Advance On Settlement

5 reasons not to use advance settlement funding imagine that you ve been injured in an auto accident in florida.

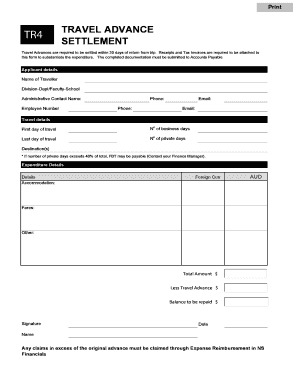

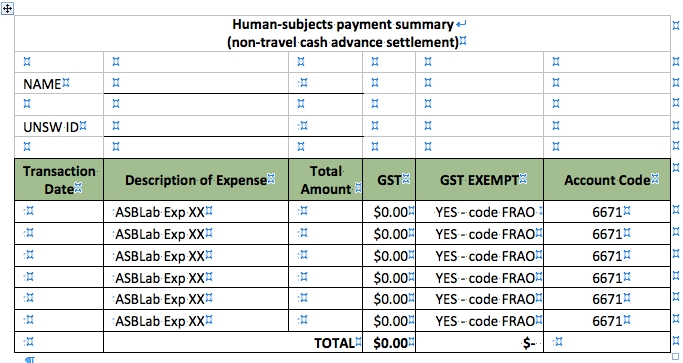

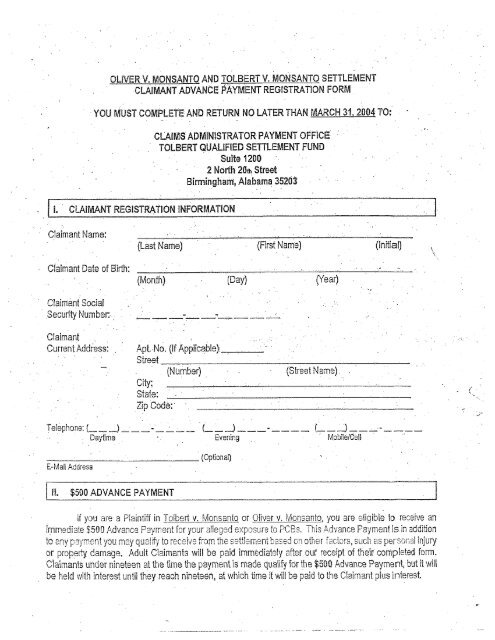

Advance on settlement. Pre settlement funding also known as a lawsuit advance gives plaintiffs access to money before a case is settled so they can pay for expenses mounting during the legal process. We do not require credit checks or income verification. If you need money before your claim settles to cover bills and living expenses pre settlement funding is one way to get you the cash you need as quickly as possible. Depending on your case approved pre settlement funds are anywhere from 500 250 000.

5 month later the insurance company offers plaintiff 100 000. You can use the money to pay for your rent or mortgage car payments medical bills or even groceries. A settlement advance gives you the cash you need to cover your living expenses and bills before a judgment is issued or the case is settled. But the arrangement is controversial the laws are unclear and caution is warranted.

You are out of work and bills are piling up you ve hired an attorney to help with your claim but things seem to be moving along so slowly and you need money now or else the electric company is going to shut your power off. Pre settlement funding provides you with a cash advance on the future compensation that you expect to receive from a claim. Apply now what is a pre settlement cash advance. Plaintiff discusses with their attorney and decides to decline the offer and obtain a 10 000 pre settlement advance with legal bay to pay bills.

First companies have a limit on the percentage of your expected settlement value usually ranging between 10 and 20. To expedite your settlement cash advance we just need to confirm the facts of the case with your attorney. So if they decide your potential settlement will amount to 50 000 you can expect offers between 5 000 and 10 000. Many companies also have a dollar amount limit and won t advance funds over a certain number.