Bankruptcy And Irs Debt Relief

Chapter 13 bankruptcy may help you deal with irs debt relief that doesn t qualify for discharge.

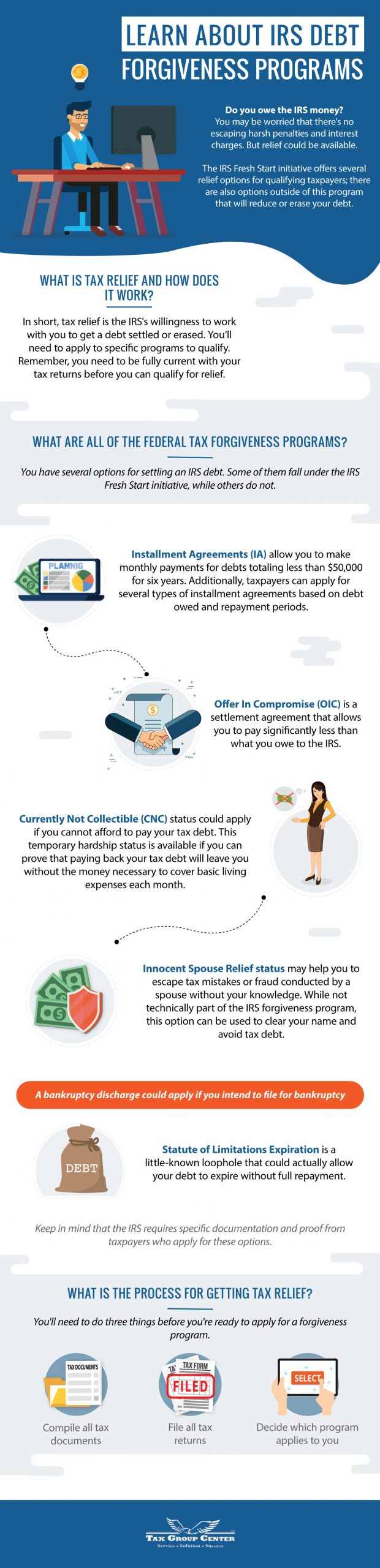

Bankruptcy and irs debt relief. If you are a person that has filed bankruptcy a debtor s attorney or a u s. Anyone who files bankruptcy receives a so called automatic stay which means that their creditors including the irs have to stop any efforts underway to collect on their debt. Other options include an irs payment plan or an offer in compromise. A chapter 7 bankruptcy will wipe out your personal obligation to pay the debt and prevent the irs from going after your bank account or wages but if the irs recorded a tax lien on your property before you file for bankruptcy the lien will remain on the property.

Secured debt bankruptcy does not eliminate i e discharge secured debt irs creates secured debt with a properly filed notice of federal tax lien nftl valid nftl must identify taxpayer tax year assessment and release date treas. Chapter 7 bankruptcy can eliminate or offer irs debt relief that meets necessary requirements. The return was due at least three years ago before you file for bankruptcy. To 10 00 p m.

If you owe past due federal taxes that you cannot pay bankruptcy may be an option. You ll propose a plan to pay your irs debt along with your other debts over a three to five year period. Chapter 7 bankruptcy is designed to offer debt relief to low earners which means you ll have to pass a means test to assess whether your income is truly low enough. If you have nondischargeable irs debt you can use a chapter 13 payment plan to manage it.

With chapter 13 you may be able to repay what you owe without penalties or interest making your payments more affordable. Tax debt is dischargeable in chapter 7 bankruptcy if they meet specific requirements under the bankruptcy code. If you re eligible for this type of bankruptcy you may be able to discharge your irs debts if you meet the following criteria. Trustee with questions about an open bankruptcy you may contact the irs centralized insolvency operations unit monday through friday 7 00 a m.

If you re eligible for this type of bankruptcy you may be able to discharge your irs debts if you meet the following criteria. When chapter 7 bankruptcy can offer irs debt relief. 301 6323 1 d 2 rules for proper place to file nftl vary by state. The time is measured from the date the taxpayer actually filed the return.

If the bankruptcy case doesn t discharge the irs tax debt the irs will be free to resume collection actions. For example bob s 2010 return was due on april 15 2011. The tax debt must be related to a tax return that was filed at least two years before the taxpayer files for bankruptcy. This is because bankruptcy will not wipe out prior recorded tax liens.

These requirements are often called the 3 year 2 year and 240 day rules. When chapter 7 bankruptcy can offer irs debt relief.