Age To Qualify For Reverse Mortgage

However there is a relatively new feature for reverse mortgage prospective borrowers that can help some applicants qualify even if they do not meet the credit or income requirements.

Age to qualify for reverse mortgage. Here s what you need to know. To qualify for a reverse mortgage your property must have sufficient equity remaining in it to eliminate any existing mortgages or liens using the reverse mortgage. There are a number of factors to consider which may impact whether a reverse mortgage is right for you. Frequently asked questions regarding reverse mortgage eligibility.

Aside from age there are a few other requirements for taking out a reverse mortgage including. Reverse mortgage age table march 2020. Although the minimum age to qualify is 62 consumers will benefit more from a reverse mortgage loan if they apply for it later in life. A non borrowing spouse nbs is not named on the home title a spouse and he or she can be any age thus he or she doesn t qualify to be a full borrower on a hecm reverse mortgage.

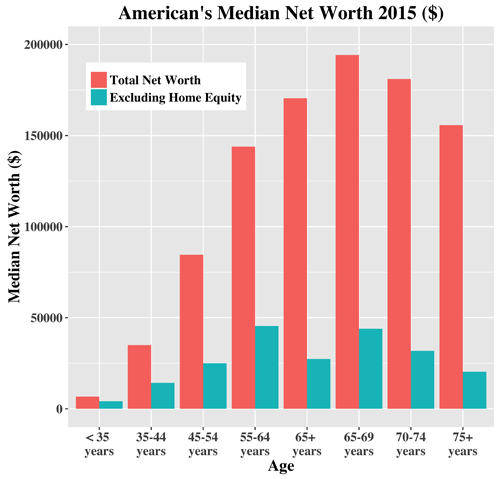

Since age is one of the factors that determines how much money a borrower gets getting a reverse mortgage after 62 means there will be more funds available to the applicant. The minimum age is 62 years and there are no exceptions for disability or social security status. Further these amounts change weekly based on the performance of the 10 year libor swap rate. But in 2014 hud introduced new rules to better protect non borrowing spouses.

You must either own your home outright or have a low mortgage balance. Your home must be your principal residence meaning it must be where you spend the majority of the year. This reverse mortgage age chart was updated in march of 2020. A surviving non borrowing spouse can remain in the home after the borrower has passed.

But exactly how much equity do you have to have in your home in order to qualify. In practice this means you generally must have at least 50 equity in the home in order to qualify though the precise limit depends on your age and current interest rates. Set aside rules were implemented in 2015 allowing lenders to essentially set aside funds they will need to pay for their property charges. Can a homeowner that has a mortgage still get a reverse mortgage loan.

While there is no maximum age to qualify. Age to qualify for reverse mortgage contents age 21 won senior years borrowers january 1st 2018 basic qualifications homeowners reverse mortgage educational conversion mortgage hecm and public benefits received by children up until age 21 won t be considered. According to the article the age of most reverse mortgage borrowers is between 65 and 75. To be eligible for a reverse mortgage you have to be 62 or older.

A reverse mortgage is a lending product that allows borrowers aged 62 and older to borrow against the equity in their home without having to make payments until the borrower and any non borrowing spouse has left the house.