Bankrupt Oil Company

In addition it owes 654 million by the.

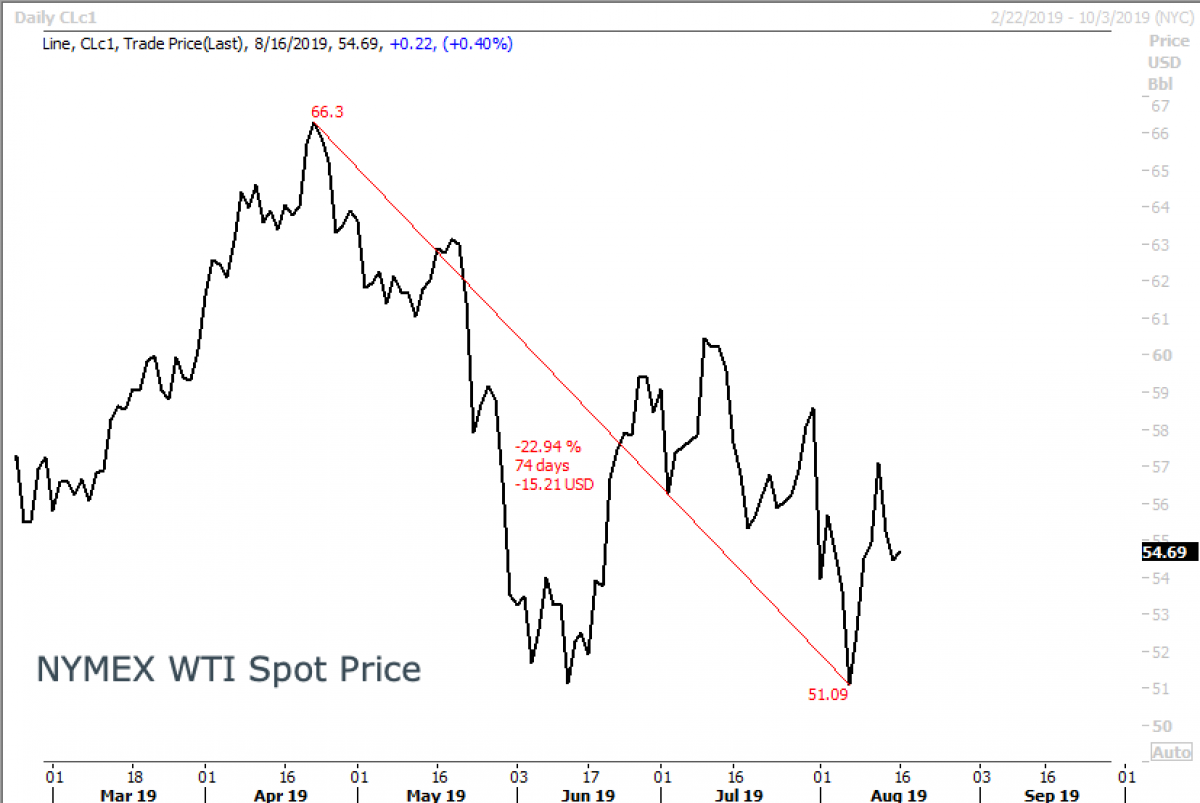

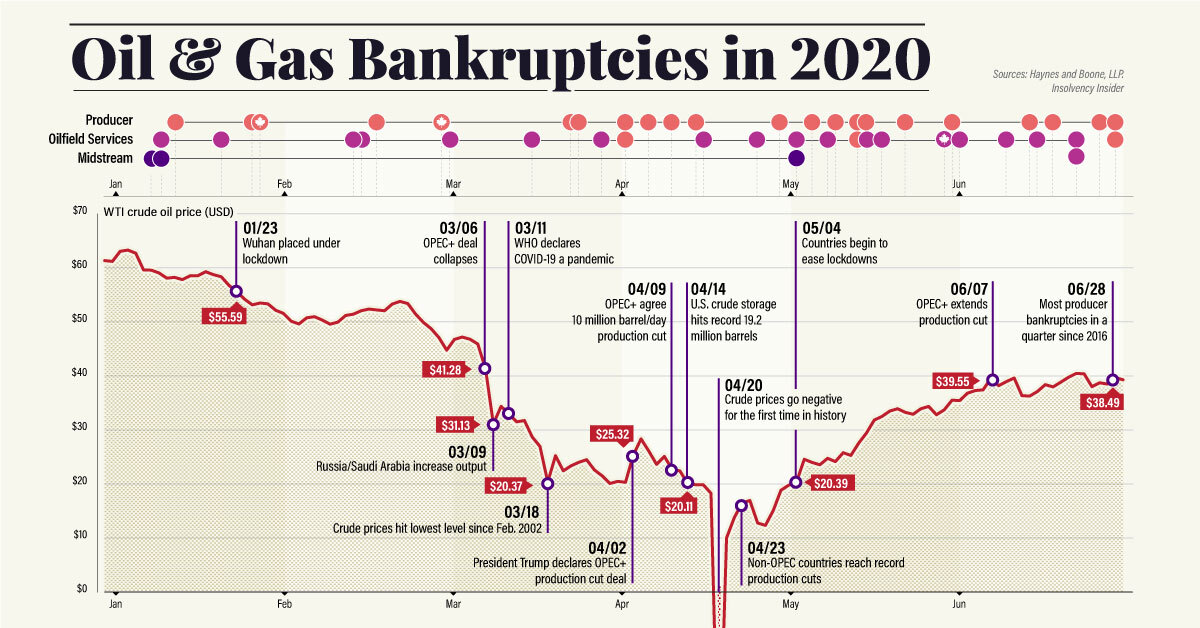

Bankrupt oil company. The american oil industry is facing a doomsday scenario. Of the more than 35 companies in the oil industry he. The oil and gas company is reportedly preparing a bankruptcy filing after its business took a hit from the saudi russia price war and declining demand for oil amid the coronavirus pandemic. A decline in oil demand is going to be devastating for transocean.

