Apply For Income Based Repayment Student Loans

You can enroll in an income driven repayment plan through your student loan servicer the company where you send your monthly payments.

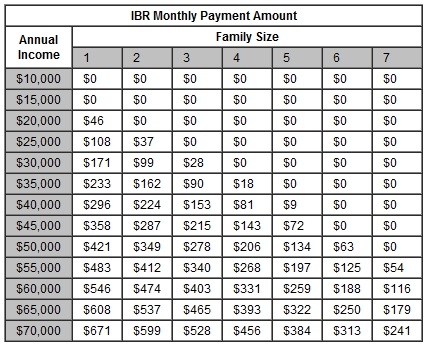

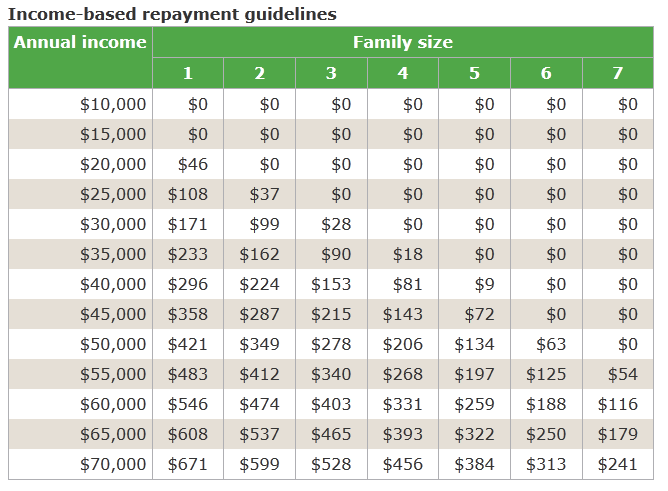

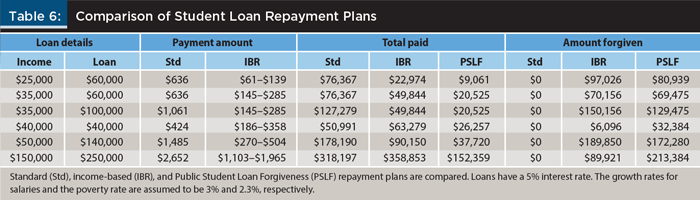

Apply for income based repayment student loans. Give back get forgiveness. When applying for ibr the government looks at your income family size and state of residence to calculate your monthly payments. Ford federal direct loan direct loan program and federal family education loan ffel programs. It was created to help people who have a hard time making their student loan payments in a typical 10 year repayment plan.

