Advisory Account Vs Brokerage Account

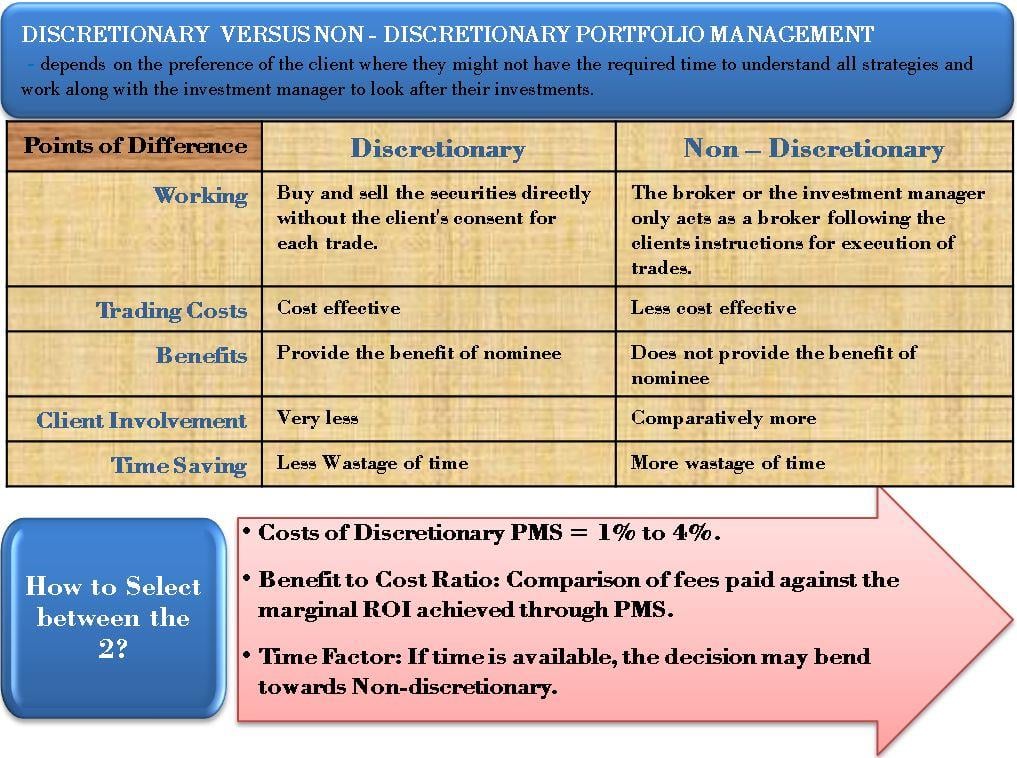

With a self directed brokerage account you control the buying and selling of securities.

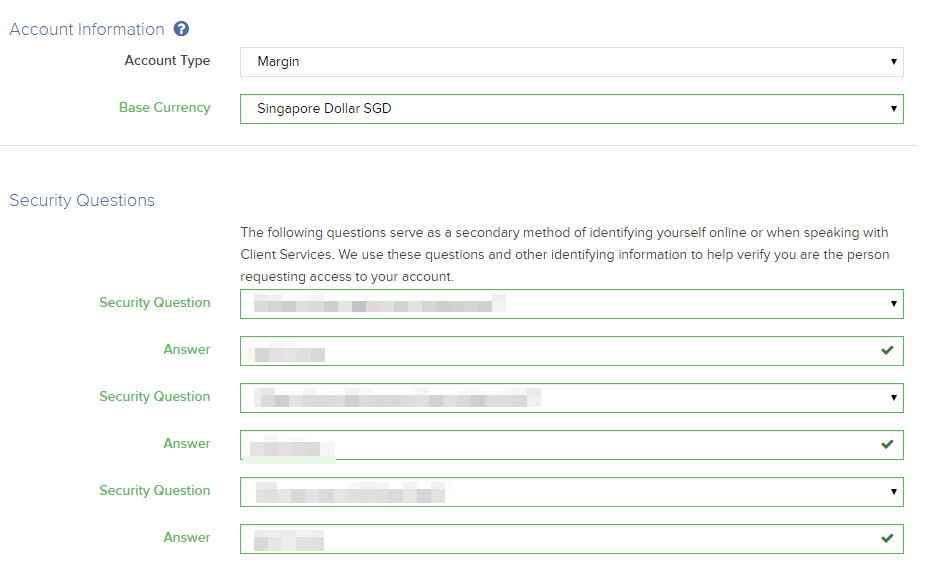

Advisory account vs brokerage account. In an advisory account advice and monitoring occur on an ongoing basis. Large corporation with national presence. An effective way to make sure. Locally owned and operated.

