Auto Insurance Functions

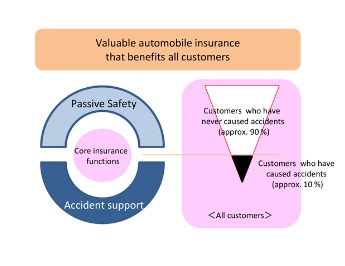

The function of an insurance company is to assess risk and offer policies to provide financial compensation in case of loss or a claim against you.

Auto insurance functions. Understanding auto insurance the basics. The function of auto insurance is to provide protection in the event of an automobile accident or other incident involving a motor vehicle. Different types of business insurance include professional and product liability property and workers compensation. Auto insurance provides coverage for.

The only part of auto insurance that is mandatory by the government is the liability portion. The main function of insurance is to protect the probable chances of loss. The time and amount of loss are uncertain and at the happening of risk the person will suffer the loss in the absence of insurance. The function of auto insurance is to insure your vehicle and personal liability should you be involved in an at fault accident.

Auto insurance is a contract between you and the insurance company that protects you against financial loss in the event of an accident or theft. In exchange for your paying a premium the insurance company agrees to pay your losses as outlined in your policy. The policy is designed to pay for damage to property as well as medical expenses of injured parties. Vehicle insurance also known as car insurance motor insurance or auto insurance is insurance for cars trucks motorcycles and other road vehicles its primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle.

/agents-versus-brokers-and-how-they-make-money-462383-color-V2-cc2b7ad3db6c4ee5a0d2302843c1213f.png)