Annuity Distribution Taxation

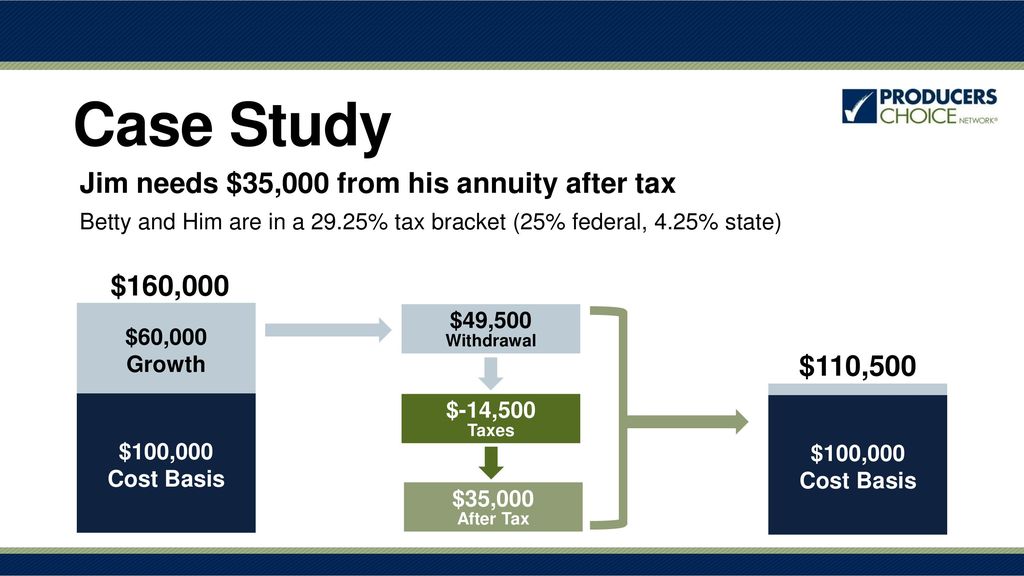

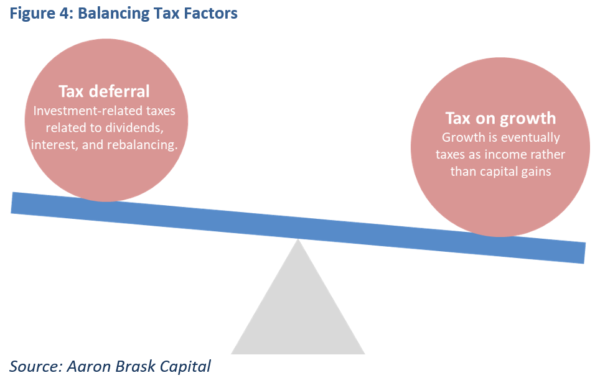

Withdrawals and lump sum distributions from an annuity are taxed as ordinary income.

