Accounts Receivables Factoring

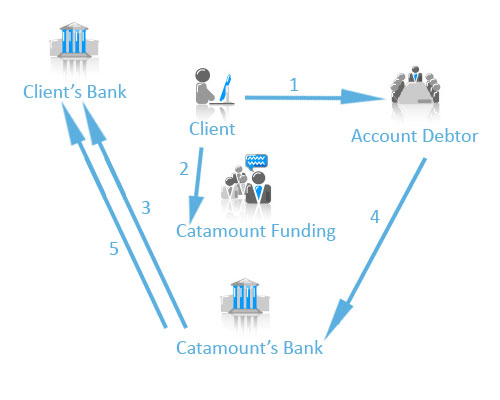

Once the factor has been paid by your customers it returns what remains of the receivable balance minus a factoring fee.

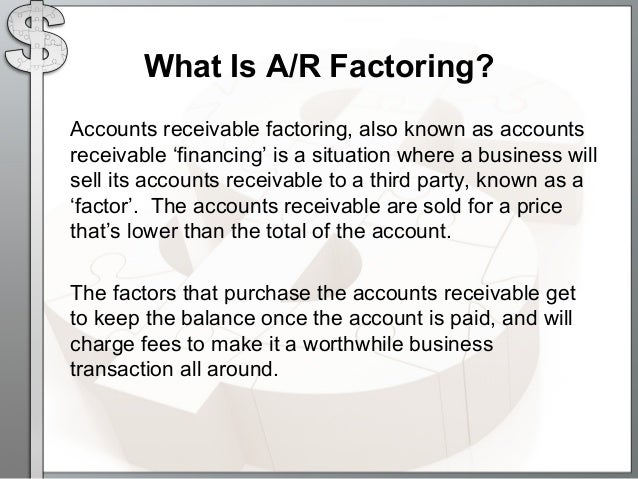

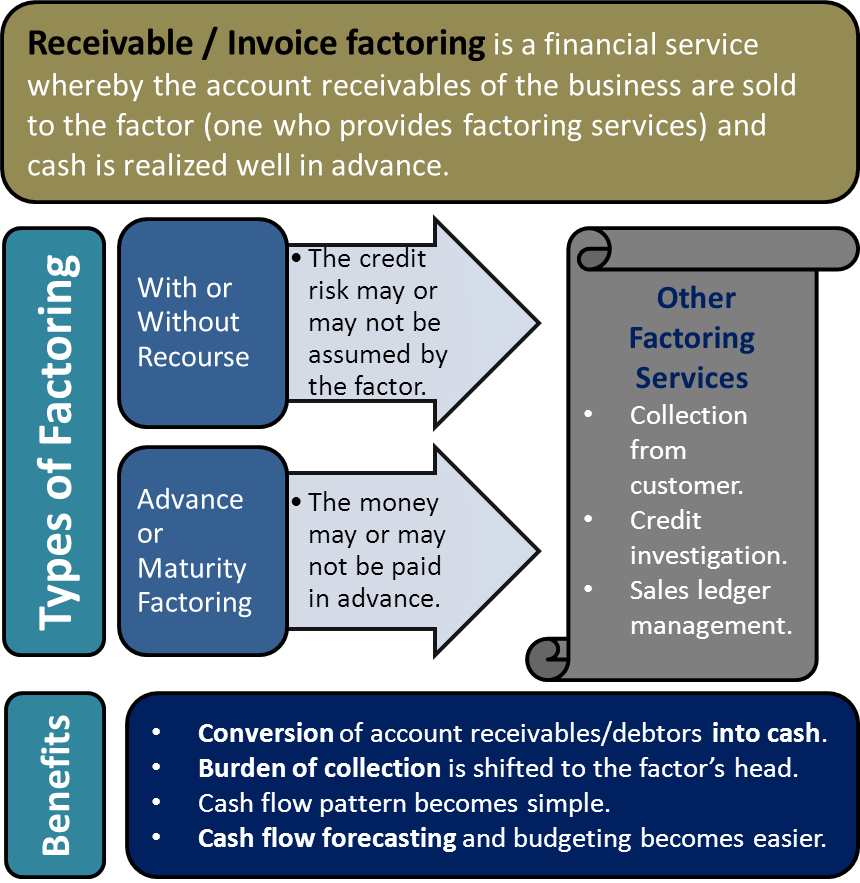

Accounts receivables factoring. Under this invoice factoring arrangement only early payment of invoices is provided by the accounts receivables factoring companies in return for factor fees to the business. Accounts receivable financing is an agreement that involves capital principal in relation to a company s accounts receivables. Factoring is a common practice among small companies. Factoring helps a business convert its receivables immediately into cash instead of waiting for due dates of payment by customers.

Forfaiting is a factoring arrangement used in international trade finance by exporters who wish to sell their. Let s say you sold 20 000 of outstanding receivables. Factoring accounts receivable means selling receivables both accounts receivable and notes receivable to a financial institution at a discount. The financing company which buys the receivables is called a factor.

In case any bad debt arises at a later date due to nonpayment of dues by the customer resulting in a loss the business will make it good for the accounts receivables factoring companies. And let s say the factor rate is 3. Accounts receivable funding average costs. Accounts receivable are assets equal to the outstanding balances of.

Instead of waiting for weeks or months for customers to pay their invoices accounts receivable financing lets business owners get an advance on those invoices and use the cash for pressing business needs instead of waiting for weeks or months for customers to pay their invoices. Accounts receivable factoring is also known as invoice factoring or accounts receivable financing. So when you sell your accounts receivables to a third party factoring company the discounted purchase price gets calculated using what s known as a factor rate. Factoring is the sale of accounts receivable of a company to a financing company at discount.

The costs typically associated with factoring receivables are as follows. Accounts receivable factoring is a solution that allows business owners to quickly turn invoices into working capital. Factoring is the selling of accounts receivables to a third party to raise cash. When a business sells products and services to a customer on account the goods are delivered and the sales invoice is created but the customer does not have to pay until the invoice due date.

Accounts receivable factoring also known as factoring is a financial transaction in which a company sells its accounts receivable to a financing company that specializes in buying receivables called a factor at a discount. The institution to whom receivables are sold is known as factor. An example of accounts receivables factoring.