Annuity Settlement Options Explained

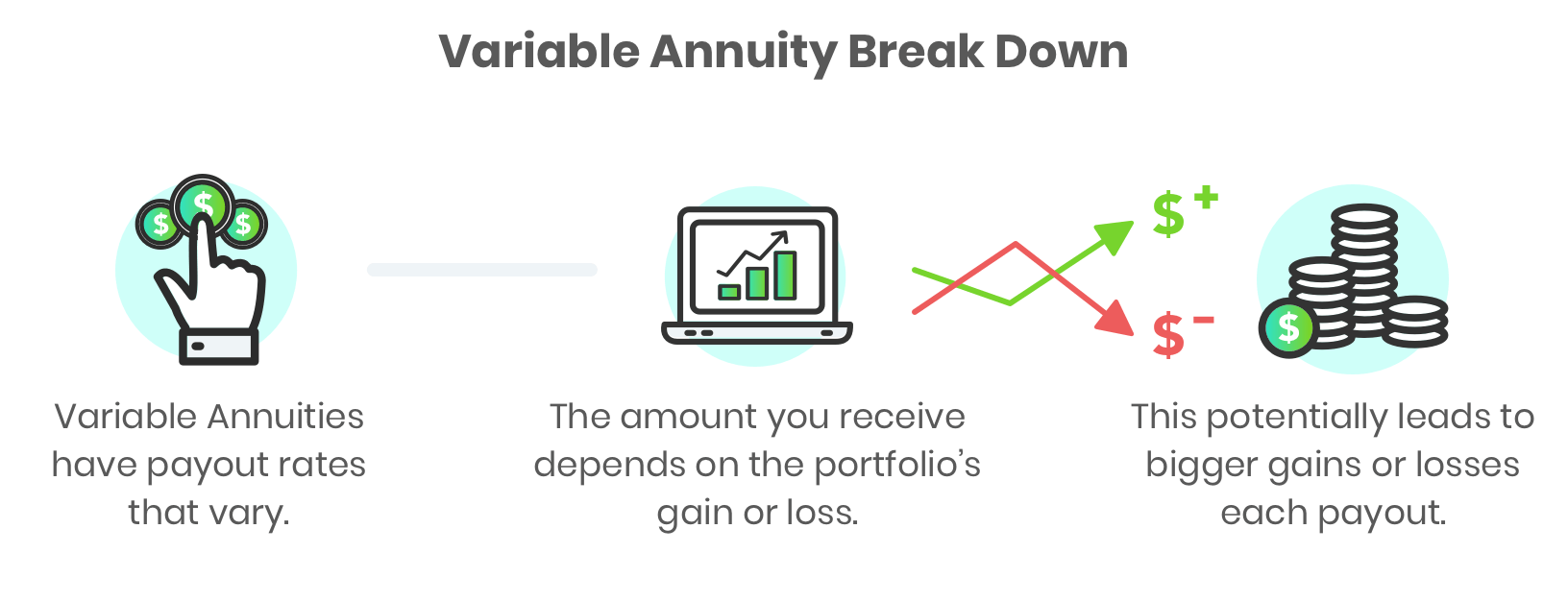

Annuities are a popular choice for investors who want to receive a steady income stream.

