Auto Insurance Liability Definition

Liability insurance also called third party insurance is a part of the general insurance system of risk financing to protect the purchaser the insured from the risks of liabilities imposed by lawsuits and similar claims and protects the insured if the purchaser is sued for claims that come within the coverage of the insurance policy.

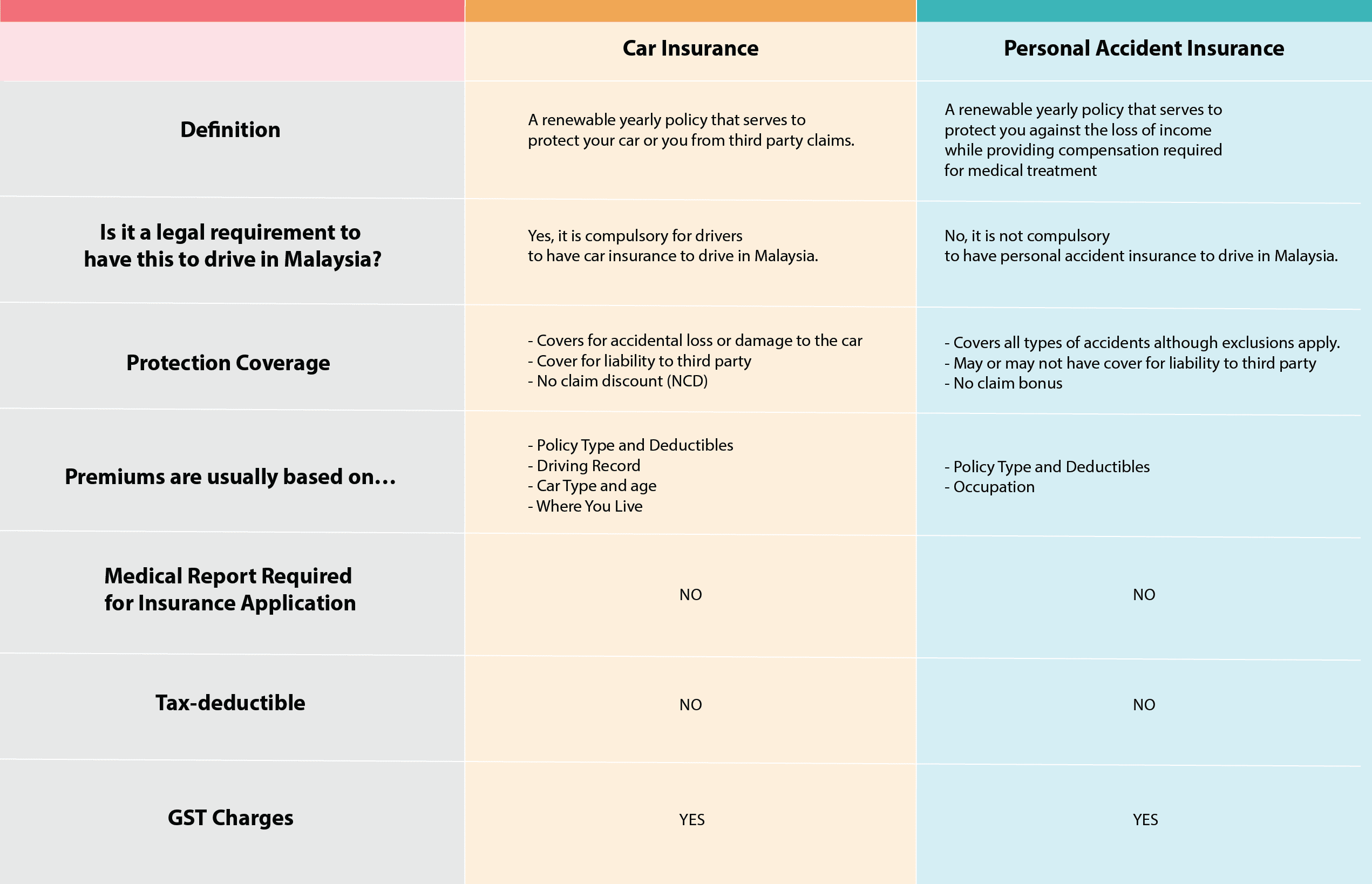

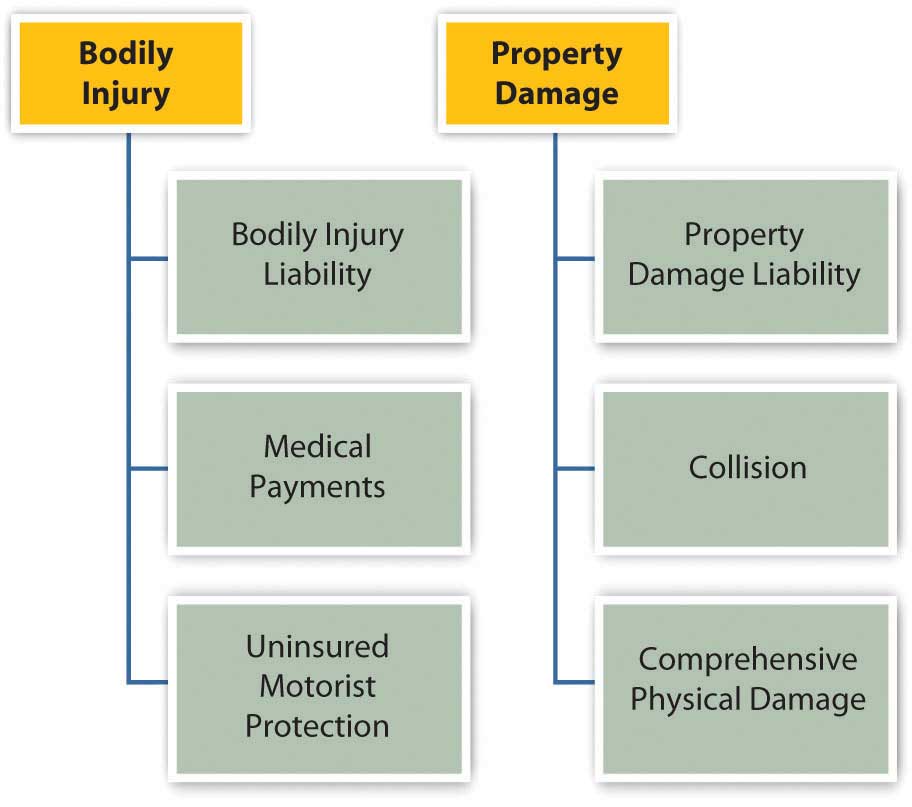

Auto insurance liability definition. Liability auto insurance is divided into two parts. Liability car insurance is the part of a car insurance policy that provides financial protection for a driver who harms someone else or their property while operating a vehicle. Liability insurance coverage protects other drivers from bodily injury or property damage you might cause in an at fault accident. It is required by nearly every state in order to legally drive and register your vehicle.

It is the most basic form of auto insurance and does not cover you or your vehicle in an accident. These two parts work together to compensate others to whom you ve caused harm with your vehicle thereby protecting your assets. Property damage liability pd pays up to your policy limits for damages to someone else s property that you the policyholder or other drivers covered by your car insurance policy are found responsible for after a motor vehicle accident. It does not cover any damages to the driver their automobile or other property.

