Average First Time Home Buyer Loan

If you buy a 250 000 home with 10 down and a 30 year fixed rate of 4 5 you ll pay 95 63 a month in pmi at a rate of 0 51 in addition to the 1 140 monthly principal and interest payment taxes and.

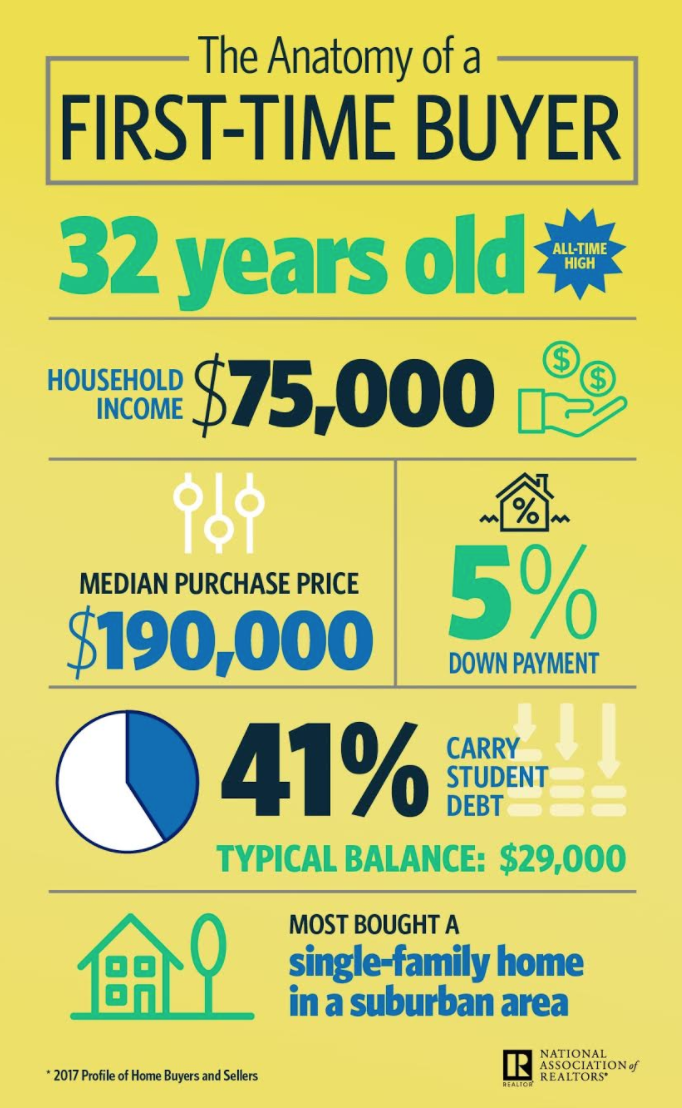

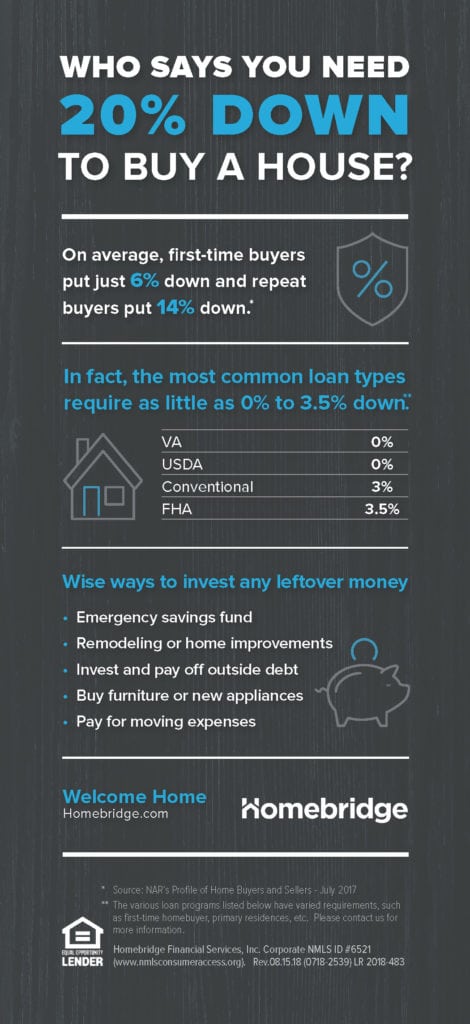

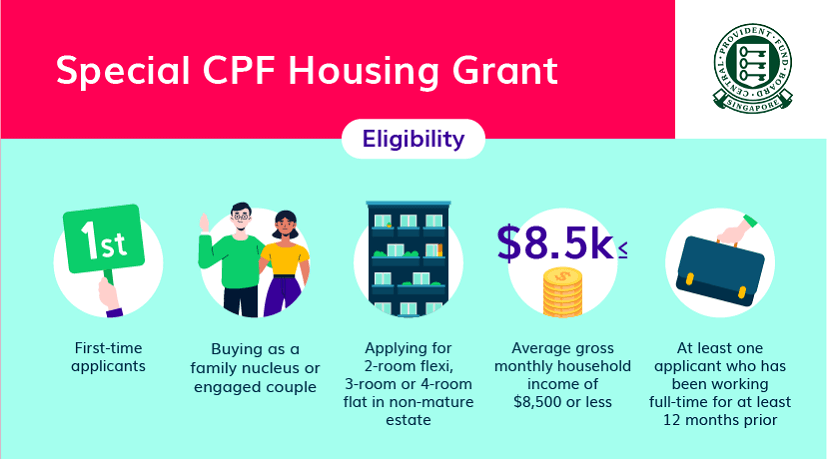

Average first time home buyer loan. Local first time homebuyer programs. There are loan programs that cater to first time home buyers such as the fha loan which allow for down payments as little as 3 5. And certain loans such as va loans for veterans and military or usda loans for buyers in rural areas don t require a down payment at. If you have a 580 credit score or higher you can get approved for an fha loan with just 3.

Thus our 300 000 first time home buyer should sock away about 6 000 7 500 to cover the back end of their buying experience. Fha loans are popular with first time home buyers because the program allows below average credit scores. Unfortunately for sydney house hunters the average mortgage size in nsw is 621 500. The cost of private mortgage insurance depends on your credit score and the size of your down payment.

Tallying the recommended savings so far the amount comes to 36 000. Freddie mac estimates the cost at 30 to 70 per month for each 100 000 borrowed. For example if you earn the median income of 50 305 for first time buyers and you buy a median priced home with a 20 down payment your monthly mortgage payment would be about 1 084 based on interest rates as of the fourth quarter of 2018. Department of hud 2019 annual report.

Fha section 203 k loan program borrow the funds needed to pay for home improvement projects and roll the costs into one fha loan with your primary mortgage. On the flipside mortgages which require a 10 deposit or less have been growing in popularity and now account for 30 of all deals up from just 9 at the beginning of 2010 according to moneyfacts. The three year mark can help previous home buyers who have come on hard times get back into a home with access to first time buyer programs like the conventional 97 loan with 3 down and. Average mortgage size in australia by state.

Compare that to victoria s average mortgage size of 517 900 and you will see that sydneysiders indeed pay a premium for their predictable weather patterns and sunny beaches. This is the average deposit put down by first time buyers according to uk finance which represents the nation s mortgage lenders it compares to just 9 in the mid 1990s.