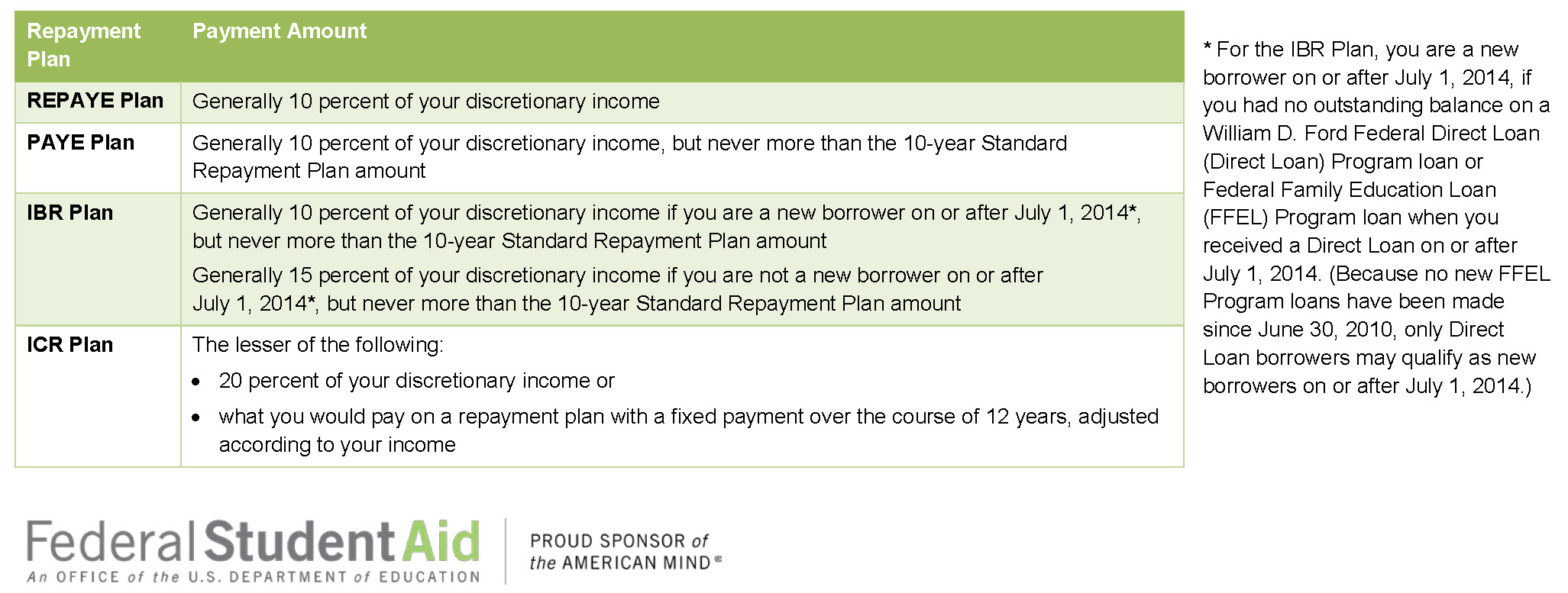

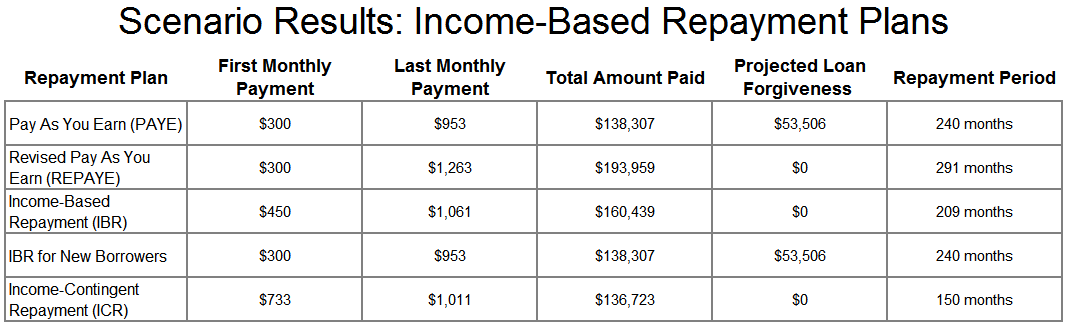

Certain eligibility conditions apply and an annual renewal is required so be sure to find out how these plans work. The main plans are income based repayment ibr pay as you earn paye revised pay as you earn. An income based repayment ibr plan is a debt repayment option for anyone holding a federal student loan. The income based repayment plan is a new payment option for student loan borrowers intended to help those who have a high debt level compared to their income.

Income driven repayment idr plan request. Income driven repayment idr plans are designed to make your student loan debt more manageable by reducing your monthly payment amount. Income based repayment plans are only for federal student loans. With income driven repayment idr plans you could potentially reduce your monthly payment to as low as 0.

Public service loan forgiveness. Not all private student loan lenders offer idr plans so you d have to talk with your lender to see if a similar option exists for you. This plan sets a person s monthly student loan payment at an amount that is affordable to the borrower since the payment is based on your monthly income and family situation. If you need to make lower monthly payments or if your outstanding federal student loan debt represents a significant portion of your annual income one of the following income driven plans may be right for you.

A repayment plan based on your income can help you manage your federal student loan payments. When discussing income based repayment student loans we are only referring to the programs available for federal student loans. Income based repayment ibr is a repayment plan available to federal student loan borrowers. 1845 0102 form approved expiration.

If you have federal student loans such as stafford or gradplus. It s based on the idea that how much you pay each month should be based on your ability to pay not how much you owe.