Average Payroll Taxes For Small Business

One of the issues small business owners have to contend with is staying current with the many obligations for local state and federal taxes.

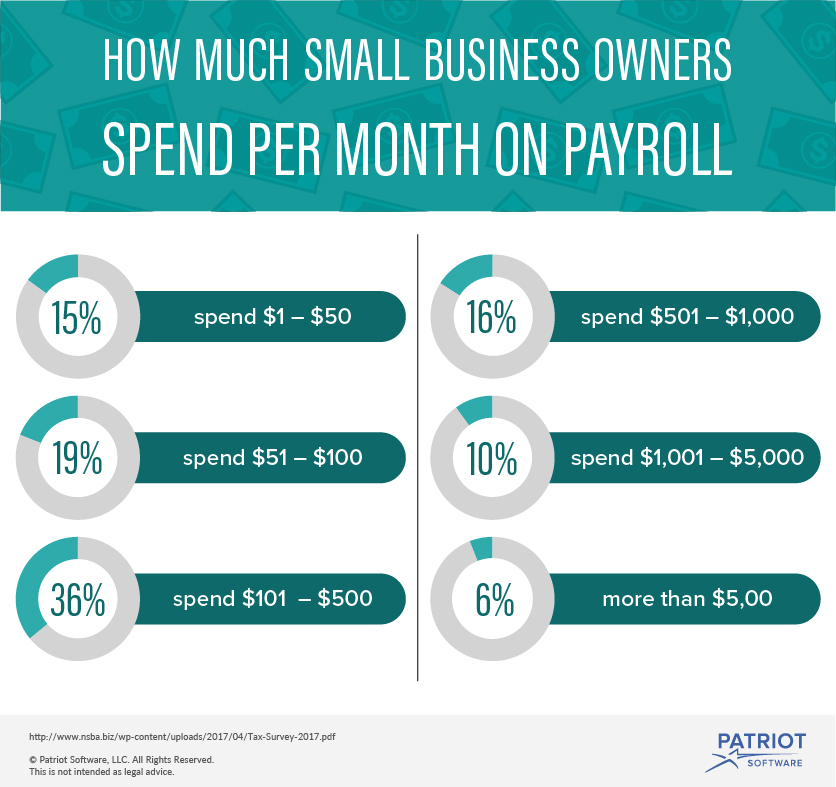

Average payroll taxes for small business. Small businesses with one owner pay a 13 3 percent tax rate on average and ones with more than one owner pay an average of 23 6 percent. While most business owners hire an accountant or a tax. While base account fees vary widely from one provider to the next you can expect to pay anywhere from 20 to 100 per month plus an additional 1 50 5 00 per payroll run for each employee. On average basic payroll processing has a per employee or per check fee in addition to the base account fee.

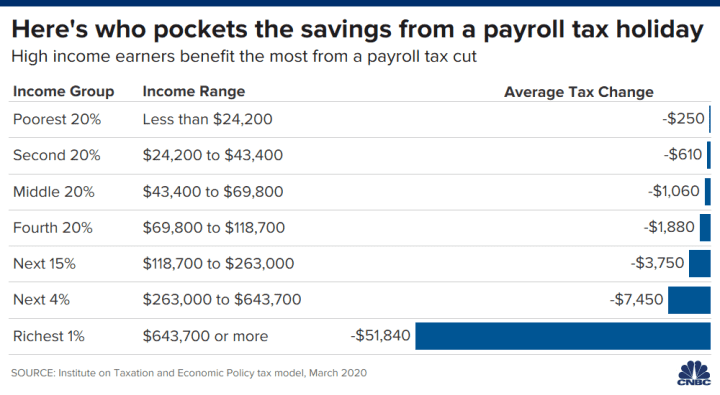

The standard futa tax rate is 6 so your max contribution per employee could be 420. Below is a state by state map showing tax rates including supplemental taxes and workers compensation. However each state specifies its own rates for income unemployment and other taxes. Small business corporations known as small s corporations pay an average of 26 9 percent according to the small business administration.

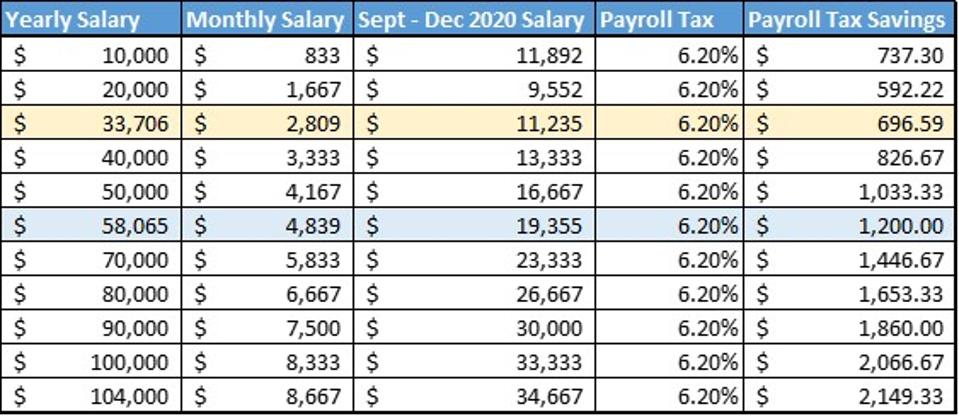

This is called self employment tax and is effectively medicare plus social security for yourself which amounts to 15 3 of your net business income. However you can also claim a tax credit of up to 5 4 a max of 378. If you run a small business but you don t have employees you ll still have to remit payroll taxes for yourself. The market for payroll services is very competitive with many providers offering packages geared specifically toward small or mid sized companies.

Some pre tax deductions reduce only wages subject to federal income tax while other deductions reduce wages subject to social security and medicare taxes as well. Small businesses pay an average of 19 8 percent in taxes depending on the type of small business.