Bankers Check

:max_bytes(150000):strip_icc()/money-order-vs-cashiers-check-315050-v3-5b46696ac9e77c00379e261d.png)

Eastwest bank internet banking portal.

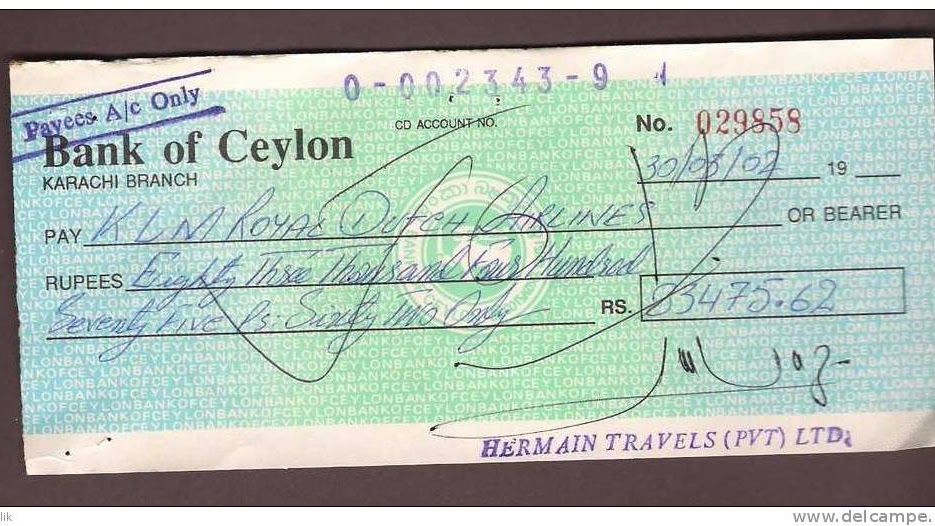

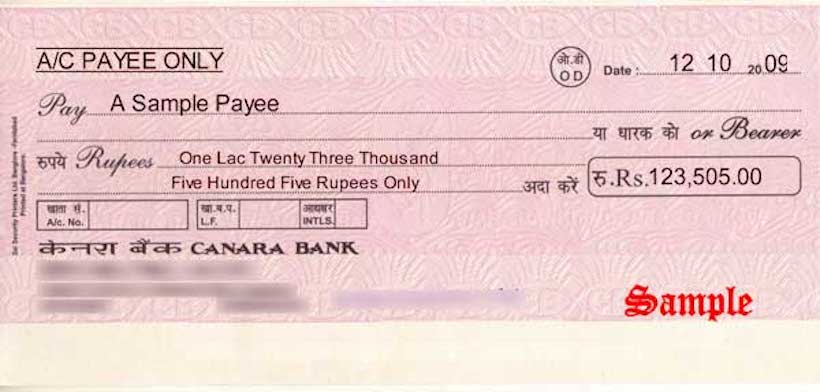

Bankers check. Filed under deceased customer cashier s checks check presentment checks official checks return items checks. Bank drafts also called banker s drafts bank check or teller s check are just like cashier s checks they are secure payment options that are guaranteed by the issuing bank in many cases. Bank closed sign print out and keep copies on hand in the event of a disaster or security incident or robbery. Dont act upon spoof e mail.

A banker s draft also known as a banker s cheque is like asking a bank to write a cheque for you. For this reason they do. Some banks particularly online banks allow you to request cashier s checks online. Your bank s contact information and or logo is usually printed on the check.