Automobile liability insurance is a type of insurance that covers damages the insured causes to a third party or their property while driving a vehicle. It does not have a deductible and is required in every state. The term liability insurance refers to an insurance product that provides an insured party with protection against claims resulting from injuries and damage to other people or property. Auto liability insurance is a type of car insurance coverage that s required by law in most states.

Liability just means responsibility so liability insurance protects you when. The auto liability coverage definition may sound simple enough but here s a real life example. If you cause a car accident in other words if you are liable for the accident liability coverage helps pay for the other person s expenses. Auto liability insurance coverage helps cover the costs of the other driver s property and bodily injuries if you re found at fault in an accident.

Liability car insurance is the coverage that pays to repair the damage you cause to other people and their things.

/auto-accident-involving-two-cars-on-a-city-street-970958674-a196dc719c4a464a99c5cf128f2b1aa2.jpg)

:max_bytes(150000):strip_icc()/car_insurance-928675064-5bbe7d28c9e77c0058d884e9.jpg)

/car_accident-e79ae57204b34f5589a2967bff98e89a.jpg)

:max_bytes(150000):strip_icc()/SwitchingCarInsurance_GettyImages-1029356602-0e311271353c47a99e61036d78e0fdff.jpg)

:max_bytes(150000):strip_icc()/auto-and-car-insurance-policy-with-keys-1048031806-6dbe3526b6d84e14aa23d07fbe11c40e.jpg)

/Clipboard01-5c7005ccc9e77c0001ddce7a.jpg)

/what-is-a-property-damage-claim-527109-V1-98ea220c8cf842708c2e789bfcdce113.jpg)