Advance Payroll Funding

Reviews from advance payroll funding employees about advance payroll funding culture salaries benefits work life balance management job security and more.

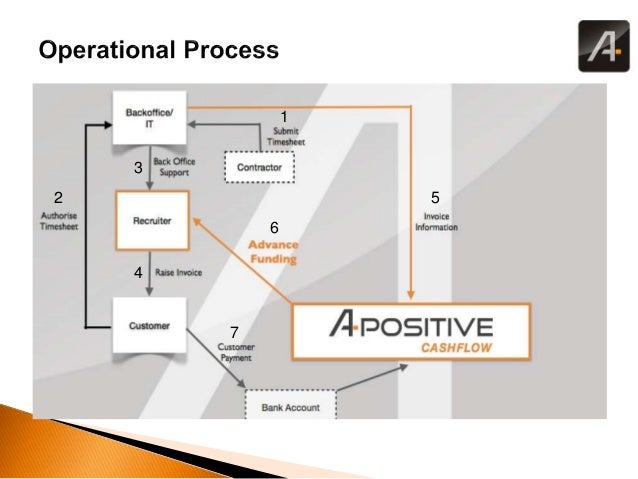

Advance payroll funding. Payroll funding is the process where a third party company buys your outstanding accounts receivable and advances you liquid capital immediately. To apply online you need a government gateway. For training outside working hours ap funding is given to employers to defray the overtime pay that was paid to their employees. The transaction was structured as an acquisition of substantially all of the assets of advance payroll funding ltd the operating company and advance temporary help services inc its non operating parent company by a wholly owned subsidiary of paychex.

Payroll funding can be used to pay employee wages worker s compensation benefits and other payroll requirements. The payroll finance company advances up to 90 of the invoice or invoices which can be used to cover payroll. To apply for an advance of statutory parental paternal adoption or maternity pay you can use the online service to apply for all types of advance. Flexible funding has nearly 30 years of payroll funding company experience to help with growth consulting factoring services and billing integration.

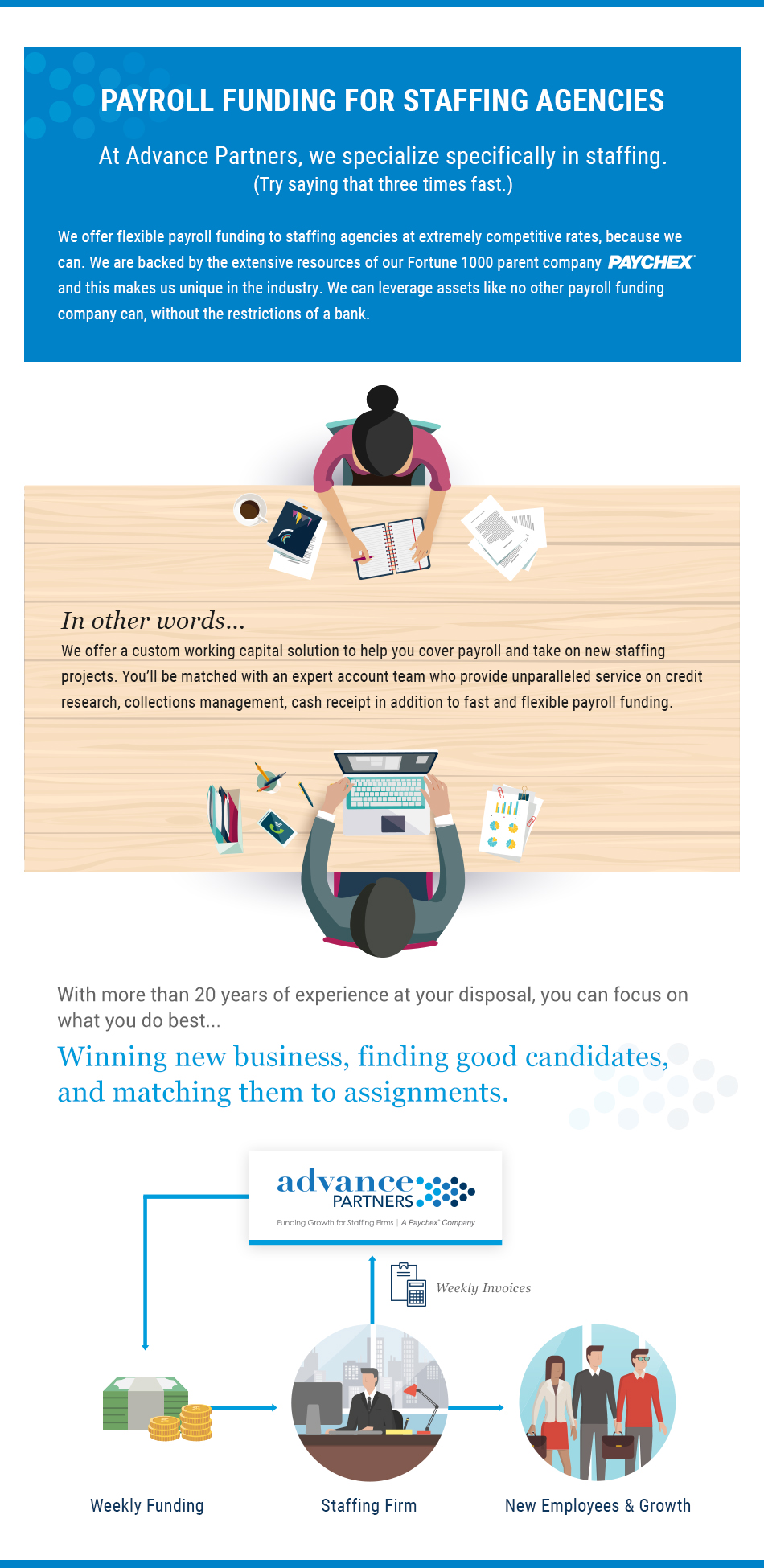

While you have the ability to pay employees you can also use the extra working capital for other business expenses take on new clients pay vendors or whatever else you need to do to grow your company. Why use payroll funding. Payroll apply for financial help for an employee tax refund you can ask hm revenue and customs hmrc for financial help if you need to give an employee a tax refund and cannot pay for it yourself. Advance partners a paychex company helps staffing firms with advanced payroll funding back office operations support and business development.

.jpg?sfvrsn=336ac8c3_4)