Adhesion Insurance

The adhesion insurance definition is an example of a type of adhesion contract.

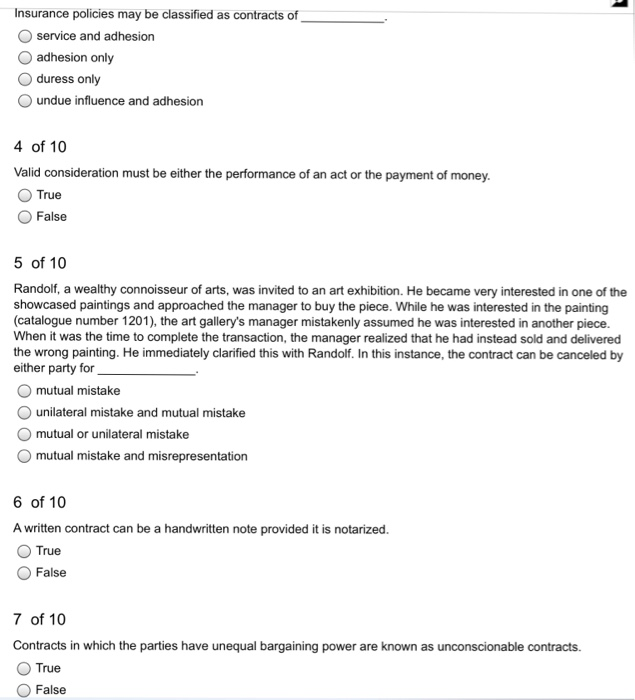

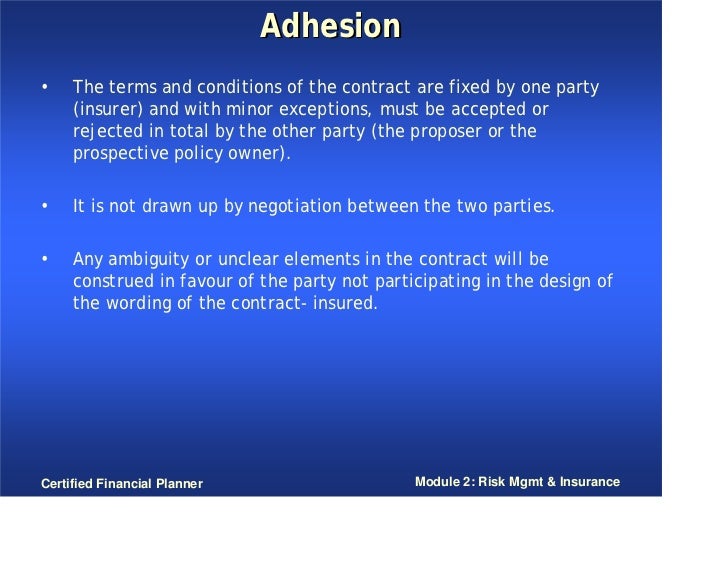

Adhesion insurance. And if the accident insurance event occurs the insurance company will bear all or all of the costs in full or in part. For instance the stronger party an insurance company provides products and services to the weaker party s needs and wants. Adhesion contracts are commonly used for matters involving insurance leases deeds mortgages automobile purchases and other forms of consumer credit. A type of contract a legally binding agreement between two parties to do a certain thing in which one side has all the bargaining power and uses it to write the contract primarily to his or her advantage.

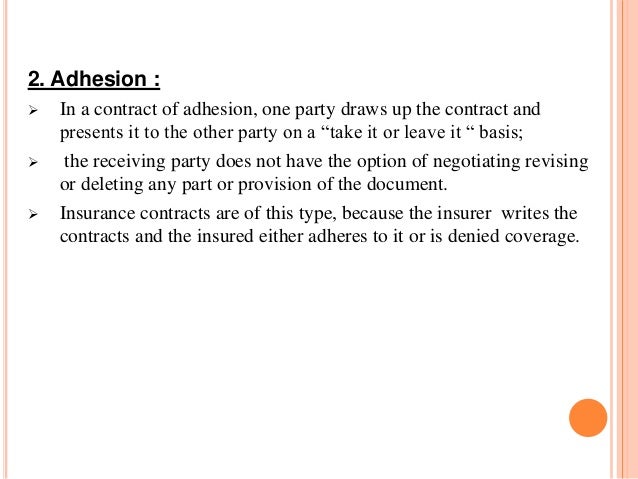

An example of an adhesion contract is a standardized contract form that offers goods or services to consumers on. Adhesion insurance contract is a contract where one party states the provisions of the contract while the other party is not involved in its drafting but whose participation is in either agreeing with it or declining it. A contract or contractual provision that is so unfair or oppressive to one party that no reasonable or informed person would agree to it. Since there is such disparity between the parties the weaker party usually adheres to the initial contract since it is unable to negotiate the original terms of the deal.

