Auto Insurance Coverage Explained

The coverage limits are written out as a single number showing the max amount paid out per accident.

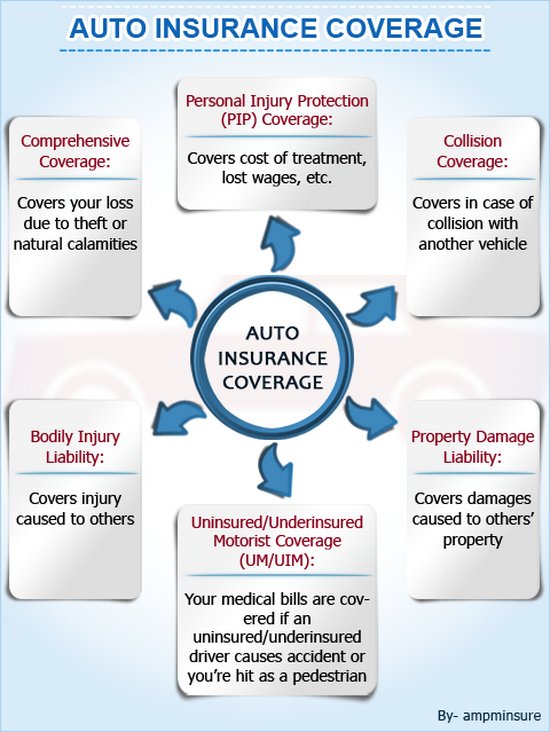

Auto insurance coverage explained. 5 types of insurance coverage. Comprehensive coverage pays to repair your vehicle subject to. In the event of hail damage or a tree limb falling on your car risks not involving an automobile collision this coverage insures you. Some auto insurers however are now offering supplemental insurance products at additional cost that extend coverage for vehicle owners providing ride sharing services.

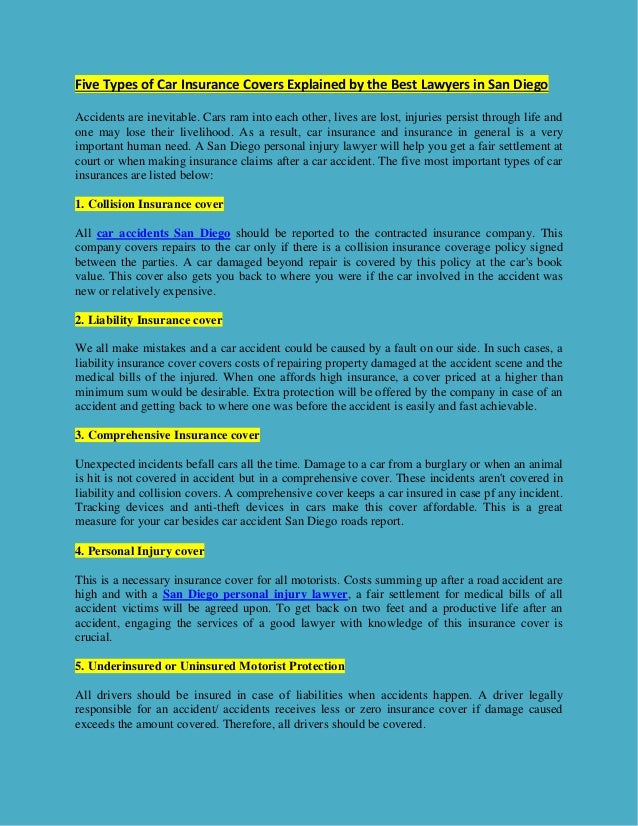

The following 5 types of car insurance coverage should be studied to choose the best coverage for your car. If you re in an automobile accident regardless of who is at fault collision insurance provides protection to replace or repair your vehicle subject to a deductible. In the case that someone without insurance hits your car and is at fault or you re on the receiving end of a hit and run umpd can help pay for the damages done to your vehicle. When you start to consider the various types of auto insurance coverage available it can get overwhelming.

Below we detail 5 types of coverages and provide a few scenarios where you would benefit from having a non required coverage added to your policy. In the same way uninsured motorist coverage protects your body uninsured motorists property damage umpd protects your car. Are there ways to save money and still have the right amount of coverage. Typically increasing your auto coverage limits will increase your monthly rate and decreasing limits will decrease your rate.

Coverage limits and your insurance rate. When you are involved in the accident and when it is concluded that that accident took place before of your fault negligence the liability coverage will come to your rescue. Typically it is either a 10 000 15 000 or 25 000 limit.

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

:max_bytes(150000):strip_icc()/insurance-endorsement-or-rider-2645729-FINAL-5bdb553b46e0fb00518eef20.png)