Balancing A Checking Account

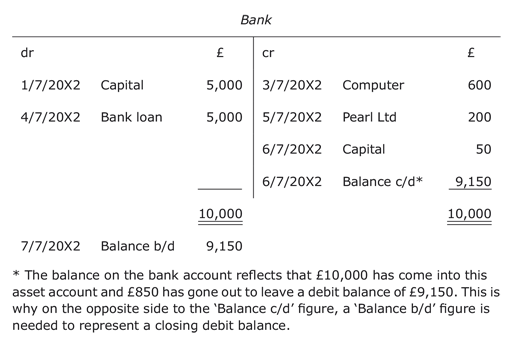

The account balance is always the net amount after.

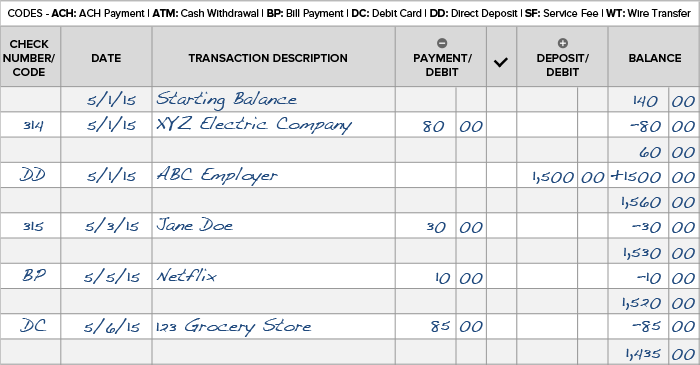

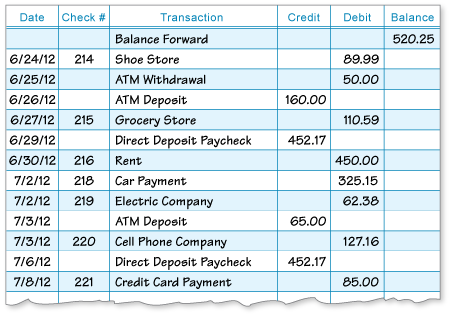

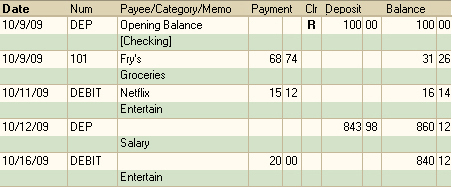

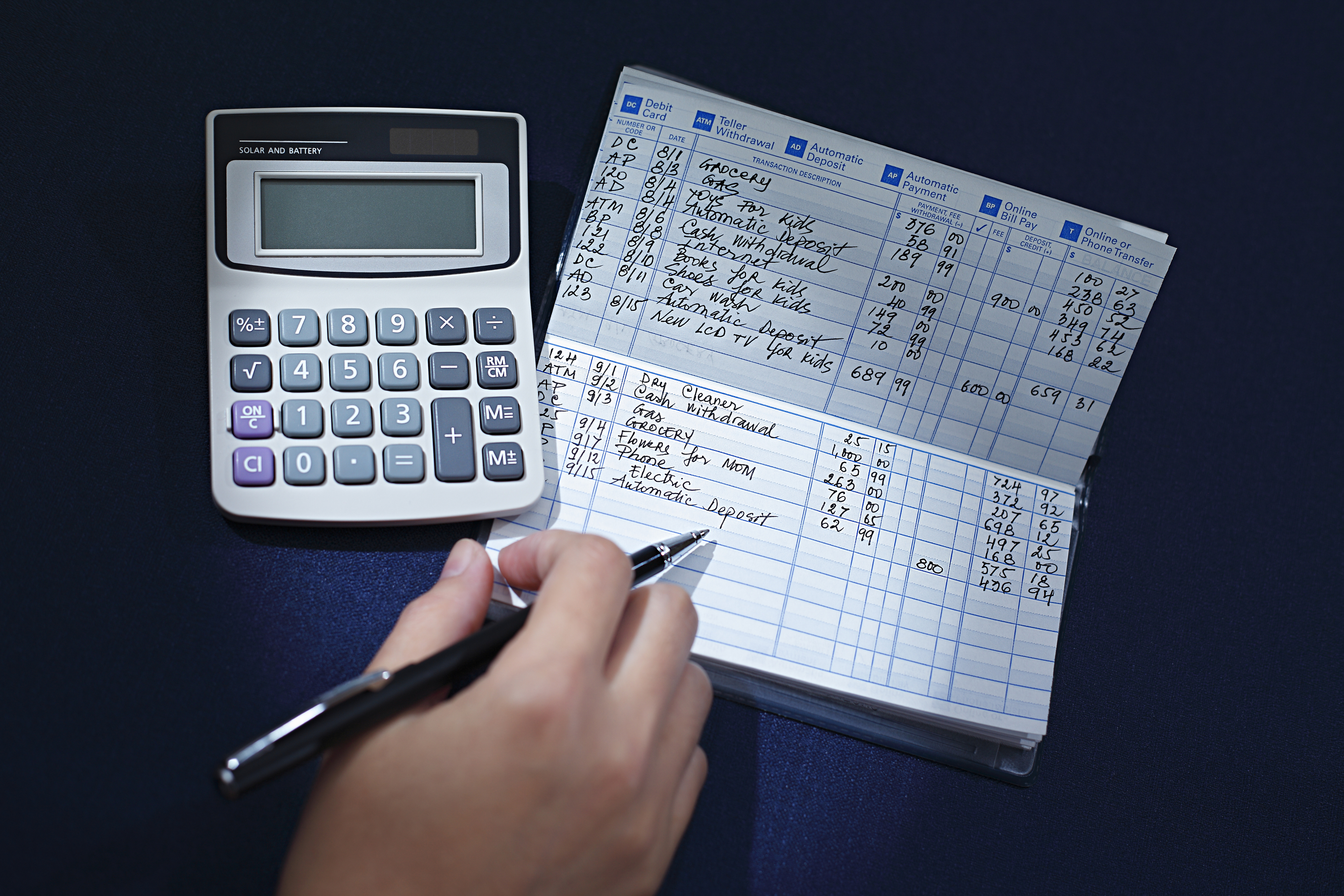

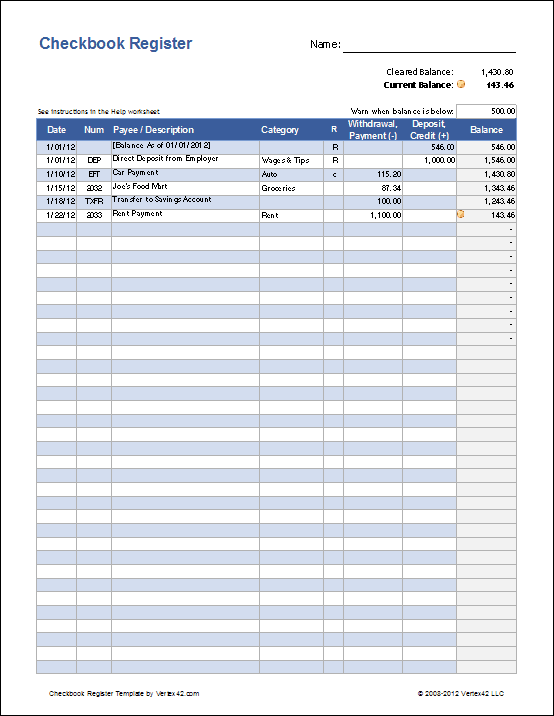

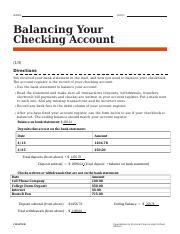

Balancing a checking account. Balance the checking account. That means you have to keep a record of your spending. The easiest way to do this is to write every transaction in your checking account register when the transaction takes place and keep a running balance. However getting into a habit of balancing your checking account on a regular basis can be a big step in maintaining healthy finances.

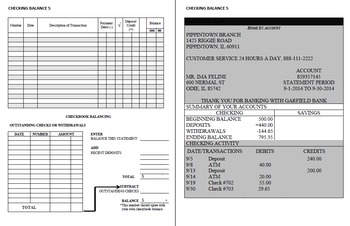

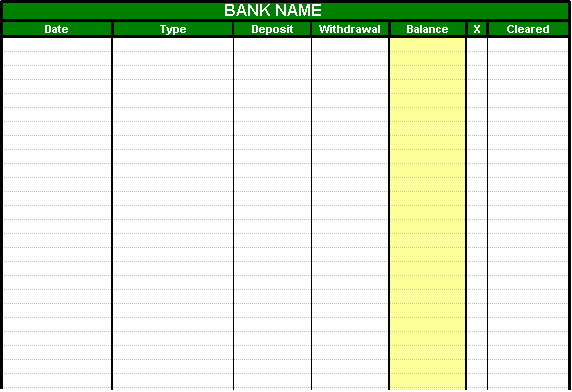

Each deposit and withdrawal is called a transaction. To get started with balancing a checking account gather everything you ll need to balance the books. Would definitely recommend this especially if someone has a hard time keeping up with a paper checkbook or just finds a normal check book confusing. An account balance is the amount of money present in a financial repository such as a savings or checking account at any given moment.

Balancing your bank account helps you keep track of everything in your account and it s a relatively easy task. The easiest way to do this is to write every transaction in your checking account register when the transaction takes place and keep