Auto Insurance Personal Injury Protection Coverage

Up to 250 000 in coverage.

Auto insurance personal injury protection coverage. It can often include lost wages too. What is personal injury protection insurance. Up to 500 000 in coverage. Personal injury protection pip.

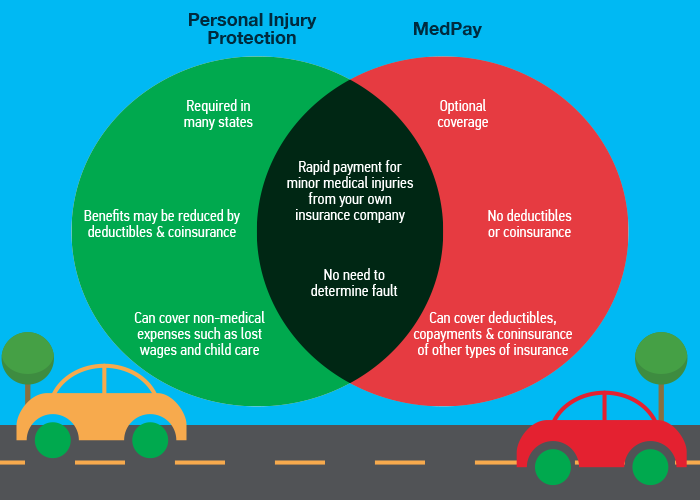

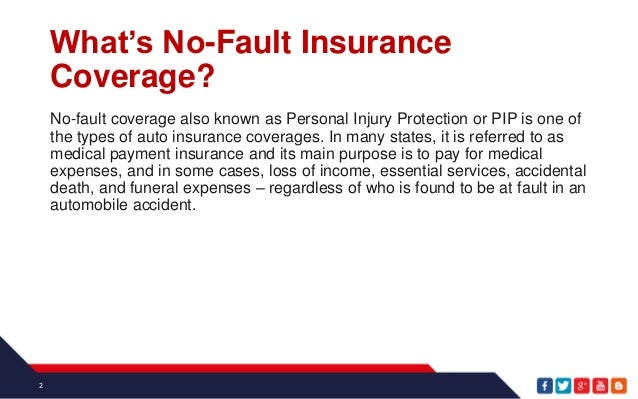

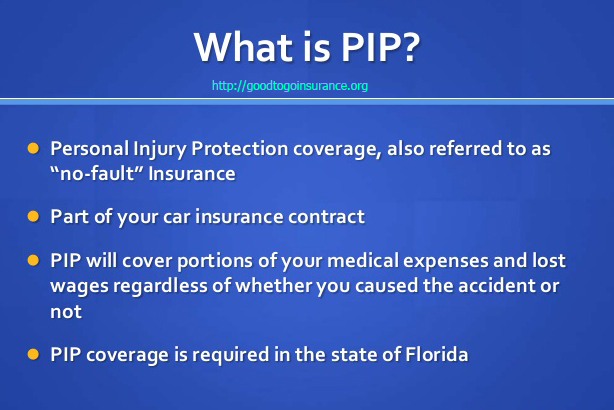

These benefits are paid by the car accident victim s own auto insurance and they are paid without regard to fault who caused the underlying motor vehicle accident. Personal injury protection pip insurance covers your medical bills and lost wages when you or your passengers are injured in a car accident. Pip stands for personal insurance protection personal injury protection and it is an extension of car insurance that covers medical expenses and in many cases lost wages. Pip stands for personal injury protection and it covers medical expenses possibly including work loss coverage for you and your passengers after a collision.

States that require personal injury protection also require liability car insurance which helps pay for injuries or property damage suffered by others in car accidents you cause. This coverage could help even if you re not in your car. Personal injury protection insurance coverage in most no fault states pays for a car accident victim s medical expenses attendant care medical mileages lost wages and replacement services. Purchasing extended pip allows you to amend your pip so that 100 of medical expenses and 100 of lost wages will be paid up to the maximum limits of your pip coverage.

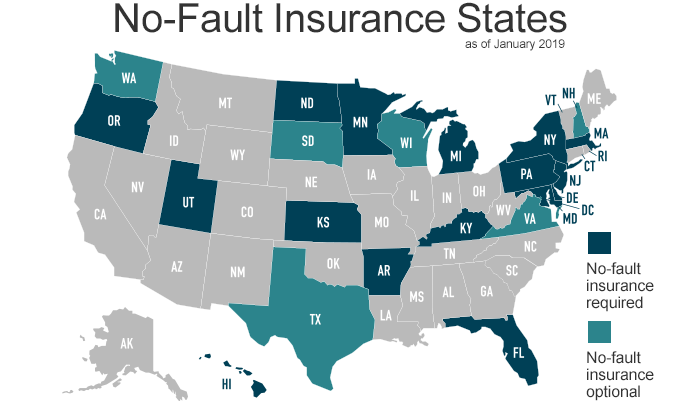

However 16 states require you to carry a minimum amount of pip coverage. Depending on the state where you live pip may be an available insurance coverage or a required policy add on. Personal injury protection also known as pip coverage or no fault insurance covers medical expenses regardless of who s at fault. Personal injury protection is a no fault coverage and is required in some states.

It is often called no fault coverage because its inherent comprehensiveness pays out claims agnostic of who is at fault in the accident. With personal injury. Up to 250 000 in coverage with pip medical exclusion s exclusion is available for a named insured with non medicare health coverage that covers auto accident injuries and or for household members if they have health insurance that will cover auto accident injuries. Pip insurance falls under the wider umbrella of auto insurance.

No fault means that regardless of which driver was at fault some of the medical expenses for the policyholder and others in the policyholder s car may be covered by insurance. Pip is optional in most states.

/people-helping-a-woman-after-a-car-accident-104304102-d7c7bec2c3bf45f78b16aa96f19427d9.jpg)

/car_accident-e79ae57204b34f5589a2967bff98e89a.jpg)