Best Auto Insurance For Bad Credit

Get free car insurance quotes how insurers may interpret your credit score.

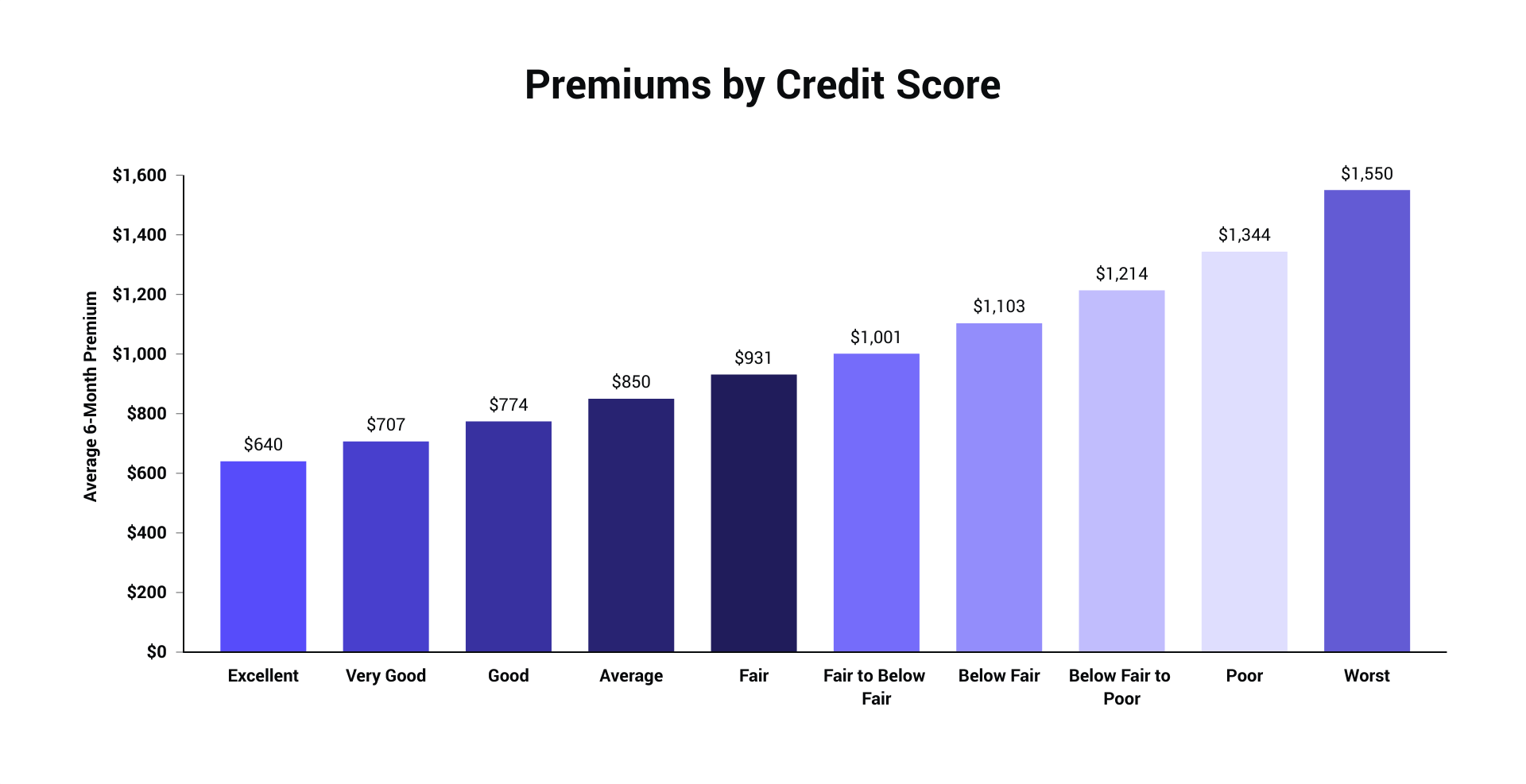

Best auto insurance for bad credit. Unfortunately a bad credit score will also affect your car insurance rates. Credit scores are typically used to ascertain your chances of defaulting on a loan but insurance companies also use them to judge the level of financial responsibility a person has. As your credit scores improve your car insurance rates are likely to decline. Getting car insurance if you re a driver with bad credit is not impossible and you might be able to pay monthly though it s likely a credit check would be involved.

Another contributing factor to your car insurance rate is the company you buy from. People with bad credit typically pay about 20 percent more for their car insurance that those with good credit. Every auto insurance company prices policies differently giving rating factors varying weights in their pricing calculations. Finding cheap car insurance with bad credit can be difficult.

If you have bad credit you might get a quote from a no credit check auto insurance company a bad credit auto insurance company and a few standard auto insurance companies as well as a usage based policy quote or two. How to save on car insurance if you have bad credit. You should consider comparing car insurance quotes at renewal time if you have seen a positive trend in your scores. For more tips on keeping your rates low read our comprehensive guide to car insurance.

If you have bad credit research the best way to get the most out of your auto insurance without sacrificing coverage and affordability. Below are the 7 best car insurance companies for bad credit in the united states. Why do credit scores affect insurance coverage and rates. Read on for more information about getting the best auto insurance rates with bad credit and where you might be able to get no credit check car insurance.

To get and compare the best free quotes provided by top rated bad credit car insurance companies in business online it could be better if you consider the following aspects. After reviewing auto insurance quotes from four major auto insurers across three cities we found that geico offers the cheapest car insurance for drivers with bad credit at 27 below the average. Best cheap car insurance for drivers with bad credit. This comes out to a penalty of over 100 per month.

Best auto insurance companies for bad credit in new york. If you have a very poor credit score of between 300 and 579 then farmers insurance will charge you approximately 2 044 on average per year. The lower your credit score is the higher your rates will be. Some useful guidelines for lowering bad credit car insurance premiums.

High risk drivers can still save on car insurance. Ensure that your driving record is good and free of any traffic tickets for last 2 to 3 years.