Average Business Line Of Credit Interest Rate

Here s what you need to know about business line of credit rates.

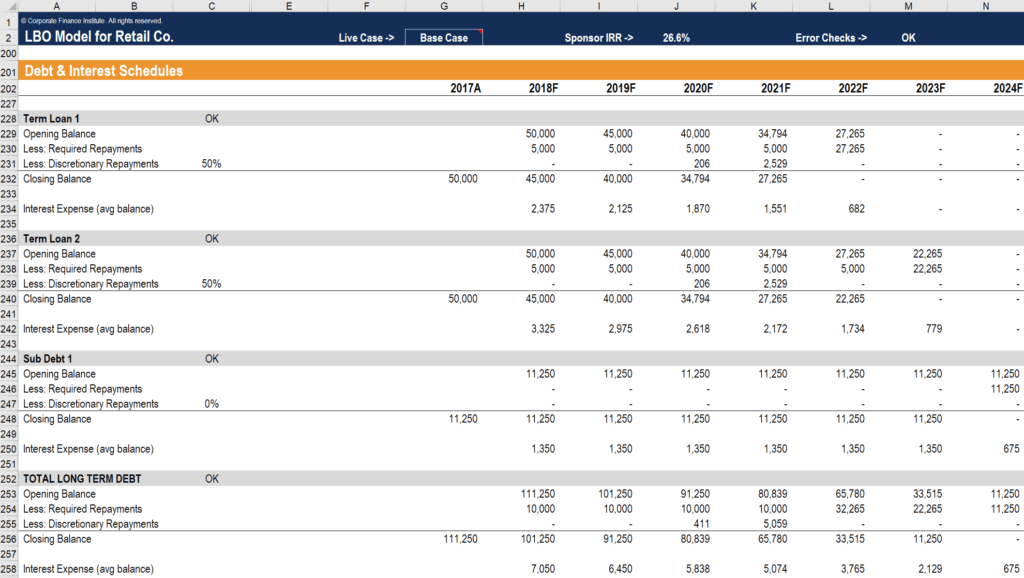

Average business line of credit interest rate. Even two different locs offered by the same lender may fall within a huge range. Business line of credit. A line of credit is a useful tool for managing cash flow. Note as an aggregator lendio s rates may vary based on the lender you are matched with.

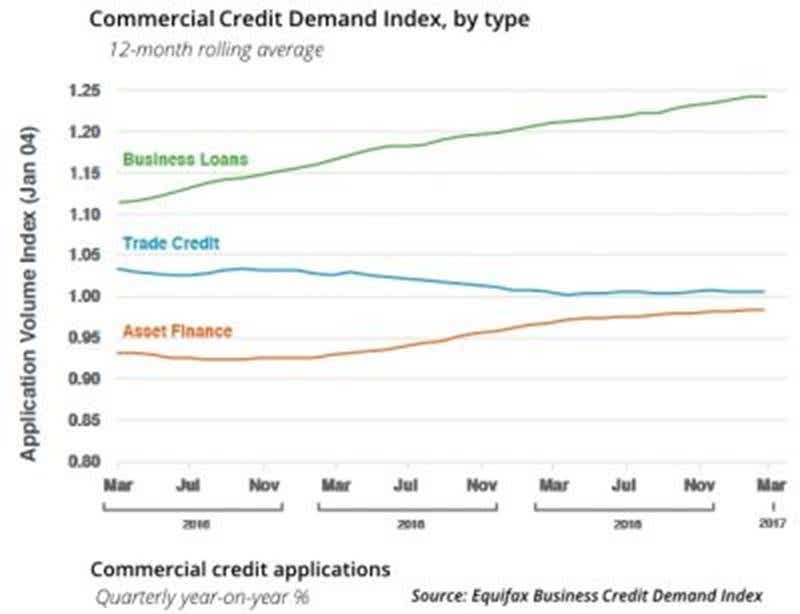

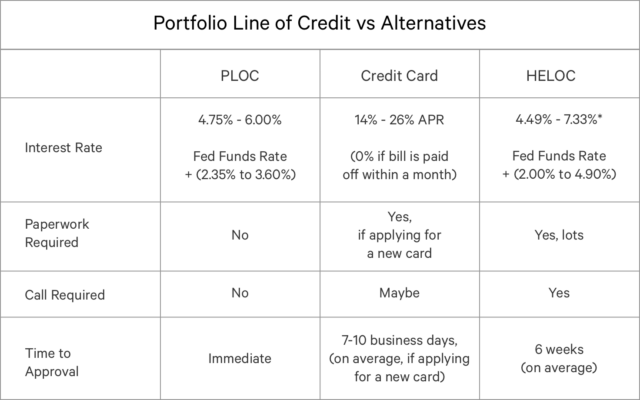

You can buy inventory and pay expenses before revenue comes in and you can minimize costs by using only what you need from an available pool of money. Interest rates for business lines of credit might run anywhere from 5 to more than 20. Typically it s easier to qualify for the best rates in a booming economy than a difficult one. For businesses with no credit record or a poor one theinterest rate may be tagged to the current prime rate which changes over time.

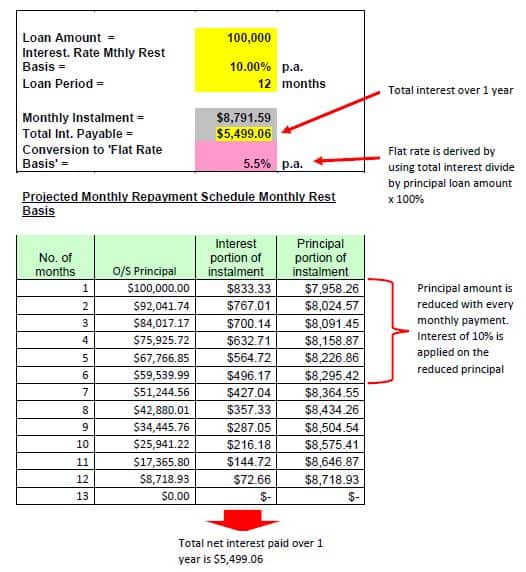

Enjoy this low introductory rate equal to cibc prime currently at rds rate 1 prime published null null null null o2 until march 7 2021. Average rate for business lines of credit by. Note that although this is an example of the rates you might receive business line of credit rates can vary enormously. With bank of america you could qualify for a business line of credit with an interest rate as low as 7 00.

You credit limit will be between 10 000 and 100 000 and you can get unsecured business lines without having to use any property as collateral. A line of credit to help conquer your goals get convenient access to cash and only pay interest on the funds you use. The business line of credit rates can vary significantly depending on your business the economy and the type of lender you go to.

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

/calculate-Interestrate_393165-76ce02cdd3b0498280004aa12a7596f8.png)

/credit-limit-definition-960695-v1-82b65d7e2653423cb55f871b05a0ccf1.png)

/ScreenShot2019-01-15at3.35.40PM-5c3e475ec9e77c00019b7191.png)