Applying For A Small Business Credit Card

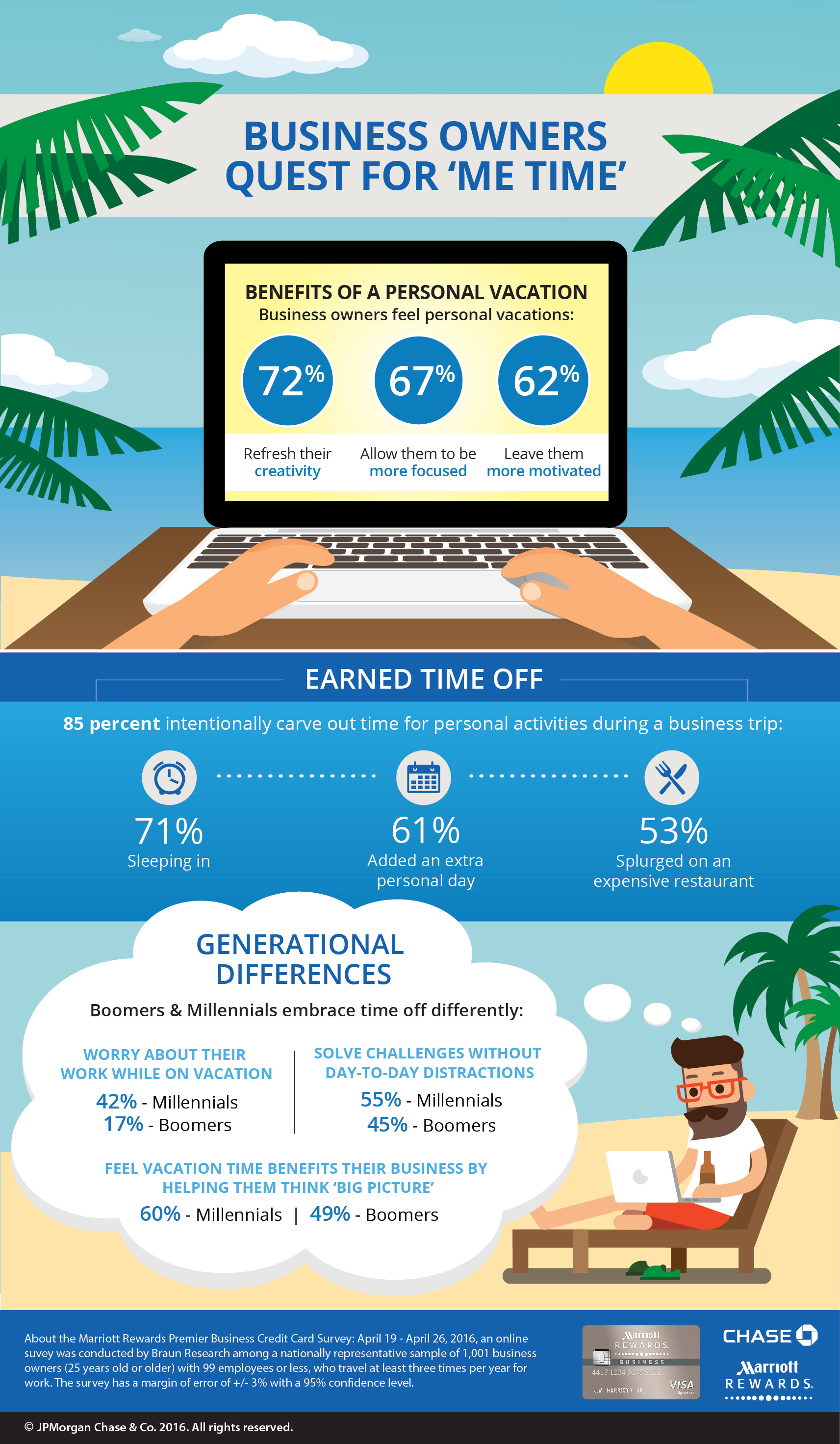

Many small business credit cards participate in the same points and miles reward programs as personal credit cards.

Applying for a small business credit card. Credit will appear within two billing cycles and will apply to whichever program is applied for first. Credit card limit is up to 75 of your business s monthly sales with maximum credit limit of 5 million. 500 000 in monthly sales required to qualify for brex. To get a business credit card you must provide your tax id number tin or employer id number ein along with your social security number on the business credit card application.

Compare business credit card offers to find the best one for you. You may qualify for a small business credit card and not realize it. Credit card issuers consider multiple factors including your spending and repayment habits existing debts income and personal credit score. To receive a statement credit you must use your spark miles card to either complete the global entry application and pay the 100 application fee or complete the tsa pre application and pay the 85 application fee.

Know your credit score so you know which cards you qualify for. No personal guarantee needed we do not ask for a personal credit check or security deposit during the application. Have a small business with an intent to make a profit. Here are 5 steps to qualify for a business credit card.

Fill out application with your business name and ein or your name and ssn.