Accounts Receivables Factoring Companies

Factoring company collects the accounts receivable from the customer.

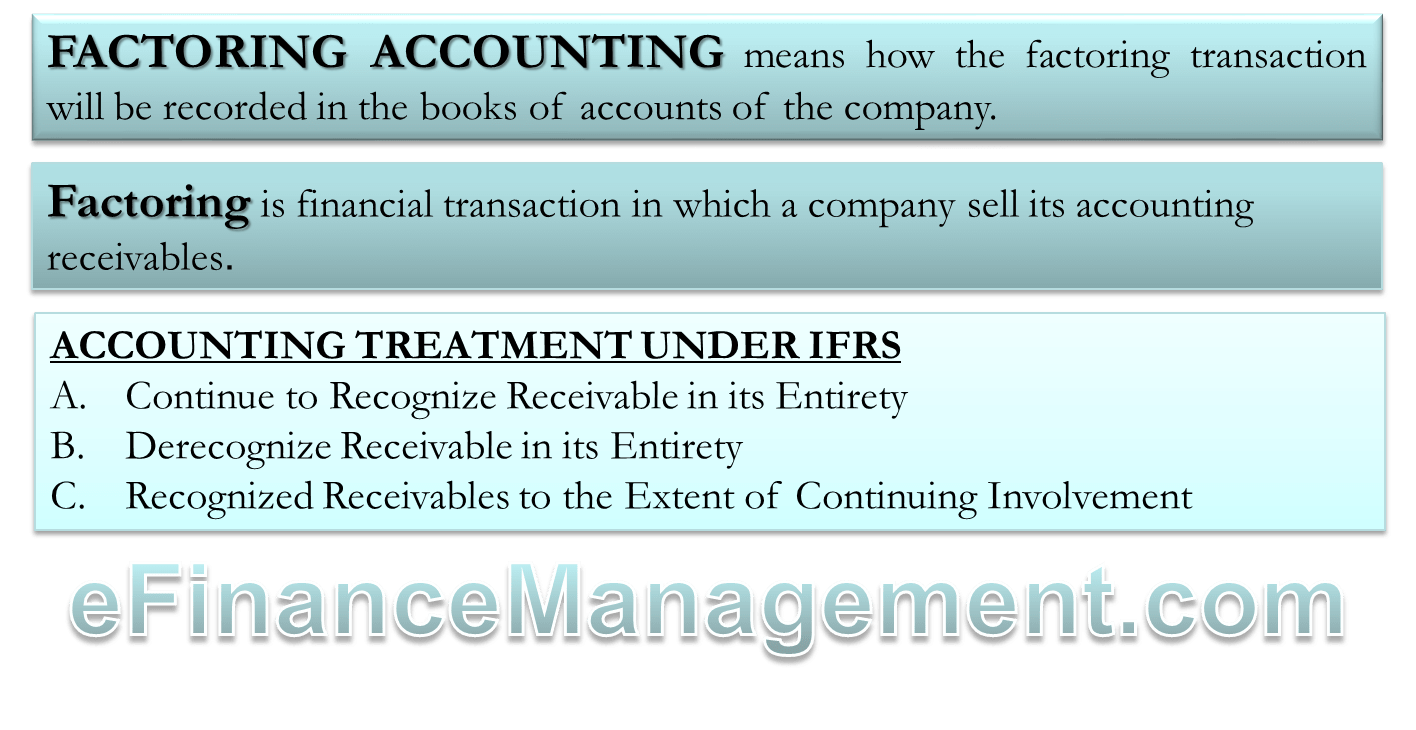

Accounts receivables factoring companies. Choosing accounts receivables financing companies. Factoring companies charge what is known as a factoring fee the factoring fee is a percentage of the amount of receivables being factored. The rate charged by factoring companies depends on. The industry that the company is in.

If you re just starting up or growing quickly and could benefit from some extra capital factoring companies provide a simple and straightforward financing solution. Discover accounts receivable factoring companies. Accounts receivable factoring is not the same as a loan. Each accounts receivables financing company has its own costs policies and procedures so it pays to shop around and compare your options.