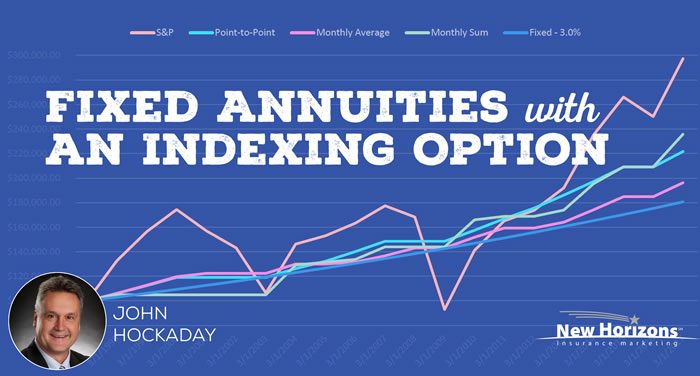

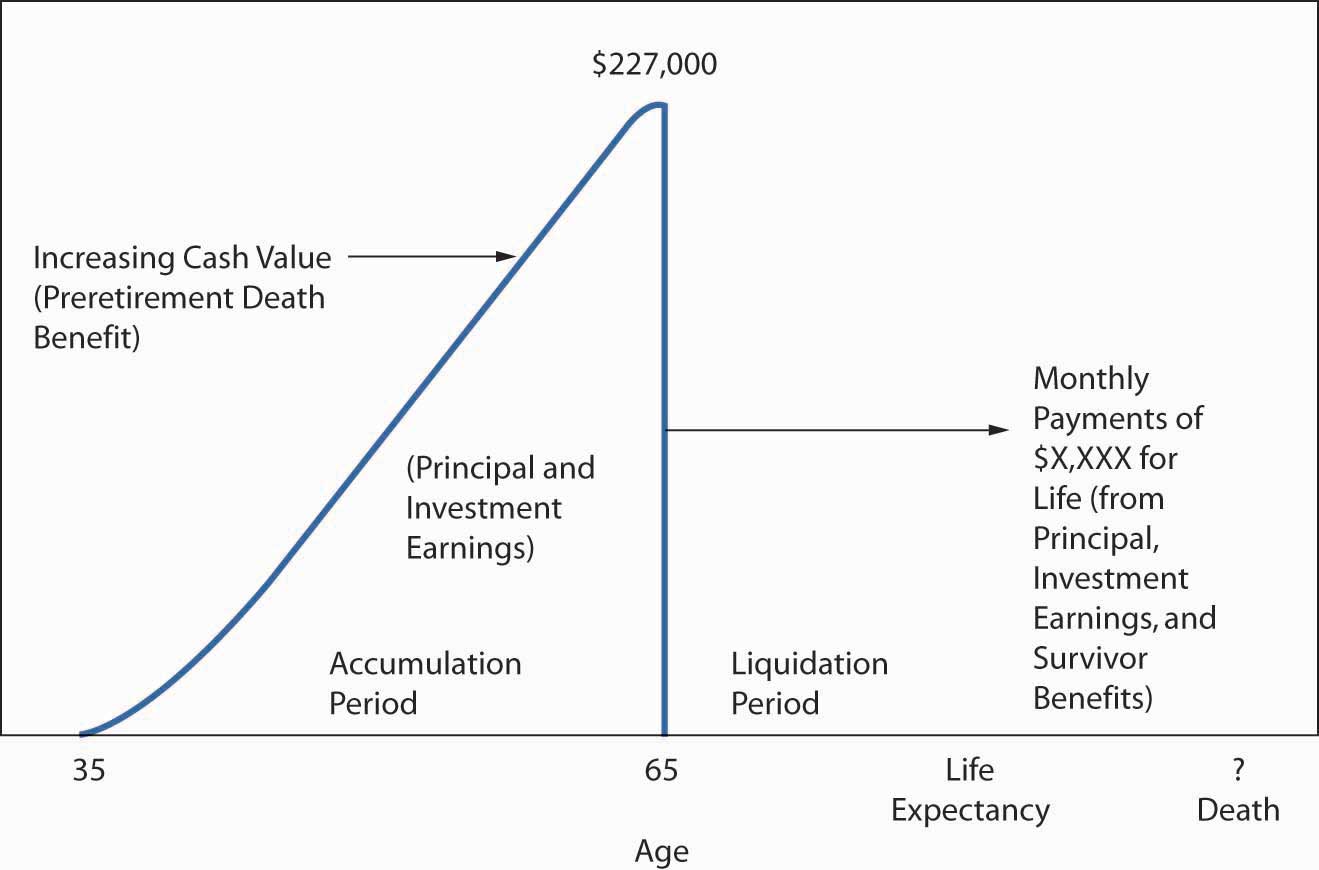

Annuity settlement options explained. There are a number of settlement options that can be chosen for the distribution of annuity payments. By annuitizing your deferred annuity contract and choosing an income option you will be exchanging your accumulated savings for a guaranteed income stream. After the fixed interest rate expires the interest rate starts to adjust based on an index plus a. Although the basic premise and reasoning for purchasing all annuities is the same the ways that benefits may be received by the annuitant or the annuitant s beneficiaries can be diverse.

An annuity is an insurance product that pays out income and can be used as part of a retirement strategy. In this article we review the inherited annuity taxes and stretch concept. There are many rules surrounding distribution options in a non qualified annuity. An adjustable rate mortgage arm with an initial fixed interest rate period.

These include when payments begin how long they last and whether money will go to a beneficiary when the annuitant dies. If a settlement option is elected gleaner will make periodic payments to the annuitant. Annuity settlement options one of the unique features of an annuity is the opportunity to elect a settlement option and set up a dependable stream of income.