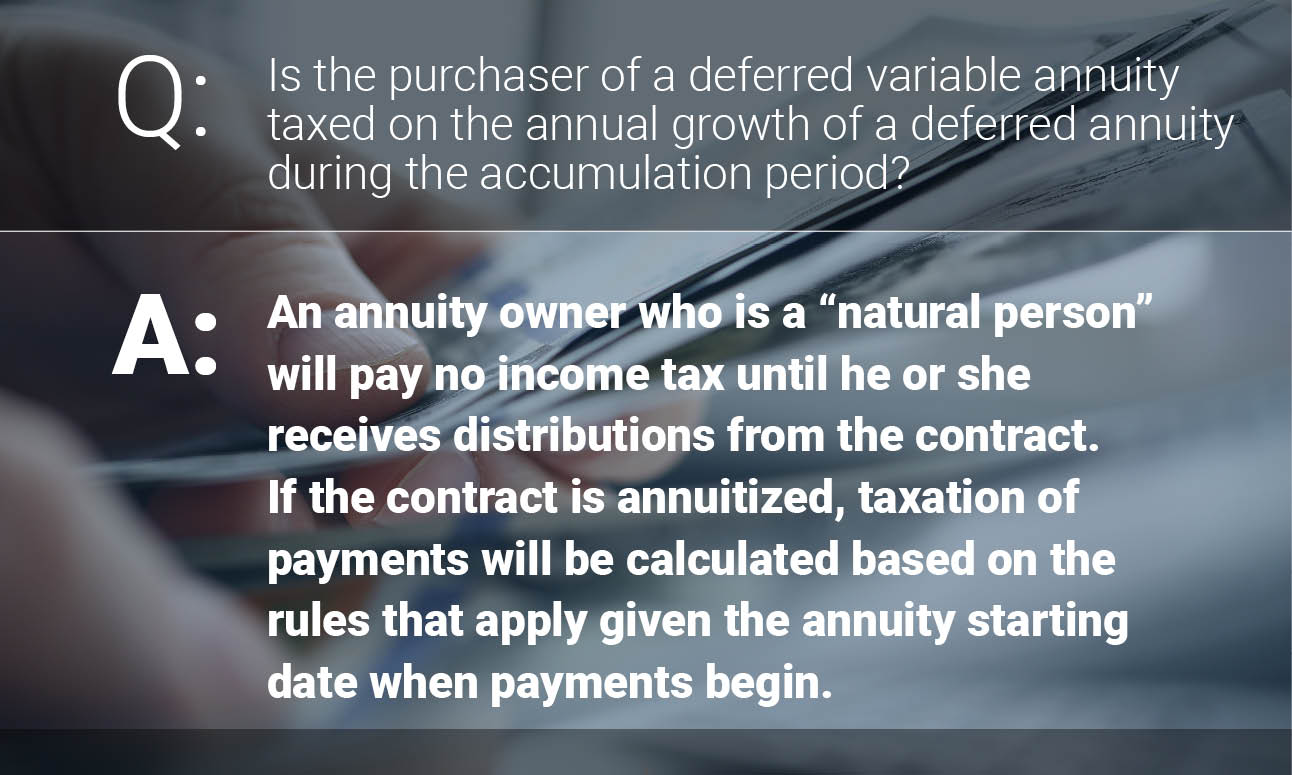

Annuity distribution taxation. First to the extent the annuity is deferred taxation on the growth in the annuity s value is income tax deferred until distributions are made from the policy. Say for example you invest 100 000 in an immediate annuity and the annual payouts are 8 000. They do not receive the benefit of being taxed as capital gains. But that doesn t mean they re a way to avoid taxes completely.

High income taxpayers must include the taxable portion of their variable annuity income in calculating their 3 8 additional net investment income tax. An annuity normally includes both gains and non taxable principal. Any applicable tax payments on this type of annuity are deferred until the money is withdrawn. If the irs considers your life expectancy to be 20 years divide 100 000 by 20 to determine how.

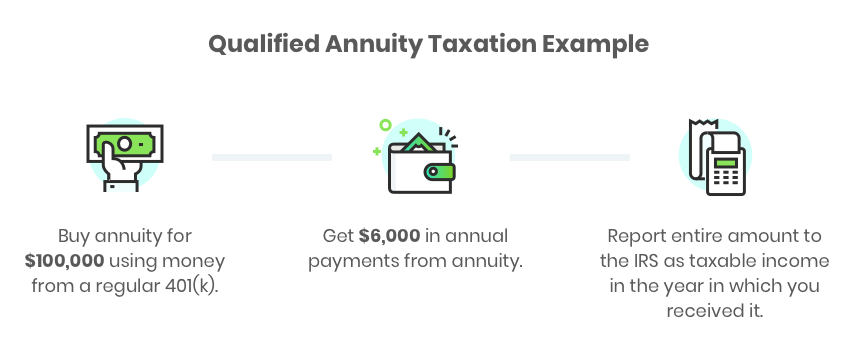

Qualified annuities are purchased with pre tax dollars such as money from an ira. Annuities are tax deferred. But even a series of five equal distributions has tax drawbacks. Unfortunately gains are distributed first.

There are two basic income tax rules. A distribution from a tax sheltered annuity section 403 b plan. What this means is taxes are not due until you receive income payments from your annuity.

:max_bytes(150000):strip_icc()/taxes-in-retirement-how-much-will-you-pay-2388083v-6-5b4cba9fc9e77c0037315bd8.png)

/ScreenShot2020-02-03at1.31.57PM-22f2d44f32ac447aa561bd652c2c11e4.png)

/annuity-1a2c27eba1cb4ecf85aca9e888096cbd.jpg)