Auto Insurance Quote Nj

A standard policy and a basic policy.

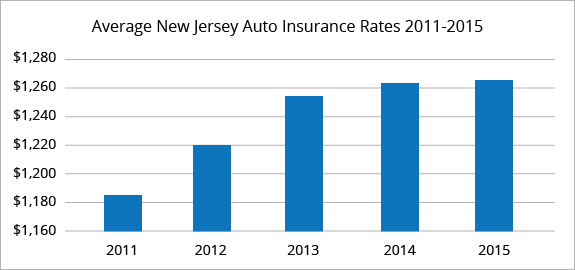

Auto insurance quote nj. Both policies require drivers to have two types of auto liability coverage. If you need additional information it can be found on our contact us page. Car insurance quote online that created typical annual rates to spike by 1 000 or even more in some states while others leapt without a doubt less. For the standard policy new jersey law sets minimum liability coverage limits of 15 30 5 and requires uninsured and underinsured motorist coverage and.

New jersey no fault insurance. Amount based on average annual savings reported by plymouth rock customers who switched during 1 1 2018 to 12 31 2018. As with most states in order to register and drive your car in new jersey the state requires that you have a minimum level of certain types of auto insurance coverage. Since new jersey is a no fault state if you or anyone covered by your policy is injured in an auto accident your policy pays for reasonable and necessary medical expenses up to your chosen limit regardless of who caused the accident.

New jersey offers two types of auto insurance policies. Call 855 993 4470 get your free quote online or find an agent to see how we can help you save on nj auto insurance. Bodily injury liability coverage and property damage liability coverage. 15 000 per person per accident up to 250 000 for certain injuries.