In the insurance world a contract of adhesion also known as an adhesion contract is a contract where one party has significantly more power than the other when creating the contract. In order to create a contract of adhesion for home insurance for example the insurer provides the homeowner with standard terms and conditions which are the same ones offered to other customers. Adhesion insurance is a tool to reduce your risks. Basically an adhesion contract is a form of a take it or leave it contract or agreement between two individuals or two parties in which one is stronger and superior than the other.

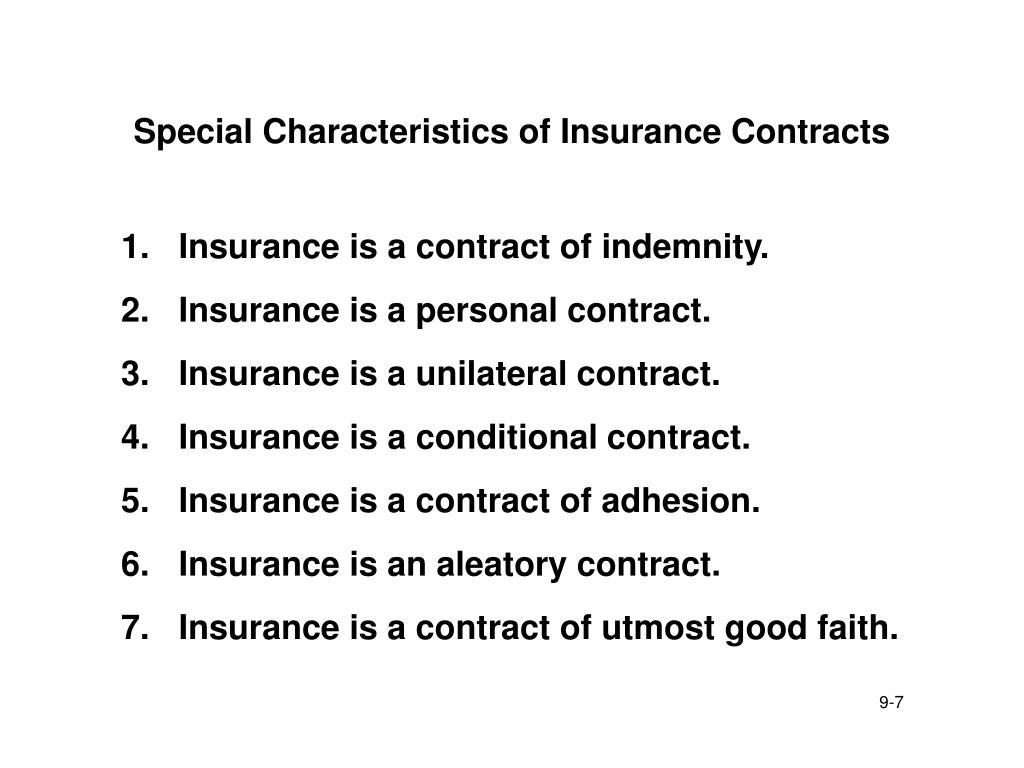

Adhesion contract explained. Insurance policies are contracts of adhesion and as such are construed strictly against the party writing them i e the insurer. Depending on the chosen program you can partially or completely protect yourself from unforeseen expenses. Courts carefully scrutinize adhesion contracts and sometimes void certain provisions because of the possibility of unequal bargaining power unfairness and unconscionability.

In an insurance contract the company and its agent has the power to draft the contract while the. This type of contract is drawn up between two parties and all terms and conditions are provided by the party with the greater bargaining power or capabilities.

/GettyImages-1053743626-3b1327252ce94a998c9508c06fed8eea.jpg)