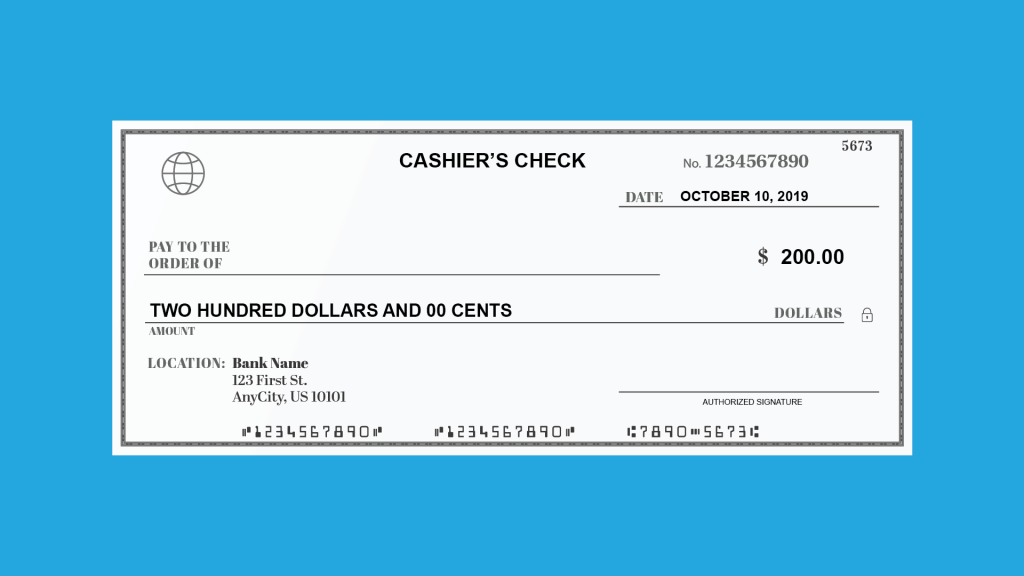

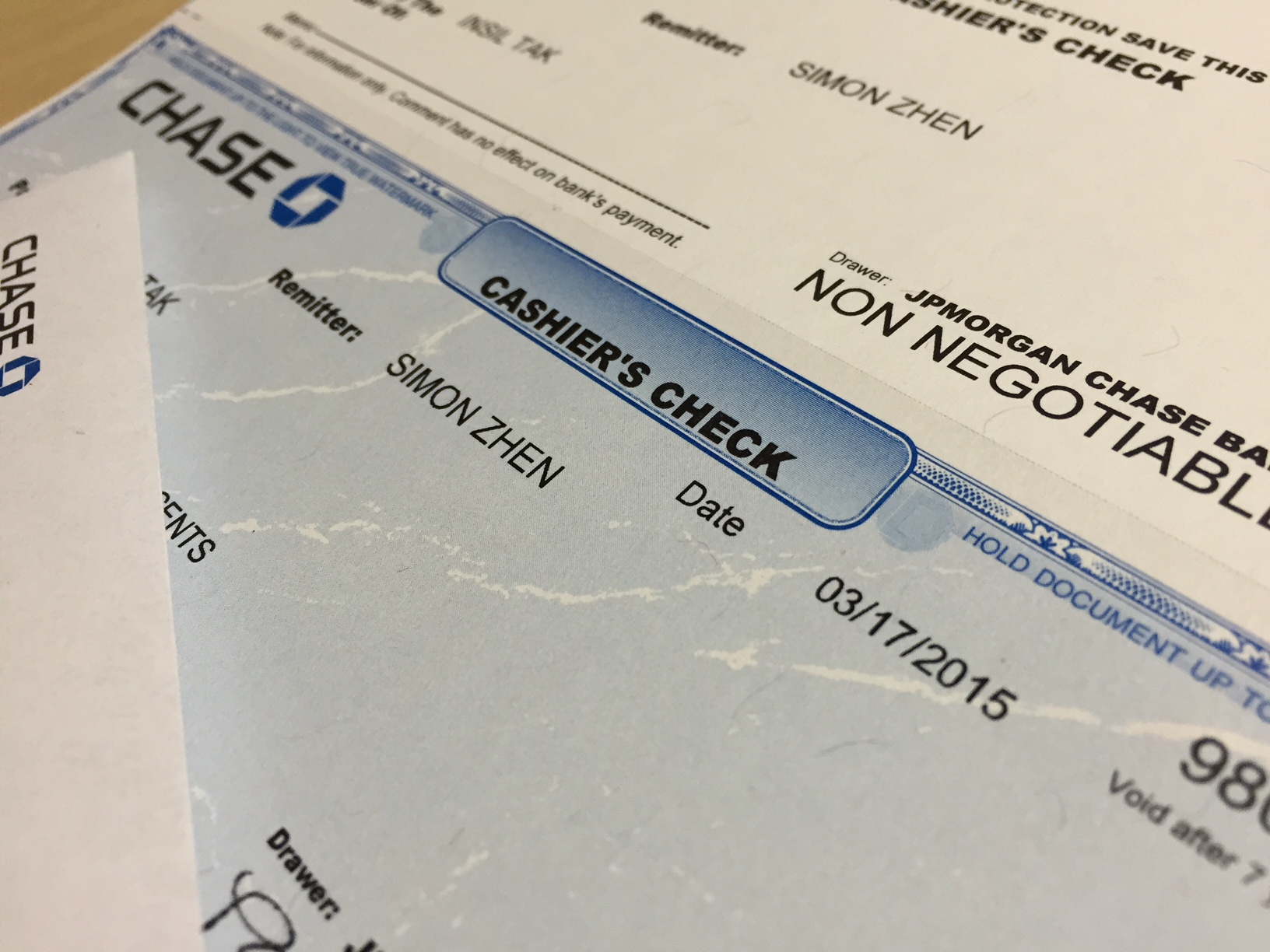

A cashier s check or cashier s cheque is a check guaranteed by a bank drawn on the bank s own funds and signed by a cashier. You give them your money and they give you a cheque for that amount to give to the person you re paying. The iban consists of up to 32 alphanumeric characters comprising a country code two check digits and a long and detailed bank account number used in bank wire transfers. Report any suspicious activity at 03 26 900 900.

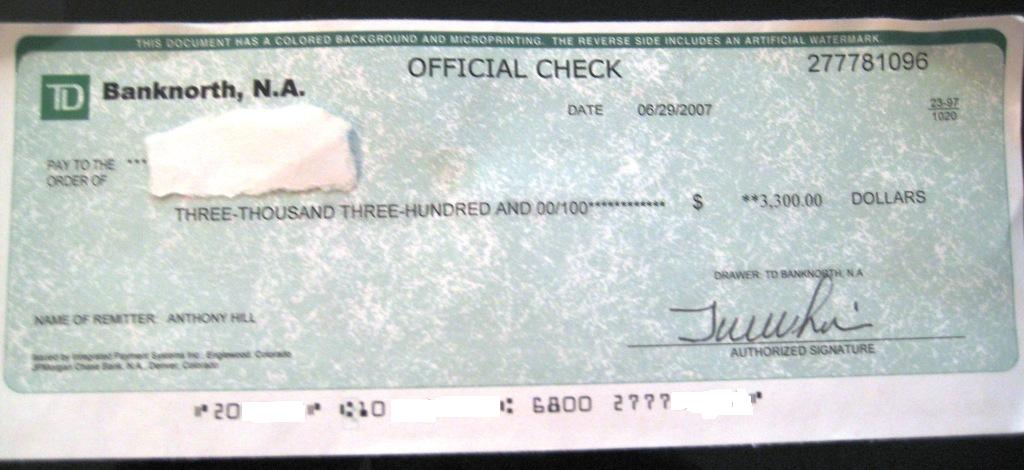

The bank might only mail checks to your verified mailing address so you need to wait for the check and then forward it. Your bank s american bankers association aba routing number tells banks where to find the funds for the check. Your account number at your bank is another identifier that lets the recipient know where the money for the check will come from. The iban structure is defined by the international standard under iso 13616 1 2007 and check digits are performed using mod 97 iso 7064.

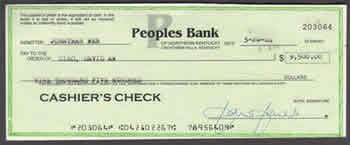

They are commonly required for real estate and brokerage transactions. Cashier s checks are treated as guaranteed funds because the bank rather than the purchaser is responsible for paying the amount. You can walk into most brick and mortar banks to get a check issued. A check whose payment is guaranteed by a bank in exchange for a fee a bank issues a certified check to a person who is very often both the payer and the payee that is a person gives the bank the amount for which the certified check is written either in cash or by deducting the appropriate amount from the payer s account.

Within a few minutes you should have a check in hand and you can pay the recipient immediately.

/cdn.vox-cdn.com/uploads/chorus_asset/file/18995632/Cashier3.jpg)

:max_bytes(150000):strip_icc()/GettyImages-949219696-e4c7b0e0b92847cb91ac7cc928362bad.jpg)