Best Accidental Death Insurance

At a high level ad d comes in two types.

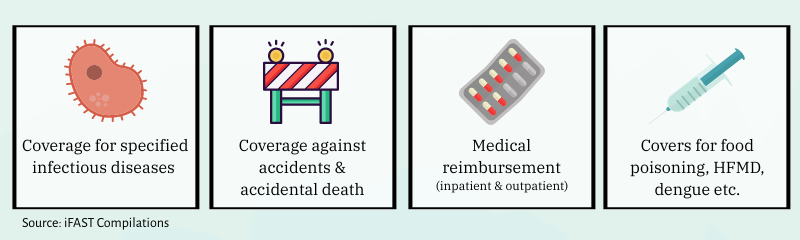

Best accidental death insurance. Unlike some policies that can confuse consumers ad d acts as advertised. Personal accident insurance compare and buy best personal accident insurance plan online at policyx. Cover against accidental death and disability with personal accident insurance plan and save medical expense. It offers financial protection in the event of accidental death or a disfiguring accident.

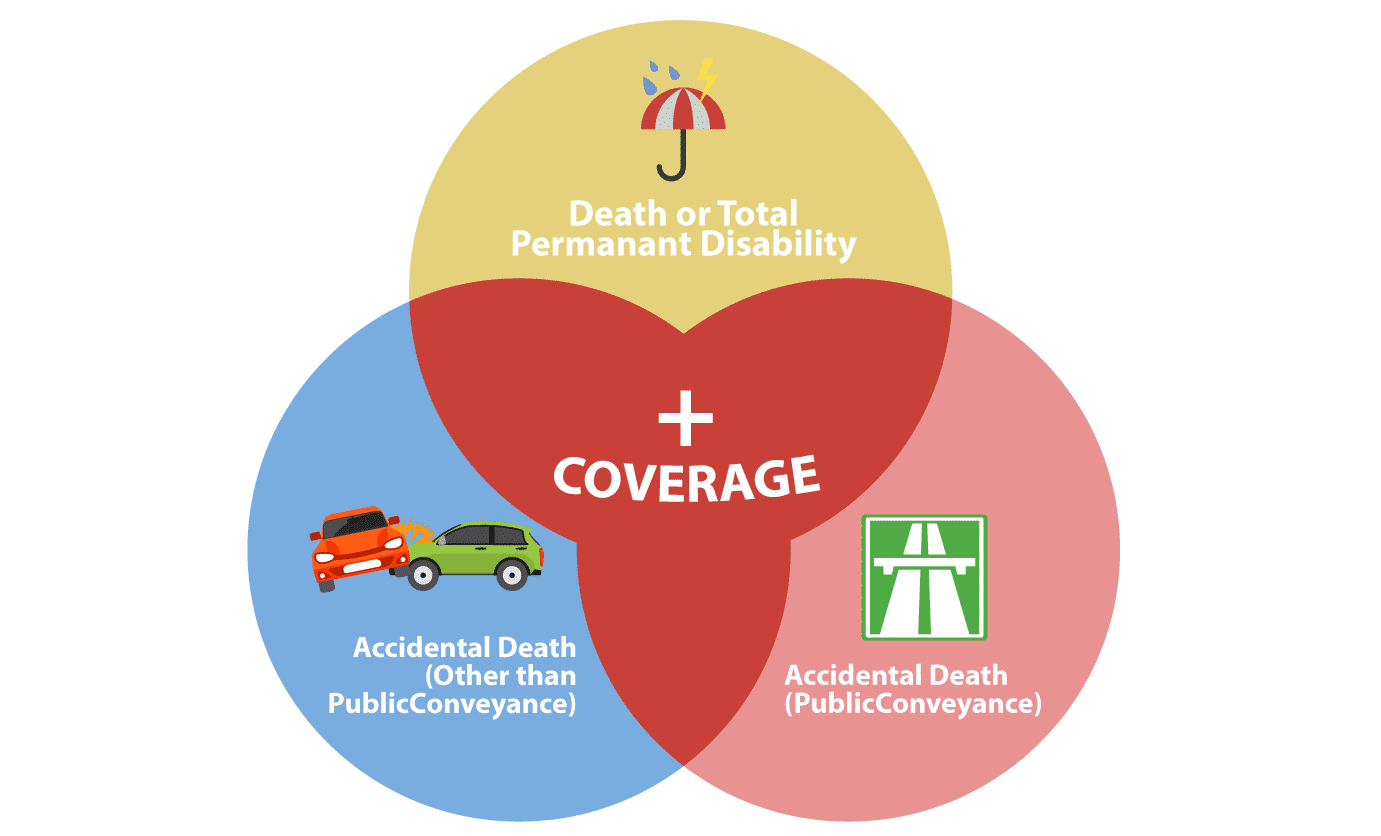

Usually it is 180 days from the accident. The insurance policy an ad d policy will provide a cash benefit to your beneficiaries if you die as the result of a covered accident or suffer a partial or complete dismemberment due to a covered accident. Or lose a limb suffer blindness or are paralyzed in a covered accident. Accidental death and dismemberment insurance is specialized coverage.

For these special cases an accidental death and dismemberment ad d insurance policy is an option to consider when choosing the right type of life insurance. Just as its name implies an accidental death and dismemberment insurance policy covers death or injuries that are proven to be the direct result of a covered accident. Abrams insurance solutions offers low cost accidental death insurance. The best accidental death and dismemberment insurance accidental death and dismemberment insurance can be purchased either as a standalone policy or as a rider to a life insurance policy.

Our agents can access over 70 of the best rated life insurers in the industry. There are various plan options in a life insurance policy retirement solutions death cover long and short term financial investment goals etc. Whereas an accidental insurance policy offers death cover even if the insured dies instantly or within the specific time frame after the accident.