Bankruptcy Foreclosure Timeline

Foreclosure repossession wage garnishment and collection actions are immediately halted at least temporarily.

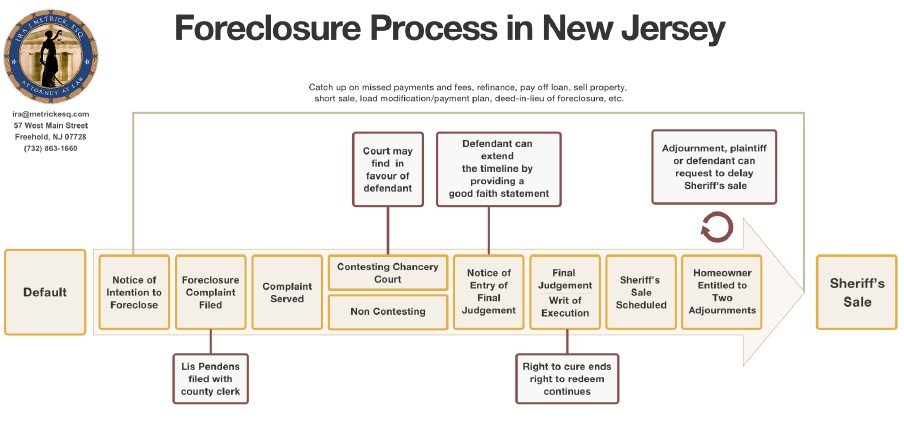

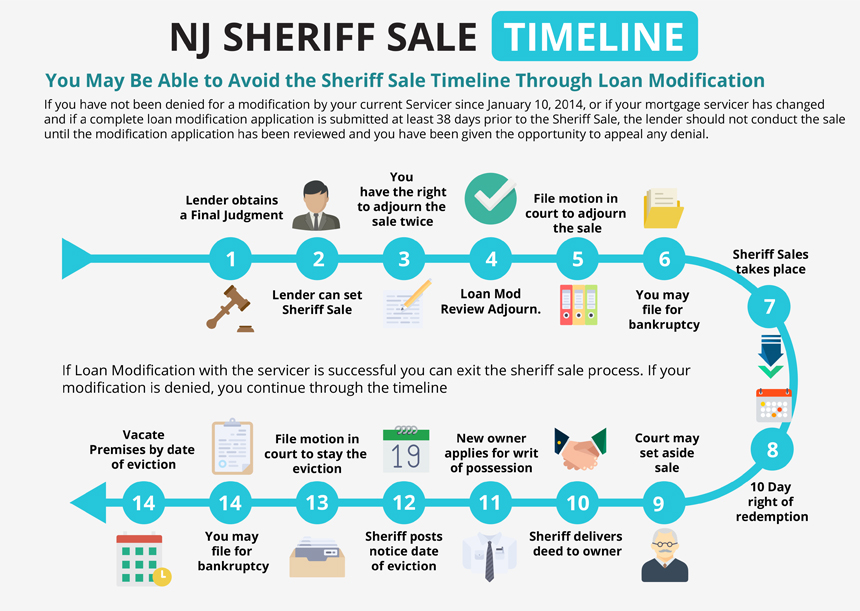

Bankruptcy foreclosure timeline. 2020 update nj foreclosure timeline overview. The homeowner defaults on their mortgage payments. All servicing management criteria. This is the period when the homeowner first gets behind in their mortgage payments.

When it comes to foreclosure and mortgage bankruptcy there are some key differences one should be aware of. Note that this is a general california foreclosure timeline. The ny foreclosure timeline demonstrates the steps that a lender must follow in order to take and sell your home for nonpayment. For the foreclosure and bankruptcy timelines this is an additional search criteria which allows the user to search for the case.

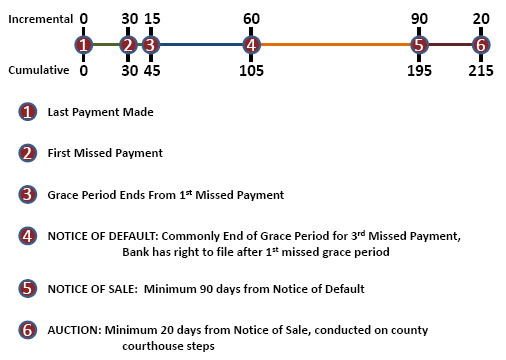

In case of the chapter 7 bankruptcy discharge you will have to wait for 2 years but in case of a foreclosure the timeline is 3 years. Like a chapter 13 plan chapter 11 bankruptcy florida is a multi stage and lengthy process that can be overwhelming without proper counsel from a jacksonville bankruptcy lawyer. Status of the claim. Day 1 missed payment.

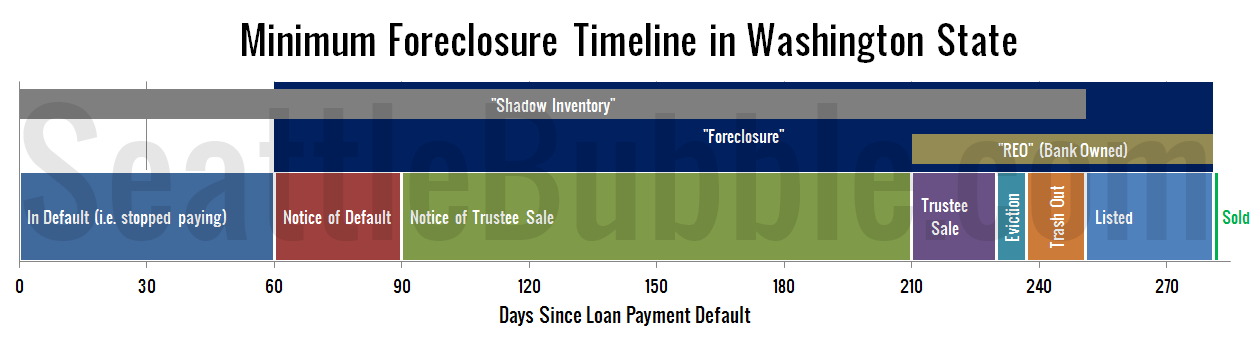

Here is a detailed foreclosure timeline for ohio. Foreclosure or bankruptcy on mortgage debt. The following is a timeline for a typical judicial foreclosure by sale case in vermont. With few exceptions most foreclosures in vermont follow the judicial foreclosure by sale procedure.

On the day that your bankruptcy petition is filed usually electronically you are protected from creditors under penalty of law. An experienced melville ny foreclosure lawyer can help you to understand the ny foreclosure timeline and can assist you in looking for alternatives to foreclosure that would be less damaging to your credit or that could even make it possible to keep your home. Is it possible to get an fha insured home loan after a foreclosure. Chapter 11 bankruptcy gives debtors commonly businesses the opportunity to formulate a restructured payment plan to satisfy outstanding debts with the supervision of a bankruptcy court.

We ll discuss all of the important points in this section. Fha loan foreclosure timeline. Contact us today for a free case review and to learn more. These differences include the process timeline and most importantly the ramifications.

The entire foreclosure process takes eight to nine months if you do nothing. When a timeline is initiated the system displays all standard steps needed to complete the business event. What is an fha loan foreclosure waiting period. Is one of the most beneficial aspects in bankruptcy in that it keeps your house safe from the bank while you go through bankruptcy.

The exceptions involve cases where a strict foreclosure or non judicial foreclosure procedure is.