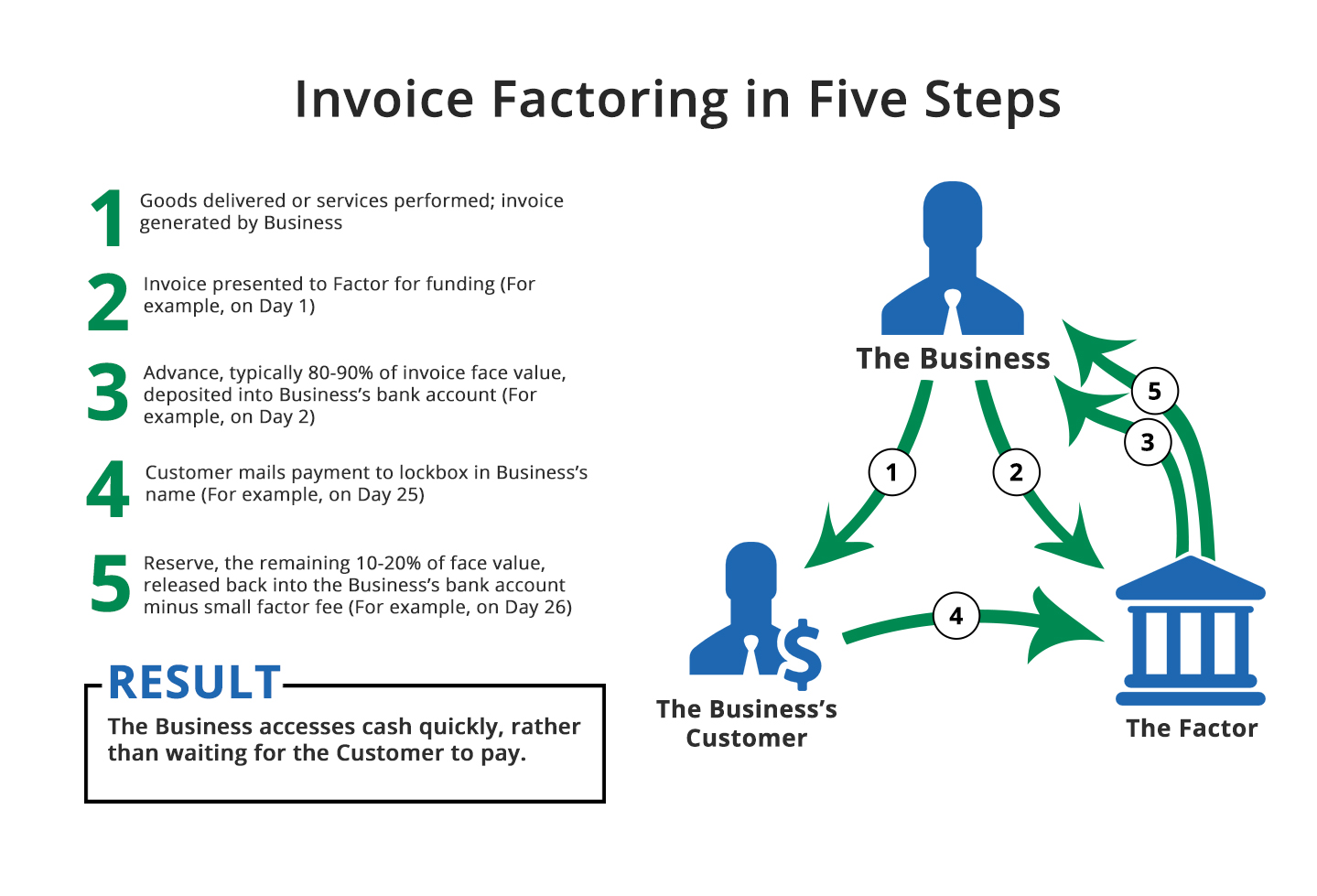

The process for accounts receivable factoring is quick and easy. To explain the process of factoring receivables we have set out the seven steps involved. The volume of receivables to be factored. This gives small businesses the money they need to fund growth or resolve short term cash problems.

Accounts receivable factoring companies can advance a small business anywhere from 80 95 of the outstanding invoice balance. Accounts receivable factoring is a solution that allows business owners to quickly turn invoices into working capital. That will advance you a percentage of their value. A business will sometimes factor its receivable assets to meet its present and immediate cash needs.

Once the factor receives payment in full for the invoices from your customers it returns the remaining balance of the receivables to you minus a factoring fee or discount rate. Perform your work or service as normal. How accounts receivables are priced by factoring companies. Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable i e invoices to a third party called a factor at a discount.

The factoring company initiates a same day advance on a percentage of your invoice total directly into your bank account. Accounts receivable factoring works for any business. Here s how it works. So when you sell your accounts receivables to a third party factoring company the discounted purchase price gets calculated using what s known as a factor rate.

Let s say you sold 20 000 of outstanding receivables. An example of accounts receivables factoring. Factoring company pays your business the balance of the invoice after deducting a commission fee based on a percentage of the invoice value. And let s say the factor rate is 3.

Instead of waiting for weeks or months for customers to pay their invoices accounts receivable financing lets business owners get an advance on those invoices and use the cash for pressing business needs instead of waiting for weeks or months for customers to pay their invoices. You can sell your accounts receivable to a factoring company also called a factor in order to get the money you need now. If you are a trucking company you may want to specialize with a freight bill factoring company that knows your region and your industry. Forfaiting is a factoring arrangement used in international trade finance by exporters who wish to sell their.

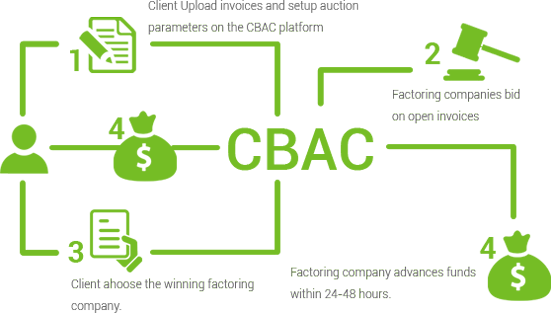

Flow chart of factoring receivables process.