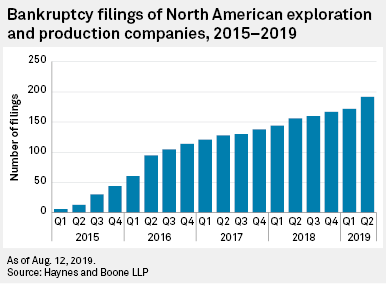

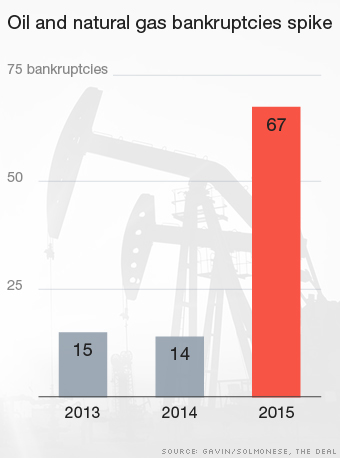

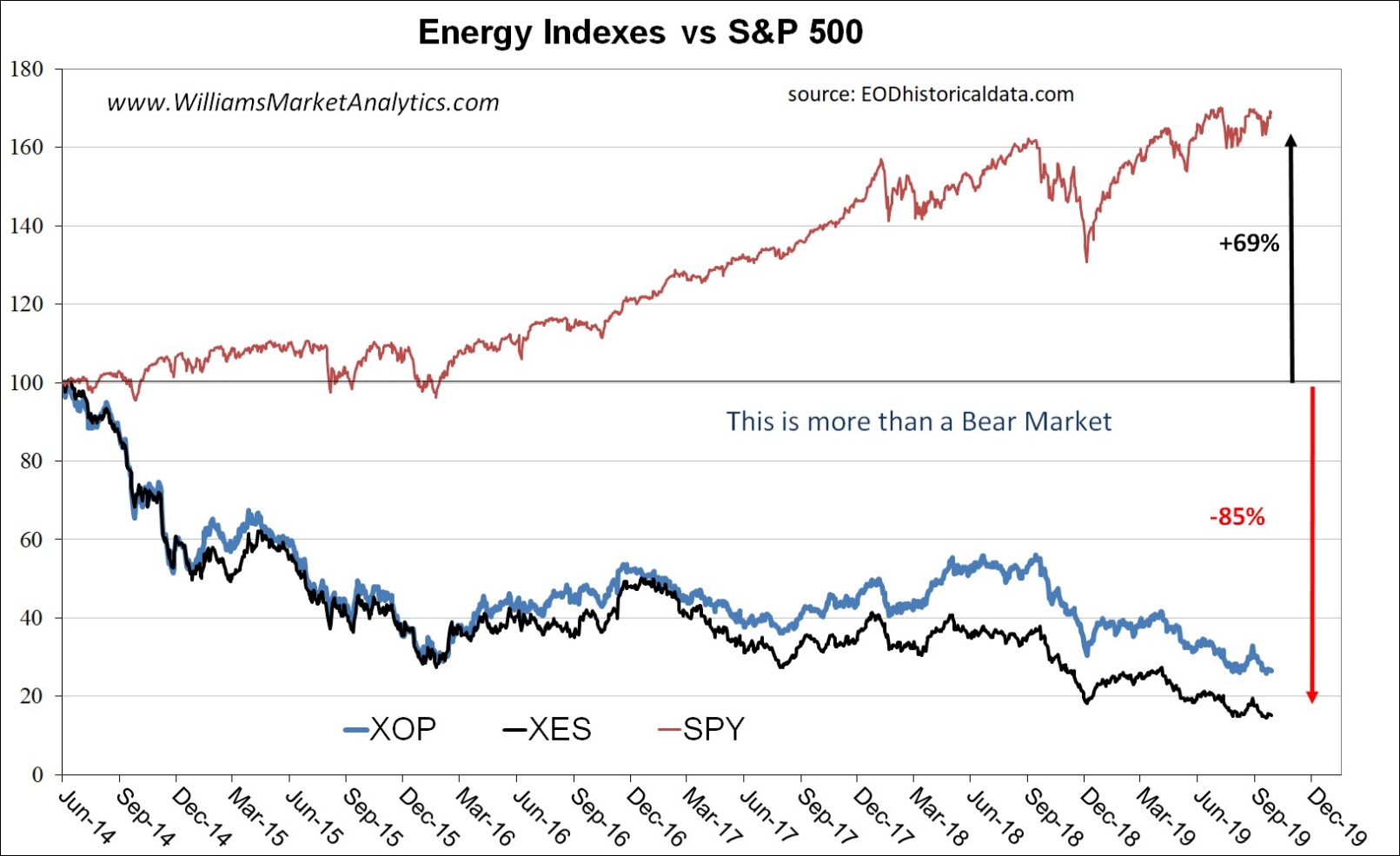

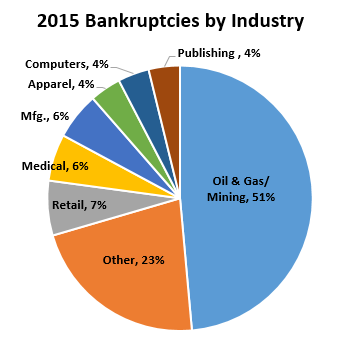

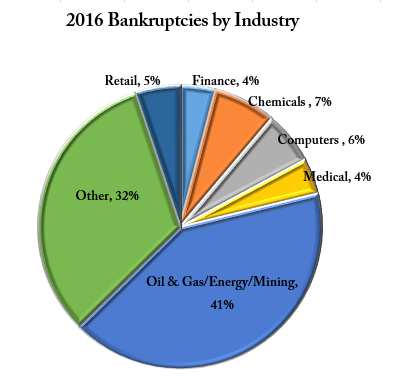

According to energy and restructuring law firm hayes and boone s a grand total of 50 energy companies filed for bankruptcy during the first nine months of the year including 33 oil and gas. Bankruptcies of us companies in the oil and gas sector started piling up in 2015. The company has 595 million of debt due within a year and 571 million of interest due. At the time it had not paid for oil it purchased in december 2017 from producers in texas and oklahoma.

Bankruptcy filings continued with smaller dollar amounts of debt involved. Cnbc s jim cramer said monday he could see the oil industry experiencing a significant wave of bankruptcies if low crude prices persist. First river an oil purchaser filed for bankruptcy protection in january 2018. That s the fifth highest.

Chesapeake energy an oil and gas company filed for bankruptcy protection on sunday. In 2019 the shakeout got rougher.