounts receivable are debts owed to a company by its customers for goods or services that have been delivered but not yet paid for. As you know accounts receivable is the amount that is yet to be received from your customers within a defined period usually a short period thus it is treated as current assets. These are generally in the form of invoices raised by a business and delivered to the customer for payment within an agreed time frame.