Apr Vs Interest Rates

To determine your apr you ll need to know your loan s interest rate the amount you plan to borrow your repayment term and your total fees then you can use our apr vs.

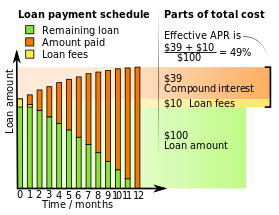

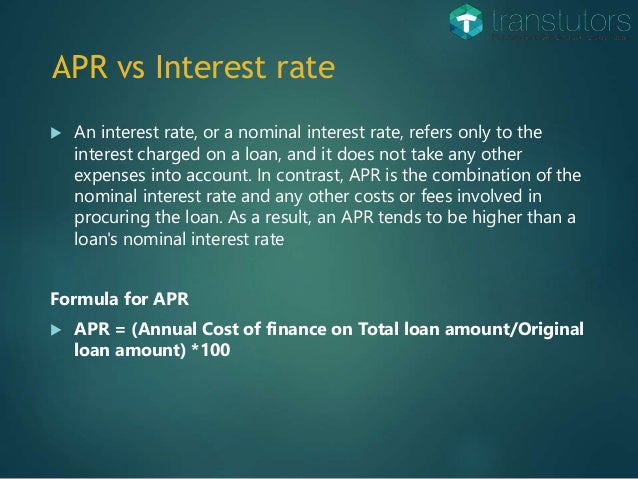

Apr vs interest rates. For example short term high interest rate loans will often have a 30 interest rate for a two week term or 30 owed for every 100 borrowed which translates into a 782 14 apr. Interest is a fee on borrowed capital. Annual percentage rate interest rate. As a numerical example of how interest rate and apr are different let s say that you re obtaining a 20 000 personal loan with a three year term with an interest rate of 6 99 and a 500.

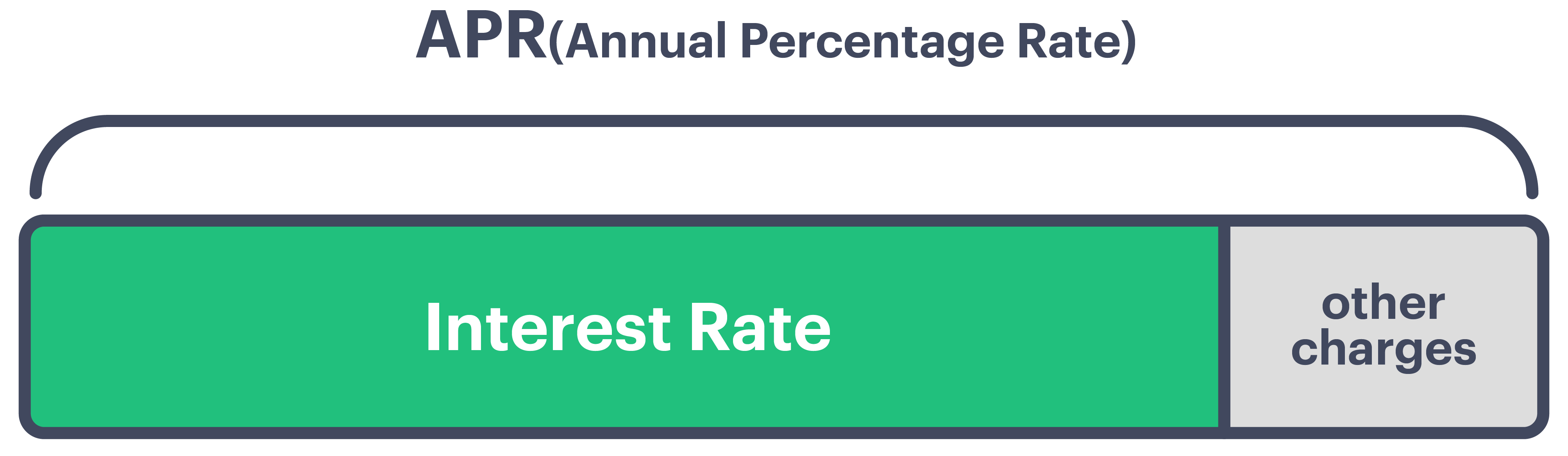

The difference between an apr and an interest rate is that the apr equals the interest rate plus other loan costs. Annual percentage rate apr is an expression of the effective interest rate that the borrower will pay on a loan taking into account one time fees and standardizing the way the rate is expressed. Interest rate calculator to get a ballpark figure of what you ll owe. The apr interest rate and break even point are all critical factors but there are also others to consider.

For example if you were considering a mortgage loan for 200 000 with a. Unlike an interest rate however it includes other charges or fees such as mortgage insurance most closing costs discount points and loan origination fees. Apr is the annual cost of a loan to a borrower including fees. Unlike a stripped down bare bones interest rate apr reveals the full price of the loan.

Arms are calculated based on current economic conditions so the apr of a loan on monday would be different from the apr of that same loan on friday similarly to how interest rates move. The rate can be variable or fixed but it s always expressed as a percentage. If you re buying a home consider. The interest rate is the cost of borrowing the principal loan amount.

A loan s annual percentage rate apr includes all those pesky fees you ll pay for borrowing money. Your down payment. Like an interest rate the apr is expressed as a percentage. The advertised rate or nominal interest rate is used when calculating the interest expense on your loan.

/annual-percentage-rate-apr-315533_byexcel_FINAL-4e3f58ac2743412cbcb0b3aadf2107f2.png)