a running balance. To balance an account add all your deposits to the beginning balance for an account s statement period and subtract. You may already record the checks you ve written in your check register but there are additional ways to track the activity in your accounts.

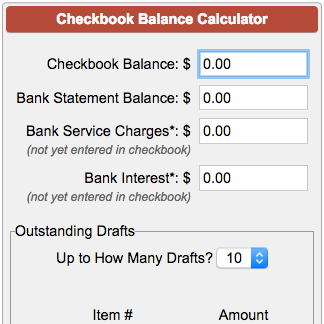

Just checking is a checkbook software app that will help manage your checkbook. How to balance a checking account. The purpose for balancing a checkbook is to know how much actual money you have in your checking account at any given time. You can keep track of all your checking account and savings accounts balances and purchases credit card accounts.

Most recent bank statement the easiest way to get it is to log in to your bank account online you ll just need your computer and account information. The point of balancing or reconciling your checking account is to make sure you and the bank agree on how much money is in your account. Use the built in check template editor to make changes if necessary. Manages multiple checking accounts.

Enter transactions mark them cleared and compare the balance to your statements to reconcile. Print checks using predefined templates. That means you have to keep a record of your spending. Balancing a checking account shows how much money is available.

Balancing a checkbook means you ve recorded all additions deposits made to your account and subtractions withdrawals. The process is fairly simple. Definitely helps me manage my money better and keep track of all my purchases.