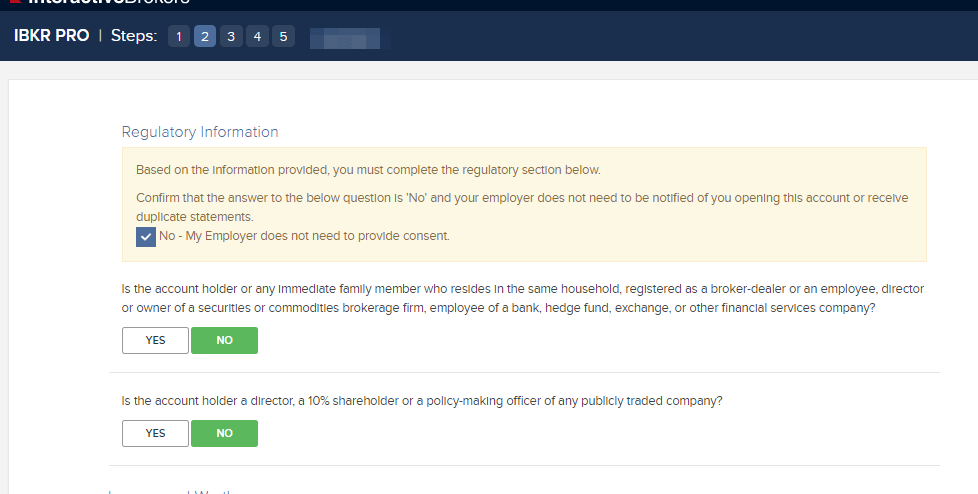

Investment advisers on the other hand work on a fee based system of dispensing investment advice catered towards individual client needs and oftentimes manage investment accounts. Your broker will you make decisions or in reality you don t even need the broker to have a brokerage account. For a buy and hold investor who does not make a significant number of trades a managed account could be more expensive than a self directed brokerage account where fees are typically charged based on transactions. Broker brokerage accounts registered investment advisor advisory accounts.

They are offered online for deep discounts on the commissions for placing trades. The broker can be a huge help in deciding what to invest in. In addition many advisory services and programs also provide clients with professional management of their accounts. Both brokerage and advisory accounts in both brokerage and investment advisory accounts that include products such as mutual funds or exchange traded funds you will incur additional expenses including investment management fees of the fund as well as operating expenses that are reflected in the funds share price.

Advisory accounts attempt to avoid conflicts of interest and disclose those which cannot be avoided. Baird believes that an advisory account is generally a better investment option for most clients compared to a brokerage account because clients receive ongoing investment advice and monitoring of their accounts. In a brokerage account the more you trade the more fees you owe. Brokerage relationship unlike an investment advisory relationship in which clients pay an ongoing asset based fee in a brokerage relationship clients typically pay a commission to lpl financial on each transaction in the account.

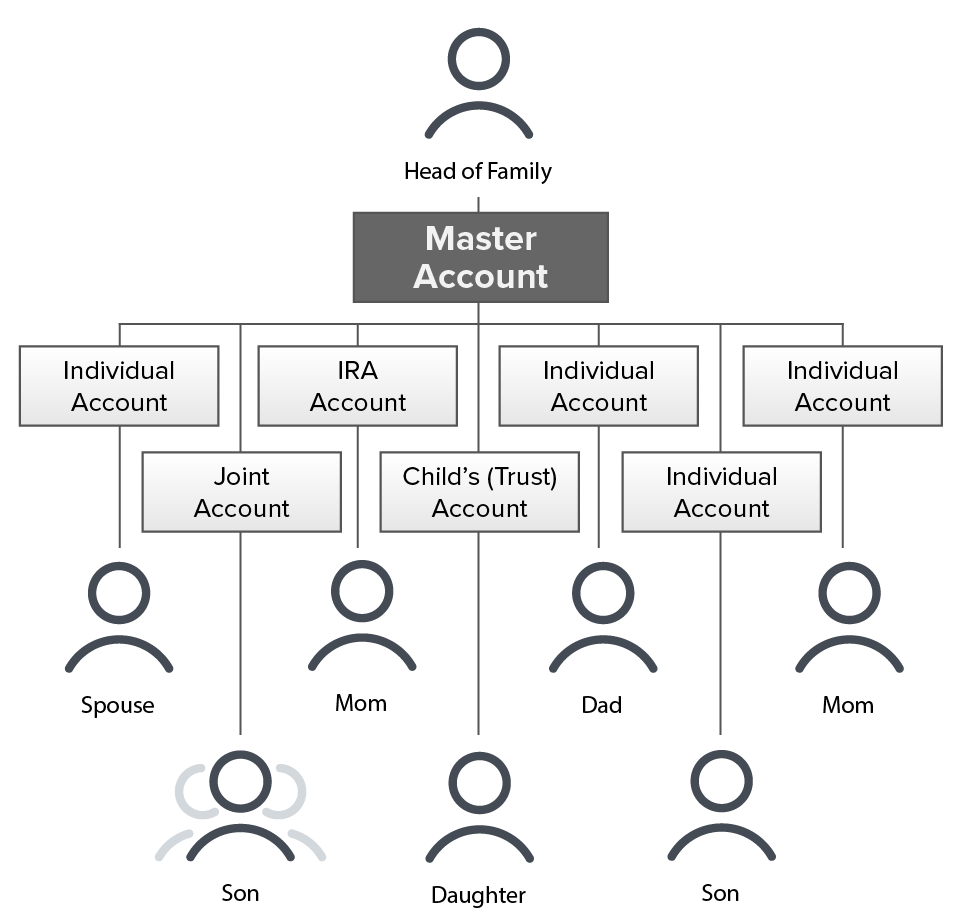

A type of investment account where an investment advisor works closely with a client in formulating and implementing investment purchases and strategies. In a brokerage account advice is typically given at the time of trade. In making your decision keep in mind that your financial needs and goals may change as you move from one stage of life to the next. In most cases the client.

May choose account platform that best fits.

:max_bytes(150000):strip_icc()/personal-capital-vs-vanguard-personal-advisor-services-4dad1d34084c4780aec788ace455b4a3.jpg)