Ar Factoring Companies

By using ar factoring you no longer have to cope with the stress of not having cash when you need it.

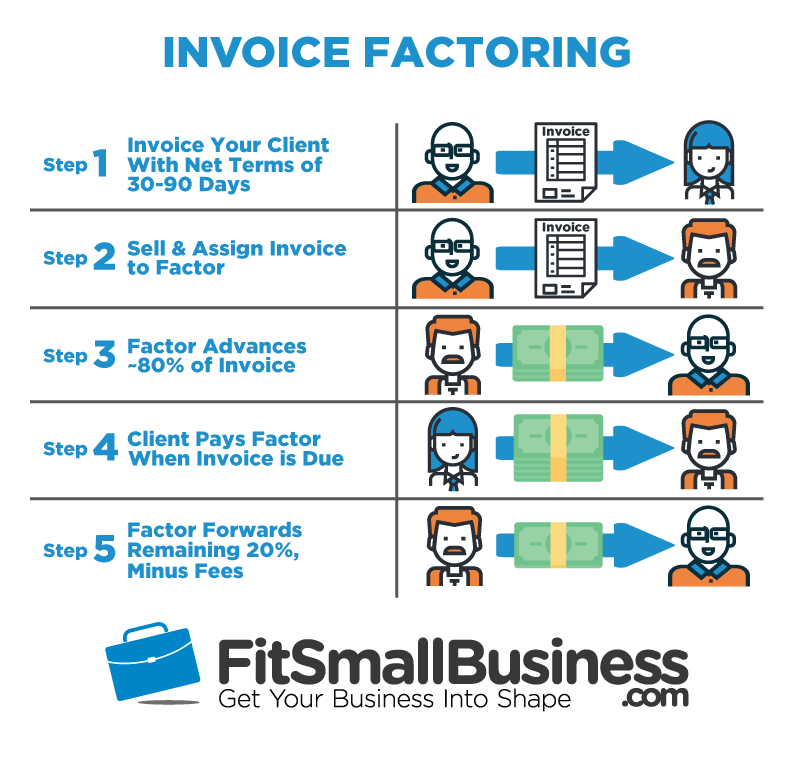

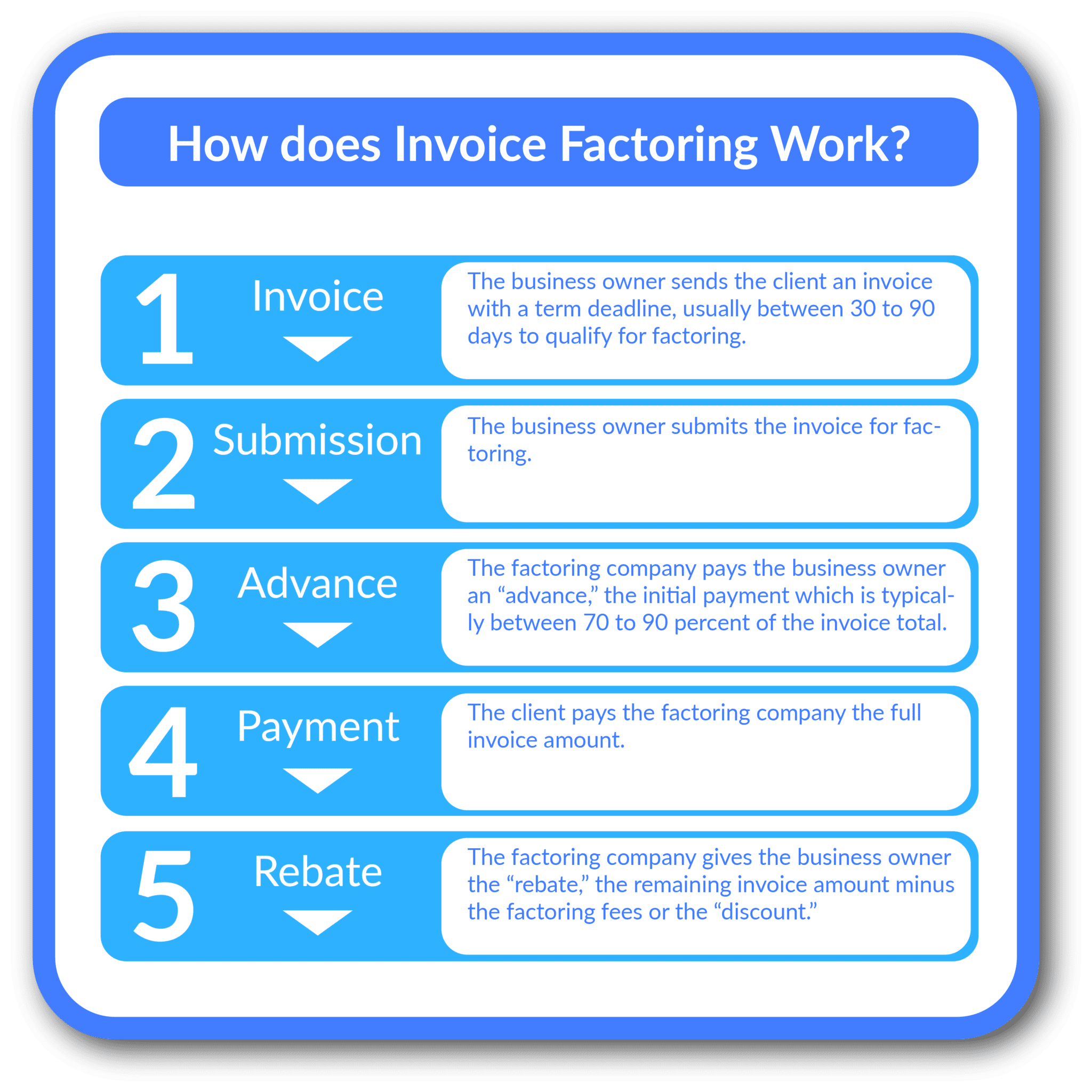

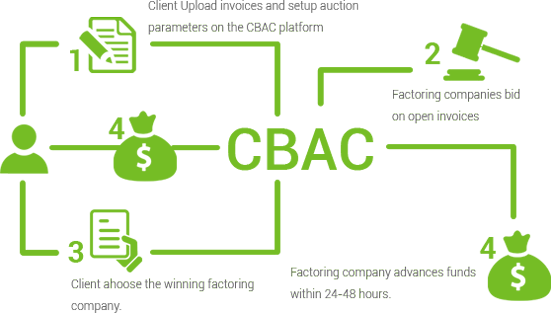

Ar factoring companies. Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable i e invoices to a third party called a factor at a discount. An ar factoring company will buy your invoice s advance you from 75 92 against their face value and pay you the difference less their fees when your client subsequently pays the invoice. Ar factoring also known as accounts receivable factoring is a great way to free up cash in a hurry often in less than 48 hours. No more sleepless nights worrying about keeping your business afloat.

Forfaiting is a factoring arrangement used in international trade finance by exporters who wish to sell their. Many ar factoring companies specialize in particular industry types. Accounts receivable factoring also known as factoring is a financial transaction in which a company sells its accounts receivable accounts receivable accounts receivable ar represents the credit sales of a business which are not yet fully paid by its customers a current asset on the balance sheet. Accounts receivable factoring is a solution that allows business owners to quickly turn invoices into working capital.

Accounts receivable funding offers invoice factoring to various companies that depend on accounts receivable funding to drive their success. Today across the u s we re providing clients with access to debt free working capital by converting accounts receivables into ready cash. Companies allow their clients to pay at a reasonable. The factoring company then collects payment on those invoices from your customers.

What is accounts receivable factoring. Instead of waiting for weeks or months for customers to pay their invoices accounts receivable financing lets business owners get an advance on those invoices and use the cash for pressing business needs instead of waiting for weeks or months for customers to pay their invoices. A business will sometimes factor its receivable assets to meet its present and immediate cash needs.